At TMS Financials, we understand the challenges you face with business income and tax obligations, such as company tax, GST, and PAYG instalments. Our team of accountants is ready to streamline your tax processes. By leveraging top-tier tax software and ensuring all your tax returns and payments are submitted on time, we free up your time so you can focus more on growing your business.

We handle everything from your company tax returns to your Goods and Services Tax (GST) obligations and Capital Gains Tax (CGT). Our commitment is to maintain your financial records with accuracy and to optimise your tax position, making sure you benefit from all available tax offsets and incentives. With TMS Financials, you’re not just meeting deadlines; you’re making smart decisions that foster business growth.

How TMS Financials Can Help with your Company Tax Return

At TMS Financials, we recognise the critical need for precise and prompt lodgement of your company tax return. Our team is dedicated to managing your company’s tax obligations effectively, ensuring compliance and giving you peace of mind. Here’s how TMS Financials can assist you with the lodgment of your company tax return:

Efficiently Manage and Lodge Your Company Tax Returns

Quarterly BAS Preparation and Lodgement Services

Streamlined Preparation of Financial Statements

Year-Round Client Manager Support

Choosing TMS Financials as your registered tax agent provides support from a dedicated professional experienced in helping small businesses. Your client manager will guide you from selecting the right business structure to preparing and lodging your tax returns. We offer comprehensive support for all your tax planning and compliance needs throughout the year, making tax management straightforward and stress-free so you can focus on growing your business.

Lodge your Company Tax Return with TMS Financials

We’re an Australian tax accounting firm with 30+ years of experience serving business owners and investors. Our reputation for reliability and exceptional client service is built on providing accurate financial advice and asset protection. We remain committed to serving our clients with integrity, professionalism, and quality, and have the expertise to help you succeed.

TMS Financials is online now

INDUSTRY ASSOCIATIONS

TMS Financials is a proud member of the following

Eng Sivieng

Principal of TMS Financials

We strive to build long-term relationships with our clients and to be a trusted advisor for all their financial needs.

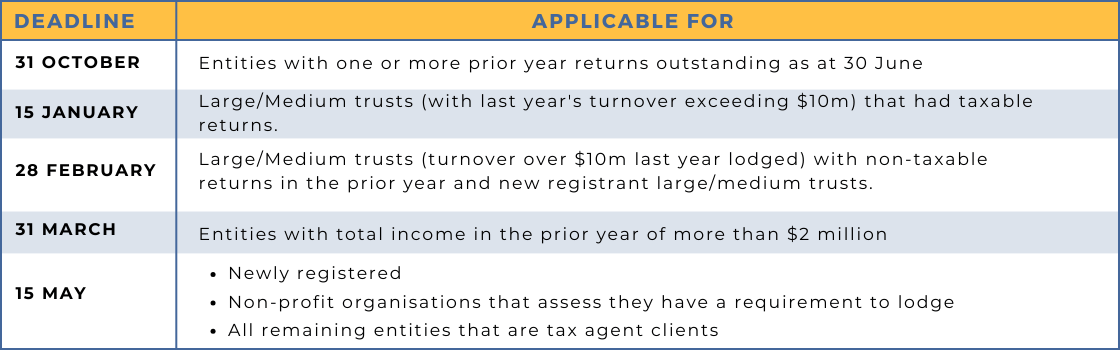

Key Lodgment Due Dates for Company Tax Returns in Australia

Stay Ahead of Your Tax Deadlines

ATO Penalties and Interest Charges

Late Lodgment Consequences

Accurate Reporting and Shortfall Charges

General Interest Charge (GIC)

Ensure Penalty-Free Tax Lodgment

Know Your Duties

Maintain Orderly Records

Ensure Accuracy

Disclaimer

Contact us today for a consultation.

Contact us today to learn more about how our accounting services can benefit your business. We look forward to hearing from you and helping you achieve financial success!