Understanding Division 293 tax: Impact on high-income super contributions

.

If you’re a high-income earner, understanding the Division 293 tax and its impact on your super contributions is crucial. This tax, also known as Division 293 tax, imposes an additional charge on super contributions for those with higher incomes. Its primary goal is to ensure equitable distribution of tax benefits from the super system, benefiting not only high-income earners but also individuals with average incomes.

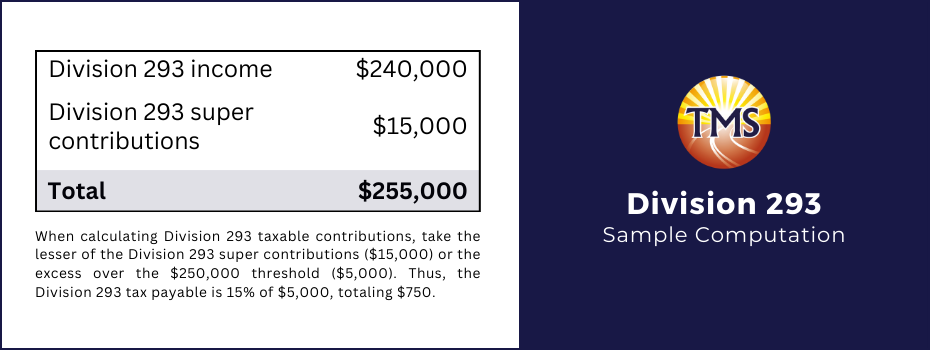

The key aspect of this tax is the “income threshold.” This threshold is the combined income and super contributions level at which the Division 293 tax kicks in. As of 1 July 2017, this threshold was set at $250,000. Prior to this, from 1 July 2012 to 30 June 2017, it was at $300,000. The lowering of the threshold was not aimed at increasing tax revenue but rather to maintain fairness and sustainability in the tax concessions within the superannuation system. The government’s intent was to align the tax benefits for high-income earners with those available to lower and middle-income groups.

For you as a high-income earner, it’s important to be mindful of how the Division 293 tax can affect your taxable income, particularly when making concessional super contributions to your super fund, including employer contributions and any before-tax contributions you make. When your income and concessional contributions exceed the Division 293 income threshold, you may be liable to pay additional tax on these contributions. Understanding this threshold and its implications can help you plan more effectively and consider seeking personal financial advice to manage your super contributions and overall tax position.

What is the Division 293 tax threshold?

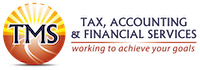

Understanding the Division 293 tax threshold is essential for high-income individuals. This tax is triggered when your combined income and specific super contributions surpass a predetermined limit. If the total of your income and super contributions exceeds this Division 293 threshold, you’re subject to this additional tax. It’s important to note that the tax is applied to either the excess amount over the threshold or the super contributions, whichever is lower, at a fixed rate of 15%.

This mechanism ensures that those with higher incomes contribute equitably, balancing the tax benefits they gain from super contributions with those available to average income earners. Keeping a close eye on your taxable income, including any concessional contributions to your super fund, is vital. This helps you understand whether you’re nearing the Division 293 threshold, which is a key factor in effectively managing your super contributions and your overall tax strategy.

Calculating Division 293 Tax

To find out if Division 293 tax applies to you, your tax return is crucial. It provides the necessary Division 293 income information. Additionally, contribution data from your super fund is used to determine your Division 293 super contributions.

Division 293 tax assessments are only issued after collecting all relevant details. It’s important to remember that if you are part of several super funds, and one reports contributions after your tax return is submitted, you may receive a revised Division 293 tax assessment.

Division 293 tax is relevant when there are taxable super contributions within a financial year. The components of taxable super contributions include:

- Concessional contributions, encompassing employer contributions, SG contributions, salary sacrifice contributions, and personal deductible contributions. This also includes certain superannuation rollover benefits, minus any excess concessional contributions.

- When your total Division 293 income and super contributions exceed the $250,000 threshold.

As for the tax rate, Division 293 tax is 15% of either the amount exceeding the threshold or your taxable super contributions, whichever is less.

Components of Division 293 Income

The income component for Division 293 tax assessment uses a similar income calculation as the Medicare levy surcharge (MLS), but it excludes any reported superannuation contributions.

Components involved in this income calculation include:

- Taxable Income: Calculated by deducting allowable deductions from your assessable income.

- Reportable Fringe Benefits: The total amount of fringe benefits is considered.

- Net Financial Investment Loss: Includes losses from financial investments.

- Net Rental Property Loss: Accounts for losses from rental properties.

- Family Trust Distribution Tax: Considers the net amount taxed under family trust distribution.

- Super Lump Sum: Takes into account taxed elements at a zero tax rate.

- First Home Super Saver Released Amount: Refers to the released amount for first home purposes.

To calculate the total income for Division 293 tax, these components are added together, subtracting the super lump sum and the assessable first home super saver released amount.

Special One-Off Events

Your income may exceed the Division 293 threshold in a particular year due to special events such as:

- Receiving an eligible termination payment.

- Realising a capital gain.

- Any other factor causing an income increase.

Consequently, Division 293 tax may apply for that specific year.

Understanding Super Contributions for Division 293

For Division 293 tax, concessional contributions are considered, but any excess concessional contributions are excluded. If your concessional contributions cap increases due to carried-forward amounts, all contributions within this increased cap are included for Division 293 purposes.

Division 293 tax and super contributions

It’s important to distinguish between your taxable super contributions and your Division 293 super contributions. Taxable contributions are the lesser of your Division 293 super contributions or the amount exceeding the threshold.

Contribution rules for Division 293 tax

Unlike excess contributions, there is no option to overlook or adjust contributions for Division 293 tax calculation. If you request (and it’s approved) to disregard or reallocate excess concessional contributions to a different year, these contributions retain their concessional status and are included in the Division 293 assessment.

Navigating the payment of Division 293 tax

As a business owner, investor, or sole trader, it’s crucial to stay informed about your tax obligations. One key aspect you may encounter is Division 293 tax. This section will guide you through understanding when and how to pay Division 293 tax, ensuring you’re well-equipped to manage this responsibility effectively. We’ll break down the essentials, from identifying if you’re liable to the steps involved in making a payment, simplifying this complex topic for your convenience and clarity.

Accumulation members

If you belong to an accumulation super fund, the Australian Taxation Office (ATO) will issue you a notice of assessment for Division 293 tax. Accompanying this notice is a release authority form, allowing you to use your super account to pay all or part of this tax. To use your super for this purpose, you need to submit the release authority to your super fund within 120 days. Beyond this period, the super fund is not obliged to process the payment. Alternatively, you can opt to pay the tax using your own funds outside of super.

Should you choose to assign the release authority to your super fund, they are required to handle the tax payment within a month, either remitting it to you or directly to the ATO, depending on your preference. It’s important to remember that this tax is typically due within 21 days following the date the notice of assessment is issued. Failing to pay within this timeframe subjects the amount to the general interest charge. Therefore, paying the tax initially with your own funds and later seeking reimbursement from your super fund through the release authority might be a more expedient approach.

Managing Division 293 Tax for Defined Benefit Members

For members in a defined benefit fund, the payment of Division 293 tax is often deferred. This deferred tax amount is recorded in a debt account managed by the Australian Taxation Office (ATO). The debt in this account accrues interest annually at the long-term bond rate. However, if you pay off the total outstanding balance before the end of a financial year, no interest will be charged for that particular year.

The tax becomes due only when you receive a benefit associated with your defined benefit membership. You have the flexibility to settle this tax at any time, using either your non-super funds or from any accumulation accounts in your super fund. When a benefit related to your defined benefit membership is paid out, it’s important for both you and the super fund to notify the ATO. The ATO will then send a notice specifying the amount you owe. This amount should be paid within 21 days of receiving the benefit. To facilitate the super fund in handling the tax payment to the ATO on your behalf, it’s crucial to inform the ATO in a timely manner. This ensures they issue the notice before your fund distributes the benefit.

For those who also have an accumulation account, be aware that any tax assigned to this account must be paid within 21 days of receiving the notice of assessment.

Guidance for Temporary Residents on Division 293 Tax Refunds

Temporary residents in Australia are eligible for a refund of any paid Division 293 tax upon receiving a Departing Australia Superannuation Payment (DASP) where withholding tax applies. This refund includes all Division 293 tax payments you’ve made while being a temporary resident in Australia.

To claim this refund, you must apply to the Australian Taxation Office (ATO) using the specific form they provide. For detailed information and to access the required forms, it’s advisable to visit the ATO’s website. This process is an important step for temporary residents to recover any Division 293 tax paid during their stay in Australia.

Super Guarantee Amnesty and Division 293 Tax

Contributions made under the Super Guarantee (SG) amnesty are not counted towards your Division 293 income and concessional contributions. This means these contributions do not affect the Division 293 threshold or your total assessable income for Division 293 tax purposes. In your Division 293 notice of assessment, SG amnesty contributions are usually shown in the ‘Division 293 super contributions’ section as a ‘Transferred to reserves strategy’ and are deducted from your total concessional contributions.

It’s important to note an exception: if your employer made SG amnesty contributions and claimed a Late Payment Offset (LPO), these might not be excluded from your Division 293 tax calculation. If your assessment seems to include these LPO amounts, a simpler review of your assessment can be requested, rather than a full objection. You’ll need to know the financial year when the LPO was added to your fund for this review.

Regular review of your Division 293 assessments is crucial, especially to understand the nuances of contributions like SG amnesty and LPO. This proactive approach ensures that you’re accurately taxed and aligns with the intent of Division 293 tax, which is to ensure equitable tax concessions for high-income earners compared to average income earners.

Releasing Super Funds for Division 293 Tax Liability

High-income earners facing a Division 293 tax liability have the option to release funds from their superannuation to cover this obligation. Here’s a brief guide on how to do this:

1. Submission of Election Form: Begin by filling out the Div 293 election form within 60 days of receiving your Division 293 tax assessment. This period allows you to decide about releasing funds, but it doesn’t change the pay tax date, which is stated in your notice of assessment.

2. Online Lodgement: The most efficient way to submit the election form is online, ensuring immediate lodgment.

3. Processing of Election Form: Upon receiving your completed form, the ATO will contact your super fund(s) with a release authority to remit the specified amount. These funds are primarily used to settle your Division 293 tax. Any excess is applied to other tax liabilities or government debts, with any remaining balance refunded to you.

Remember, once you choose to release funds, this decision is final and cannot be changed later.

The Division 293 tax is designed to ensure equitable tax concession for high-income earners, compared to average income earners, by targeting those whose income and super contributions exceed a certain threshold. By following this process, you maintain compliance with Division 293 tax requirements and effectively manage the tax benefits of your superannuation contributions.

Next step is to contact TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

Related Articles

Taking Money Out of Your Private Company: How to Avoid Division 7A Penalties

Taking Money Out of Your Private Company: How to...

Unlock the Benefits of a Bucket Company: Maximise Tax Savings and Protect Your Assets

Unlock the Benefits of a Bucket Company:...

Instalment Activity Statements (IAS) for Individuals & Businesses

Instalment Activity Statements (IAS) for...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.