Australian Tax Refund Calculator 2025

Enter your total gross income for the full income year

Enter total tax deductions

Enter total tax withheld

Calculate your refund

Download Tax Deduction Checklist

What is Annual Taxable Income?

- Your salary and wages,

- Any allowances, earnings, tips, and similar payments,

- Payments and allowances from the Australian government, like Newstart, Youth Allowance, and Austudy payment.

What is your Other Income?

- Interest that you earn,

- Money from renting out property,

- Dividends from investments..

When you’re using our tax calculator, make sure to add this other income. It helps to accurately figure out your taxes and gives a full picture of your tax situation.

Don’t forget to include any payments you get for lost salary or wages. This can be from an income protection, sickness or accident insurance policy, workers’ compensation scheme, or even compensation from a personal injury claim or court settlement.

Get the most out of your tax refund with TMS Financials

Maximise my refund

Get Started

Get my tax up-to-date

Get Started

Get tax planning advice

Get Started

What are work and Investment-Related Tax Deductions?

Work-related Expenses

- To claim a work-related deduction, it must meet the ATO’s three golden rules :

- You must have spent the money yourself (and not be reimbursed).

- It must be directly related to earning your income.

- You must have a record to prove it (e.g., receipts, bank statements, credit card statements).

- Examples of work-related deductions include :

- Car expenses

- Travel expenses

- Clothing, laundry, and dry cleaning expenses

- Self-education expenses

- Other work-related expenses such as briefcase, calculator, computer, conference and seminars, home office expenses, reference books, stationery, tools and equipment, union fees, etc.

Depending on your occupation, you can receive a free customized tax deductions checklist. Click here to enter your name, email, and occupation, and we’ll send you a tailored checklist to maximize your work-related deductions.

This checklist will help you identify eligible deductions specific to your occupation, ensuring you don’t miss out on potential tax savings.

Investment-related Deductions

If you own a rental property, you must declare your rental income and claim eligible tax deductions.

Examples of investment-related deductions for rental properties include :

- Interest expenses on loans used to acquire the property (including mortgages, personal loans, and overdrafts)

- Capital work deductions

- Other rental deductions such as advertising, borrowing expenses, body corporate fees (strata levy), cleaning, council rates, water rates, depreciation, land tax, gardening and lawn mowing, insurance premiums, pest control, property agent fees and commission, repairs and maintenance, etc.

For more information on rental property tax deductions, please refer to our article “Australian Investment Property Tax Deductions Checklist.“

If you’re interested in learning the benefits and potential tax deductions of owning an Australian investment property as a long-term investment, read our article Australian Investment Property Tax Deductions to know more.

What is your total Tax withheld?

Your Total Tax Withheld refers to the amount of tax that your employer deducted from your salary and wages and paid to the Australian Taxation Office (ATO) on your behalf. This represents the tax credits you have accumulated throughout the financial year and will be applied when you prepare your tax return. When calculating what to include in the “Total Tax Withheld” field, make sure to include any PAYG instalment paid, if applicable. To find out your specific Total Tax Withheld, you can check your myGov account.

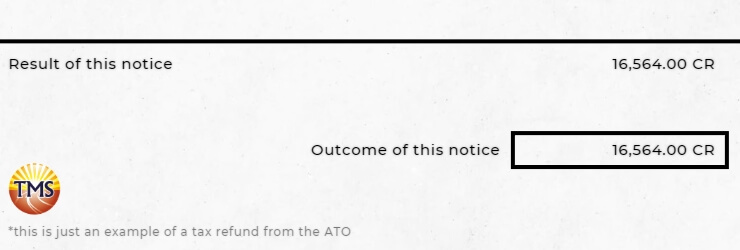

What is a tax refund?

A tax refund is an amount of money that you may receive from the Australian Taxation Office when you have paid more in tax throughout the year than what you actually owe. It is a tax refund for the excess tax you have already paid to the Australian Taxation Office (ATO). To ensure you claim the maximum tax refund and accurately prepare your tax return, it’s advisable to seek assistance from our registered tax agent.

Here’s an example: Let’s say your tax payable is $30,000, but your employer has withheld $35,000 from your income and paid it to the ATO. In this case, your Total Tax Withheld is $35,000. Since your tax payable is less than the amount withheld ($30,000 < $35,000), you are eligible for a tax refund of $5,000. We as a registered tax agent can guide you through the process, help you identify eligible deductions, and ensure your tax return is accurately lodged.

It’s important to consider factors such as your taxable income, tax deductions, tax offsets, and other financial circumstances when estimating your tax refund. Additional factors like the Medicare levy surcharge, private health insurance, dependent children, or higher education loan program obligations may also affect the final tax refund amount. By consulting a registered tax agent, you can receive personalized advice tailored to your specific situation, maximizing your potential refund.

How accurate is our Tax Refund calculator?

Our tax refund calculator provides reliable estimates based on the information provided. To ensure accuracy, have all necessary documents ready when using our calculator. While we strive for accuracy, individual factors and errors can affect the final result. For precise calculations and maximum tax refund, consult our registered tax agent. We’ll assist you in preparing and lodging your tax return, considering deductions and offsets. Trust us to provide a personalized assessment for optimal results.