BAS Due Dates

Time and Avoiding Penalties.

It’s important for businesses to understand the connection between being registered for GST and BAS lodgement. If a business has a GST turnover of $75,000 or more, or $150,000 or more for non-profit organizations, they are required to register for GST. This means that they must charge GST on their goods and services, and report and pay GST to the ATO via their BAS.

Importance of Meeting BAS Obligations and Deadlines

Consequences of late or incorrect lodgement and payment:

There are several consequences that can rise from later or incorrect lodgement of BAS. These consequences can include

PENALTIES

interest CHARGES

Audit risk

Late or incorrect BAS lodgement can increase the risk of an ATO audit, which can be a time-consuming and costly process.

Cash flow problems

Late payment of BAS can cause cash flow problems for a business, which can impact its ability to pay suppliers, employees, and other expenses.

Benefits of meeting BAS obligations and deadlines:

Meeting BAS obligations and deadlines can bring several benefits to a business. The benefits can include

AVOIDING PENALTIES

Building trust

Meeting BAS obligations and deadlines can help build trust with suppliers, customers, and the ATO, which can lead to positive long-term business relationships.

IMPROving cash flow

By paying BAS on time, a business can improve its cash flow and avoid cash flow problems.

simplify tax process

Tips for staying organized and meeting BAS obligations

KEEP ACCURATE RECORDS

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

USE TECHNOLOGY

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

SET CALENDAR REMINDERS

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

SEEK PROFESSIONAL HELP

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Understanding GST and

Its Relationship with BAS

Businesses with a turnover below $75,000 can voluntarily register for GST. Once registered, they charge GST on taxable supplies and claim GST credits paid on business expenses.

GST reporting can be done monthly, quarterly, or annually based on turnover. Businesses with a turnover of $10 million or more must pay GST monthly and submit a monthly BAS. Smaller businesses can choose their preferred reporting frequency.

Registered businesses must file an annual GST return by February 28th of the following year.

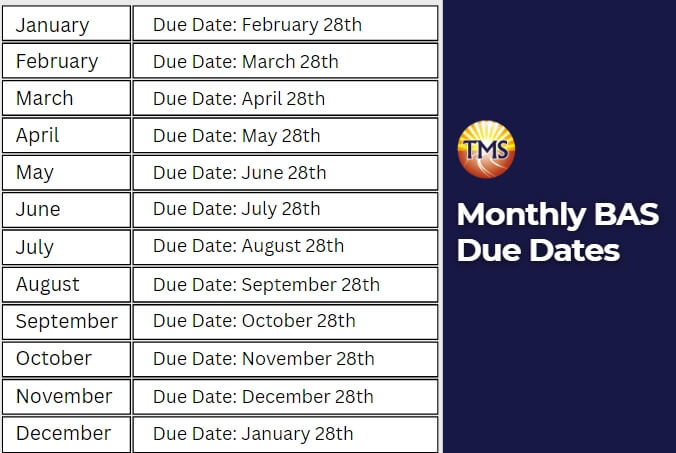

BAS Due Dates for Monthly Reporting

Businesses reporting monthly should also be aware of the payment cycle for their BAS obligations. Payment cycles may vary depending on the payment method used, and it is important for businesses to keep track of these reporting and payment cycles to avoid any late payment penalties.

The payment cycle for electronic payments made using BPAY is generally two business days before the due date, while payments made using credit or debit cards may have different payment cycles. It is important for businesses to check with their financial institution to ensure they make payments on time and avoid any late payment penalties.

Small businesses lodging monthly BAS refund or payments should also be aware of the BAS statement, which is a summary of their GST, PAYG withholding, and other tax obligations for the reporting period. It is important to accurately complete the BAS statement, as it affects the amount of tax refund or payment due.

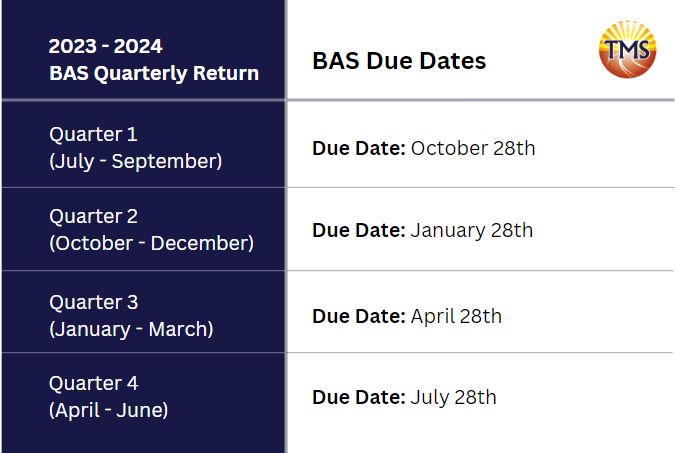

BAS Due Dates for Quarterly Reporting

If your business has a GST turnover of less than $10 million, you have the option to report your BAS quarterly. This means that you will only need to then lodge and pay a tax return for your Business Activity Statement (BAS) and make any necessary payments every quarter

Quarterly BAS reporting is a system in which businesses submit their BAS every three months, rather than monthly. This option is available to businesses with a GST turnover of less than $10 million. It is important to note that businesses can switch from quarterly to monthly BAS reporting if their GST turnover increases to $10 million or more.

The due dates for quarterly BAS are July 28, October 28, February 28, and April 28. If the due date falls on a weekend or public holiday, businesses can lodge and pay on the next business day.

Similar to payment cycle for monthly BAS reporting, there are also payment cycles for reporting quarterly BAS. Businesses have the following options for the payment cycle:

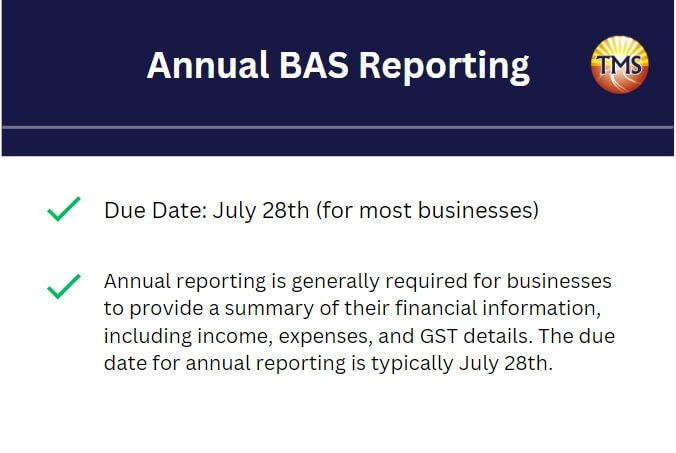

Annual Reporting and Other BAS Due Dates

In addition to the annual BAS, businesses may be required to submit an annual GST return and a December activity statement. The due date for the annual GST return and quarterly activity statements is generally February 28th of the following financial year, and the due date for the December activity statement is generally February 28th of the following calendar year.

Businesses are also required to lodge tax returns and summaries of payments by certain due dates. The due dates for tax returns may vary depending on the business structure, but typically fall on October 31st of the following financial year. Payment summaries must be provided to employees by July 14th of the following financial year.

Other BAS due dates may also apply, such as lodgement dates and payment dates for public holidays. These dates may vary depending on the specific holiday and the state or territory in which the business operates.

Meeting BAS obligations and deadlines is essential for avoiding late lodgement and payment penalties, as well as maintaining a good relationship with the Australian Taxation Office. By meeting the deadlines, businesses can avoid unnecessary stress, financial penalties, and potential legal action.