Our tax experts have a thorough understanding of the rules of Division 7A under the Income Tax Assessment Act, which covers loans from private companies to their shareholders or associates. We guide you through creating legal loan agreements that follow the required minimum interest rate, terms, and documentation to ensure your loan isn’t considered a dividend.

We can also help you understand the different options with both unsecured and secured loans, and ensure you make the minimum yearly repayments on time to avoid significant tax penalties.

Whether you’re refinancing loans or establishing new ones that meet legal standards, we make sure your financial activities comply with tax laws, keeping your tax obligations in check.

Why choose TMS Financials

Setting Up Compliant Loan Agreements

Planning for Effective Repayments

Regular Monitoring and Annual Reviews

Ensure Division 7A Compliance with TMS Financials

We’re an Australian tax accounting firm with 30+ years of experience serving business owners and investors. Our reputation for reliability and exceptional client service is built on providing accurate financial advice and asset protection. We remain committed to serving our clients with integrity, professionalism, and quality, and have the expertise to help you succeed.

TMS Financials is online now

INDUSTRY ASSOCIATIONS

TMS Financials is a proud member of the following

Eng Sivieng

Principal of TMS Financials

We strive to build long-term relationships with our clients and to be a trusted advisor for all their financial needs.

Understanding Division 7A Loan Terms

Division 7A is a part of Australian tax law that focuses on loans made by private companies to their shareholders or associates. It’s designed to prevent companies from passing on untaxed profits to shareholders in ways that should typically be taxed, such as with dividends.

Here are the basic details of Division 7A loan terms:

Minimum Yearly Repayment

Each year, there’s a required minimum amount that must be paid back to avoid tax issues. This amount includes both the principal (the amount borrowed) and the interest. This payment needs to be made by the due date for the company’s income tax return each year. If not, the Australian Taxation Office (ATO) may treat the unpaid amounts as dividends, resulting in potential tax liabilities for the shareholder or associate.

Interest Rate

The interest rate on these loans must be at least equal to the benchmark interest rate set by the ATO. This ensures the loan is seen as legitimate and not a way to distribute profits as untaxed dividends.

Loan Term

For unsecured loans, the repayment period cannot be longer than 7 years. If the loan is secured with a mortgage on real property, it can be extended up to 25 years.

Written Agreement

It’s crucial to have a formal written agreement for these loans. Without it, the ATO may treat the loan as a dividend right from the start.

What is a Division 7A Loan Agreement?

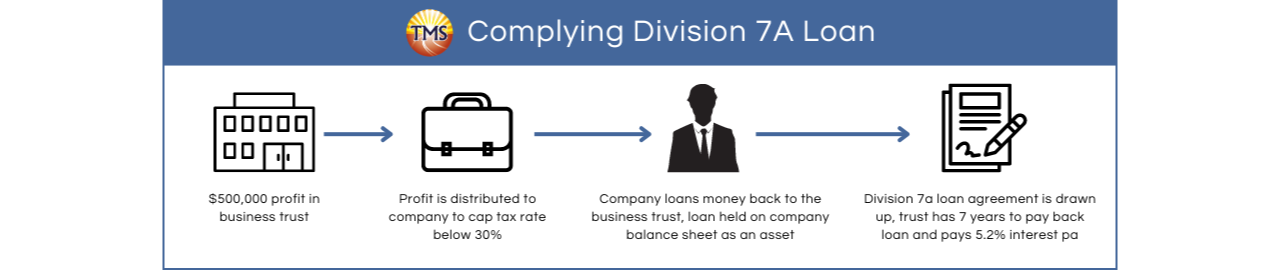

Division 7A sets out the rules for loans made within a company. By following these rules, individuals can minimise their tax liability. Typically, individuals are taxed at rates from 0% to 47%, whereas companies are taxed at a flat rate of either 25% or 30%.

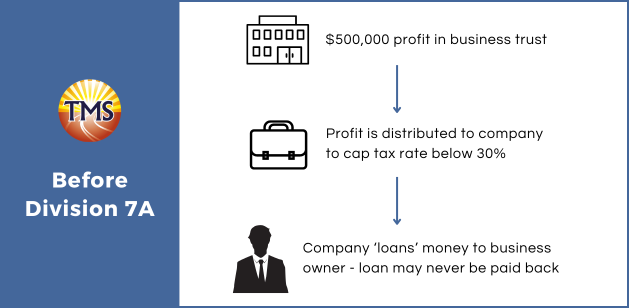

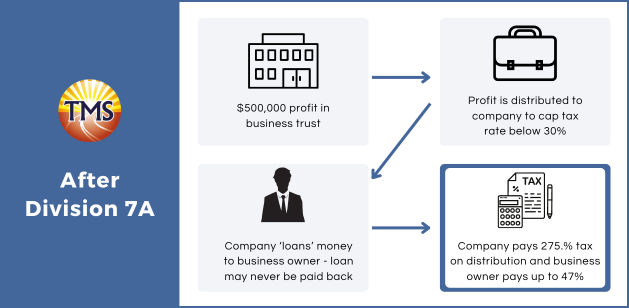

To achieve a lower tax rate, it’s common for individuals to transfer funds to a “bucket company,” capping the tax rate at 25%. However, simply transferring money to a company does not guarantee the funds will end up in your personal accounts for use on personal expenses such as paying off a mortgage or boosting your disposable income.

A frequent approach to manage this is for the company to ‘lend’ the money back to the individual, who is a shareholder. This loan is then recorded on the company’s balance sheet and is scheduled to be repaid over several years. In some instances, these loans may not be repaid at all, which are referred to as ‘forgiven’ loans.

In recent years, the Australian Taxation Office (ATO) has intensified its scrutiny on certain types of ‘loans’, viewing them as potential tax avoidance strategies. These transactions, once considered simple inter-company loans, are now often classified as ‘disguised contributions’.

In response, the Australian government introduced a specific set of regulations known as Division 7A, which is part of the Income Tax Assessment Act. Division 7A was established to prevent private companies from distributing untaxed funds to shareholders under the guise of loans or other payments that should normally be subject to taxation as dividends.

Why Compliance is Crucial

A compliant loan provides you with access to funds without triggering additional tax events, effectively allowing you to defer tax payments rather than avoid them.

For tailored advice, we encourage you to consult with one of our tax professionals today to ensure that your financial strategies are in line with Division 7A regulations.

Division 7A Loan Agreement Terms

Unsecured Loans

Secured Loans

Strategies for Paying Yourself Without Triggering Division 7A

How to pay yourself a salary as a company director

In Australia one of the simplest methods for a company director to receive payment is through a salary via the company’s payroll. This process makes tax reporting straightforward and ensures compliance with Pay As You Go (PAYG) and superannuation obligations, allowing you to receive your income regularly.

How to pay director fees and allowances as a company director

To avoid triggering Division 7A when issuing director’s fees it is essential to adhere to tax laws, including proper PAYG withholding and making superannuation contributions. Consulting with a tax professional can help you stay compliant and optimise your tax benefits.

How to pay yourself bonuses and commissions as a company director

When it comes to bonuses and commissions, careful management is key to maximising benefits and ensuring they comply with tax regulations. This will help you avoid potential tax issues under Division 7A.

How to withdraw money using a Div 7a Loan Agreement

When drawing company funds for personal use, like purchasing a luxury item, it’s crucial to use a Division 7A loan agreement. This agreement ensures that the money used is not taxed as a dividend at your higher personal tax rate.

How to make loan repayments to shareholders for Division 7a

Paying dividends, especially fully franked ones, is an effective way to improve your tax position as a company director. Fully franked dividends distribute profits that have already been taxed at the corporate level, and they come with franking credits that can offset your personal income tax, potentially reducing your overall tax liability.

FAQs on Division 7A

What is Division 7A?

When does Division 7A apply?

Division 7A applies under these circumstances:

-

The entity involved is a private company.

-

The company has profits or retained earnings.

-

A loan or payment is made to a shareholder or their associate.

-

These loans and payments are treated as dividends unless they comply with specific requirements.

What is a Division 7A loan agreement?

Why does the ATO enforce Division 7A rules?

Why can’t I just withdraw company profits for personal use?

Can I transfer company profits to my spouse or trust instead of as a loan?

What’s the best way to access my company’s profits without a large tax bill?

The safest method to access company profits is through a fully franked dividend, which comes with tax credits that mitigate the tax impact on the shareholder.

What happens if my loan doesn’t comply with Division 7A?

Non-compliant loans are treated as dividends, meaning the amount loaned becomes fully taxable income with potentially high tax implications.

How do I ensure my loan remains Division 7A compliant?

What are the repayment terms for a Division 7A loan?

What happens if I can’t meet the minimum repayments outlined in the loan agreement?

Is it better to take money out of the company as a loan or as a salary or dividend?

Would it be easier for me to repay all Division 7A loans now?

What is the current ATO benchmark interest rate?

What are unpaid present entitlement?

Next step is to contact TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic structuring.

Book a financial health review to see the difference we can make in your financial future.

Disclaimer

This outline is for general information only and not as legal, tax or accounting advice. It may not be accurate, complete or current. It is not official and not from a government institution. Always consult a qualified professional for specific advice tailored to your unique circumstances.

Contact us today for a consultation.

Contact us today to learn more about how our accounting services can benefit your business. We look forward to hearing from you and helping you achieve financial success!