ATO Client to Agent Linking: Protecting Your Financial Security

.

If you’re thinking about changing accountant, it’s important you’re aware of recent changes the Australian Taxation Office (ATO) is introducing that will impact you. As of 13 November 2023, the ATO has launched the final stage of its client-to-agent linking process. This new regulation applies to all entities with an Australian Business Number (ABN), excluding sole traders. The aim of this rollout is to enhance security and help safeguard against identity-related theft and fraud.

Existing clients of registered agents are not affected, but it’s essential for new clients or those making changes to their engagements with us to understand the process.What is the client-to-agent linking process?

The client-to-agent linking process is an additional layer of security designed to protect both tax agents and clients from identity-related fraud or theft. It requires clients to nominate their tax agent before the agent can add them to their client list, ensuring only authorised professionals can access their financial data.Why has client-to-agent linking been introduced, and when does it need to be completed?

Registered tax agents have digital access to their clients’ tax information and the functionality to lodge returns and forms through the ATO’s online services. Client-to-agent linking was introduced to strengthen the security of these online services. Client-to-agent linking also helps protect a client’s information (e.g., from identity theft) by requiring them to securely nominate a registered agent using the ATO’s online platform, Online services for business. From 13 November 2023, this new nomination process must be completed by a client with an ABN (except a sole trader) if they are:- engaging a new registered tax or BAS agent, or payroll service provider to represent them; or

- changing the authorisations given to an existing agent (for example, to start representing the client for a new obligation such as income tax, FBT, or to represent a new entity in the client group).

Why is client-to-agent linking important?

Enhanced security

The introduction of client-to-agent linking significantly strengthens the security of online tax services. In the past, the risk of fraudulent agents or hackers creating unauthorised accounts or lodging false returns on your behalf was a concern. This change ensures that only trusted professionals can access your financial data. By requiring you to nominate your tax agent, an extra layer of control is added, making it far more difficult for unauthorised individuals to tamper with your financial information.Protecting your privacy

With client-to-agent linking, you retain control over who can access your financial information. Your privacy is paramount, and this change empowers you to manage your financial affairs securely. You can rest assured that your sensitive financial data remains confidential and is accessible only to authorised individuals.Peace of mind

Knowing that your financial information is in safe hands and that only authorised professionals can access it provides you with peace of mind. You can trust that your financial interests are protected, and your financial data is handled with the utmost care and security. If you have any questions or need assistance with this process, please reach out to us. We are here to support you every step of the way in navigating these important security enhancements.How does the new process work?

Nominating an authorised tax agent is a critical step in safeguarding your financial interests and enhancing security. The process starts in the Online Services for Business, where you access the ‘Nominate Agent Screen.’ This new agent nominations feature allows you to manage your agent nominations. The introduction of the ‘New Agent Nomination Feature’ has made this process both simpler and more secure. It enables you to nominate a new tax or BAS agent, or a payroll service provider. When nominating, providing your agent’s Registered Agent Number (RAN) is essential. You can obtain this number from your agent for a quick and accurate search. Once you’ve entered the RAN, it’s important to verify the agent’s details to ensure they are correct. If your agent requires additional time to add your business as a client, the ‘Extend’ feature is available. This feature can be used for seven days starting the day after your nomination submission. Choosing the right agent is crucial, especially for specific needs such as income tax, GST affairs, or employee payroll functions. This nomination process is integral to our commitment to strengthen the security of our online services. It plays a key role in protecting against fraud and identity-related theft, ensuring a safer experience for all users.Nominate TMS as your registered agent in Online services for business:

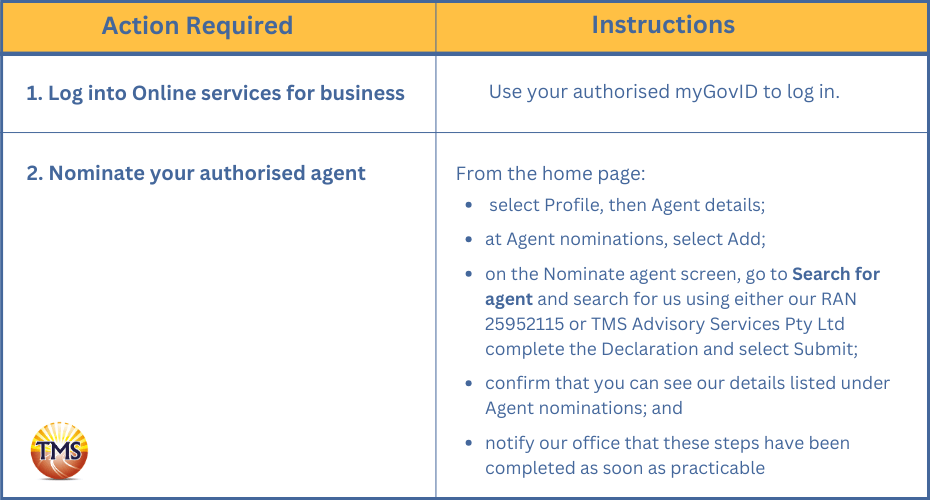

To do this, you will need to follow the client-to-agent linking steps outlined by the ATO, which vary depending on whether or not you have already set up access for Online services for business.A. If you have already set up access to Online services for business and have an appropriately authorised myGovID:

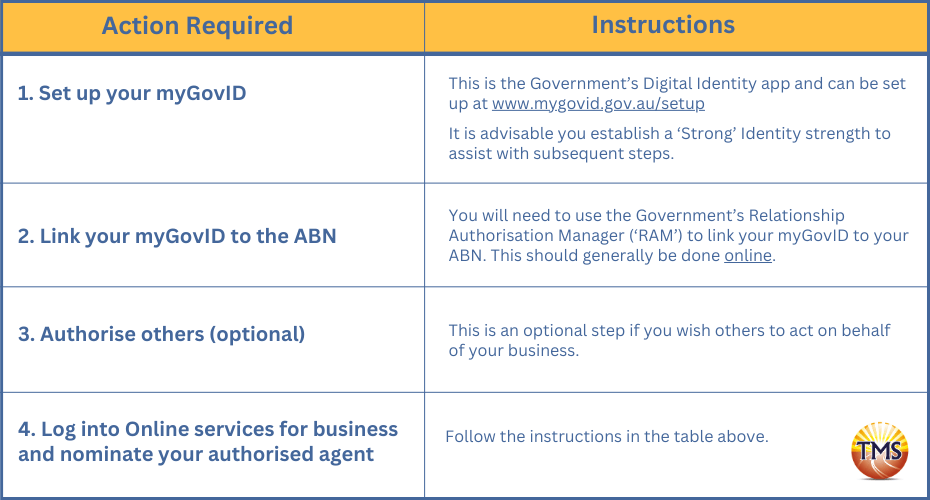

B. If you have NOT set up access to Online services for business and do NOT have an appropriately authorised myGovID, before you follow the steps in the above table you will need to:

The steps outlined in Table A or B (whichever applies) must be repeated by each individual or by an authorised person of each entity in your group wishing to nominate TMS Advisory Services to act as your authorised agent.

Notify us of each nomination

Once you’ve submitted a nomination with the ATO, please promptly notify Thomas at our office by calling 02 9725 6169 or emailing us at admin@tmsfinancial.com.au. This step is crucial, as the ATO does not directly notify agents of nominations.

Timeframe for Completion: After nomination, we have 28 calendar days to add you, any other individuals, and entities in your group as a client or to add additional tax accounts before a nomination expires. If additional time is needed, we can request the ‘Extend’ feature in Online services for business to add another 28 days to a nomination.

At TMS, we fully support this initiative as a proactive step to protect your financial interests and maintain the highest level of security. We are here to assist you every step of the way. If you have any questions or need guidance on the process, please don’t hesitate to reach out to us.

Nominating your tax agent is a simple yet important process that empowers you to safeguard your financial interests and maintain the highest level of security. We value your privacy and security and are dedicated to providing you with the best financial services.

Next step is to contact TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

Related Articles

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.