FY2025

Tax Deductions Checklist

With our expertise in accounting and taxation, we navigate complex tax laws and maximise your financial outcomes. We offer services that cover income tax, Capital Gains Tax (CGT), and Goods and Services Tax (GST), alongside preparing financial statements and business activity statements. Whether you’re a sole trader, a small business owner, or an investor, TMS Financials is committed to helping you secure the best possible results in all your financial endeavours.

Why choose TMS Financials?

We celebrate 30 years of trusted service

With over 30 years in the industry, TMS Financials is known for its reliability and exceptional service. We are committed to offering accurate financial advice and asset protection, maintaining honesty, professionalism, and quality in all we do.

We are consistently reliable

You can rely on us for prompt responses and proactive management of your tax and financial matters. We ensure your finances are up-to-date and in line with the latest tax laws.

We uphold unwavering integrity

Trust and integrity are central to our approach at TMS Financials. We manage your financial affairs with the utmost care, ensuring you can trust us completely.

We offer experienced advice

Benefit from our three decades of experience across various industries. We provide personalised advice tailored to your specific needs and circumstances, guiding you through your financial journey with expertise.

Why it is important to hire an accountant to handle your records

The Role of Qualified and Experienced Accountants

Navigating Tax Time with Confidence

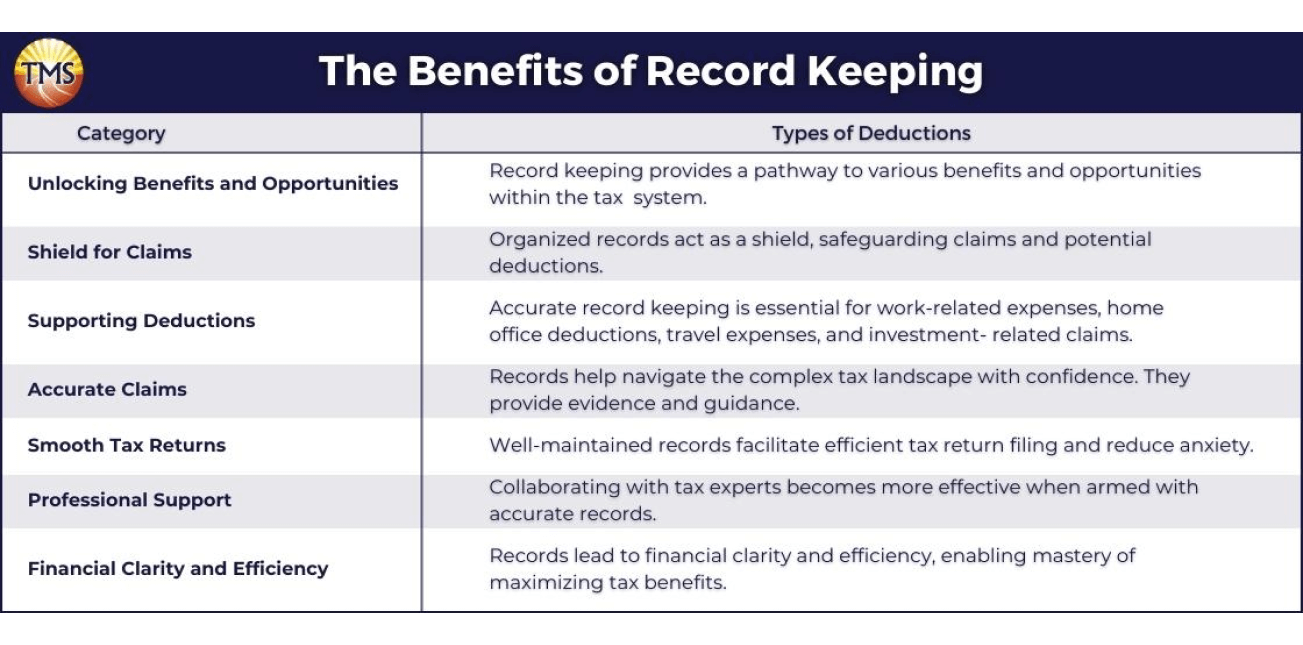

Importance of record-keeping in maximising your tax deductions

Maintaining records for different deduction types

Avoiding underclaims and overclaims with precise tax deductions

Navigating complex tax rules with comprehensive record-keeping

Efficient tax returns and deduction management

Next step is to contact TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic structuring.

Book a financial health review to see the difference we can make in your financial future.

Disclaimer

Contact us today for a consultation.

Contact us today to learn more about how our accounting services can benefit your business. We look forward to hearing from you and helping you achieve financial success!

Book a consultation today