At TMS Financials, we’re here to support you in ensuring that your trust meets its tax requirements. We provide professional advice and prepare all necessary financial statements to make the process straightforward. Our goal is to help you comply with the tax laws and protect the benefits for you and your beneficiaries, managing every step of the way to prevent any potential penalties.

How TMS Financials Can Help with Your Trust Tax Return

Here’s how TMS Financials can assist you with your trust tax return:

Assessing your Trust's tax obligations

Tracking deadlines

We keep track of all important filing deadlines to ensure your trust tax return is lodged on time. This proactive approach helps avoid any late filing penalties and keeps your trust in good standing.

Maximising your Trust tax deductions

Lodging your Trust tax return

Our team will guide you in preparing and lodging your trust tax return through the Australian Taxation Office (ATO) portal. We ensure everything is filed correctly to avoid any issues with compliance.

Lodge your Trust Tax Return with TMS Financials

We’re an Australian tax accounting firm with 30+ years of experience serving business owners and investors. Our reputation for reliability and exceptional client service is built on providing accurate financial advice and asset protection. We remain committed to serving our clients with integrity, professionalism, and quality, and have the expertise to help you succeed.

TMS Financials is online now

INDUSTRY ASSOCIATIONS

TMS Financials is a proud member of the following

Eng Sivieng

Principal of TMS Financials

We strive to build long-term relationships with our clients and to be a trusted advisor for all their financial needs.

Navigating Trust Tax Returns

Guidance on trust tax returns

Our team at TMS Financials is dedicated to assisting you with the complexities of trust tax returns, ensuring you fulfill all obligations set by the Australian Taxation Office (ATO). Whether you manage a family trust, an investment trust, or a hybrid trust, we can help you understand your responsibilities, including accurately reporting assessable income and making distributions to beneficiaries.

Section 100A

Section 100A of the Income Tax Assessment Act 1936 is designed to prevent tax avoidance. It applies when a benefit is received from a trust by one person, while another is entitled to income and thus taxed. This rule is invoked when such entitlement is part of an agreement or understanding intended to reduce or defer tax.

Family Trust Elections

Trust Tax Return Due Date For Lodgment and Payment

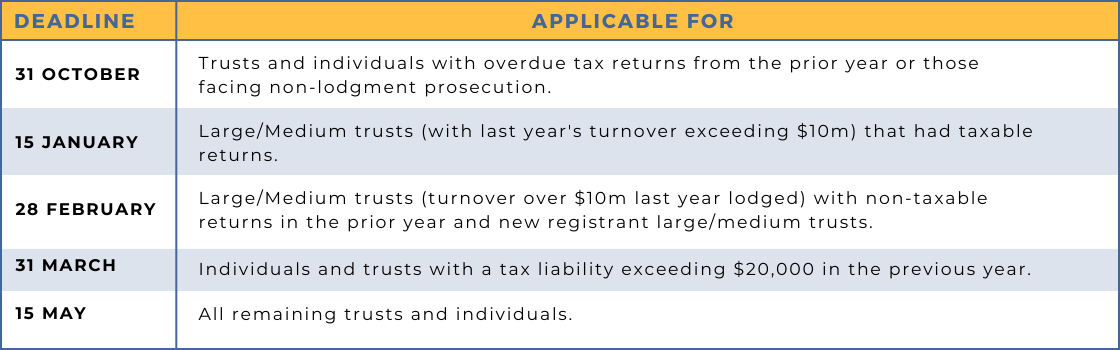

Key Lodgment Due Dates for Trust Tax Returns in Australia

Navigating the nuances of Australia’s trust tax laws can be difficult, but we’re here to guide you. Our expert tax accounting firm has in-depth knowledge of the key dates for Australian trust tax return lodgment:

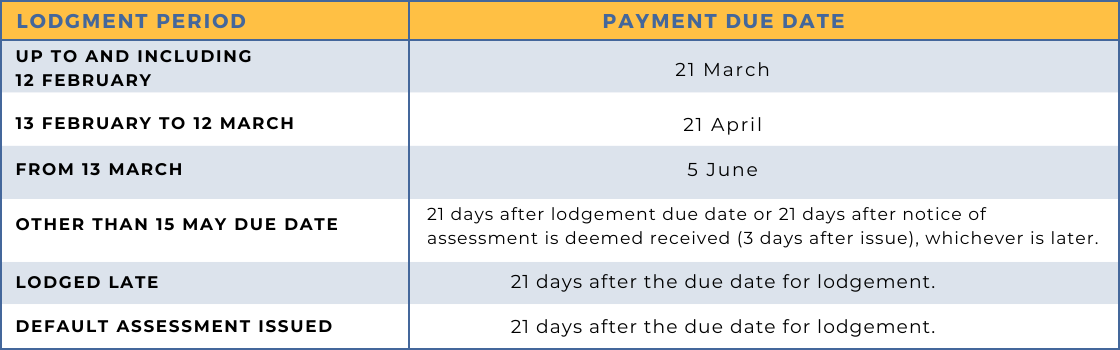

Trust Income Tax Payment Dates in Australia

ATO Late-lodgement and Other Penalties

Failure to Lodge (FTL)

Late Lodgment

Misclassification of Trust Distributions

Failure to Notify (FTN)

The FTN penalty is calculated at a rate of 8 per cent per annum of the amount not notified.

Key Taxes in Trust Tax Returns

When lodging a trust tax return in Australia, it’s important to be aware of the main taxes that need to be reported. Trusts are responsible for several tax obligations including income tax, Capital Gains Tax (CGT), Goods and Services Tax (GST), Fringe Benefits Tax (FBT), and Pay As You Go (PAYG) withholding. Accurate reporting of these taxes is essential for compliance with Australian tax laws.

Income Tax Details

Capital Gains Tax Info

About GST

Trusts registered for GST must report the GST collected from sales and can claim GST credits on purchases. This is managed through the Business Activity Statement (BAS), which is separate from the tax return. For more details on BAS, see our article “What is a Business Activity Statement?” and for GST specifics, refer to “Claiming GST Credits.”

Fringe Benefits Tax

PAYG Withholding Rules

Understanding these tax requirements is crucial for trusts in Australia. Given the complexity of tax laws, consulting with a certified tax agent is recommended to ensure full compliance.

Need a Professional Tax Accountant in Sydney?

Get in touch with us today to discover how our personalised accounting services can make a difference in managing your finances more effectively.

Contact us today for a consultation.

Contact us today to learn more about how our accounting services can benefit your business. We look forward to hearing from you and helping you achieve financial success!