Negative Gearing

Calculator 2024

for Australian Property Investors

Gather the necessary information

Input the necessary information

Click "Calculate my Tax Savings"

Take Action and Maximise Your Tax Benefits

Important information: Please be mindful that our tax calculations are only estimates. To find out what your final tax return outcome will look like, call 02 9725 6169 and let our tax accountants walk you through the tax refund process with ease. You can book an appointment here.

Optimising your tax savings with our Negative Gearing Calculator. Our negative gearing calculator is a powerful tool that can help you estimate the tax savings of your property investments. This also allows property investors to see the possible tax benefits of owning a negatively geared investment property.

What is negative gearing?

Negative gearing is an investment strategy that involves borrowing funds to invest in property, minimising your initial capital investment.

By relying on borrowed money, you can acquire valuable investment properties.

When the total expenses, including loan interest, property management fees, and maintenance costs, exceed the rental income generated, it results in a rental loss—a condition known as negative gearing.

The primary objective of negative gearing is to utilize the tax benefits associated with this loss to potentially lower your taxable income, reduce your overall tax liability, and even secure a tax refund.

Earning a tax refund through negative gearing

Negative gearing happens when your total tax deductible expenses exceed your rental income, resulting in a net rental loss. This loss can be subtracted from your salary, wages, and other income, reducing your taxable income and lowering the amount of income tax you owe.

As a result, you may qualify for a tax refund. If the total withheld, including PAYG Withholding tax and PAYG instalments, is more than your actual tax payable, you can receive a tax refund. In essence, negative gearing helps reduce the amount of income tax you have to pay and may even earn you a tax refund.

Get the most out of your tax refund with TMS Financials

Maximise my refund

Get Started

Get my tax up-to-date

Get Started

Get tax planning advice

Get Started

The Benefits Of A Negatively Geared Property

Tax Benefits

Negative gearing offers allows investors to deduct rental property expenses, such as loan interest and maintenance costs, from their taxable income. This reduces their overall tax liability and potentially results in higher tax savings.

It’s important to note that the specific tax benefits and outcomes of negative gearing can vary based on individual circumstances and the tax laws of Australia’s taxation system. Utilizing a negative gearing calculator, consulting with our Property Accountant specialist, and staying informed about current regulations can help investors make informed decisions and optimize all the potential benefits.

Risks associated with investment property negative gearing

Negatively geared properties require ongoing financial commitment, as the investor must cover the shortfall between rental income and expenses from their own funds.

What you need for negative gearing to work

Adequate Rental Income

Effective negative gearing requires rental income and tax refunds to cover cash tax deductions (interest, expenses) for positive cash flow.

Tax Liability

Investors should have a taxable income against which they can offset the losses from negative gearing. Higher marginal tax rates can enhance the tax benefits.

Long-Term Investment Horizon

Negative gearing is typically a long-term strategy, as the capital gains from the property are expected to offset the initial losses over time.

Professional Advice

Consulting with a financial advisor, mortgage broker, or tax professional is crucial to understand the specific implications, risks, and benefits of negative gearing within Australia’s tax system.

Positive gearing benefits and tax considerations

It’s essential to consider tax implications and choose a tax-effective ownership structure. Proper planning can help optimise investment returns and reduce tax burdens, ensuring a sound financial strategy for property investors.

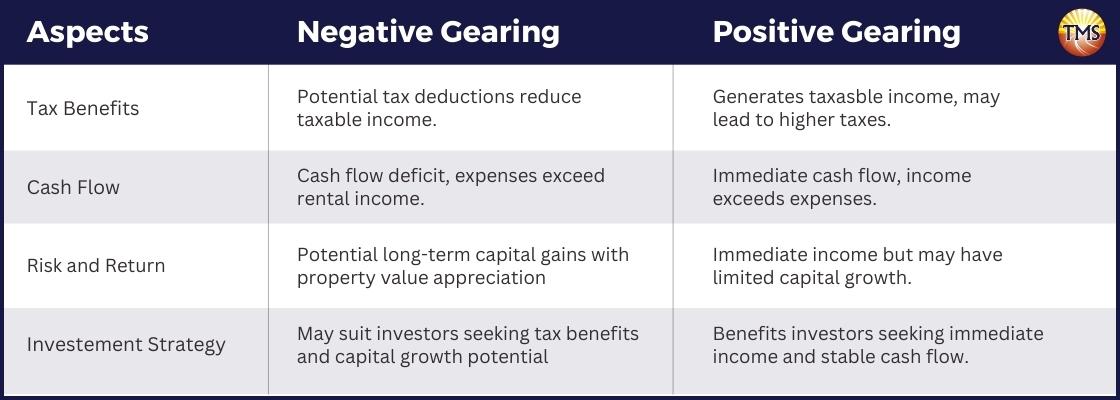

How does negative gearing work compared to positive gearing?

Tax Benefits – Negative gearing offers potential tax benefits through deductions. Expenses incurred from owning and maintaining the investment property can be deducted, reducing the overall taxable income. In contrast, positive gearing generates taxable income and may lead to higher tax obligations.

Cash Flow – Positive gearing provides immediate cash flow through rental income, where the income exceeds the expenses. On the other hand, negative gearing requires additional funds to cover the ongoing expenses, as the expenses exceed the rental income (also known as summary rental income), resulting in a cash flow deficit.

Risk and Return – Positive gearing offers immediate income but may have limited capital growth. Negative gearing, while having potential tax benefits, allows for potential long-term capital gains as the property value appreciates over time.

Understanding these differences and considering your financial goals and circumstances can help you determine the most suitable investment strategy, whether it involves positive or negative gearing.

Discover if you Qualify for PAYG Withholding Variation

If our Negative Gearing Calculator indicates significant tax savings, you may be eligible to apply for a PAYG withholding variation. This application allows you to reduce the amount of tax withheld from your payments throughout the year, giving you access to your savings sooner. Contact us for assistance with your PAYG withholding variation application.

At TMS, we are committed to helping you navigate the complexities of property investment and maximise all of your possible tax benefits. Take advantage of our resources, expertise, and personalised services to make the most of your investment property. Contact us today to get started on your journey toward financial success.

Disclaimer

In addition, please note that the results generated by our Negative Gearing Calculator are estimates based on the information provided. The accuracy of these estimates may vary depending on individual circumstances and additional factors not accounted for in the calculations. We recommend consulting with a qualified financial advisor or tax professional for a comprehensive analysis and personalized advice specific to your situation.

Take Advantage Of Negative Gearing Today

And Maximise Your Investment Potential!

Property Tax Tips & Savings

Subscribe now to our newsletter