What is the importance of having a Director ID?

Director ID: Why is it important?

If you are a director of any Australian company or want to become one, you must be verified by the Australian Business Registry Services (ABRS) by obtaining a unique 15-digit identifier called the Director Identification Number or DIN. The main goal is to prohibit unlawful activities and create fraudulent director identities. The set-out deadline is on 30 November 2022 – just a week away!

Who needs a Director ID?

You need to apply for DIN if you are an eligible officer of either:

- a company,

- a registered Australian body,

- a registered foreign company, or

- an Aboriginal and Torres Strait Islander corporation (Strait Islander Act 2006)

An eligible officer is any person appointed as either a company director or an alternate director acting in that capacity.

Director IDs need to be secured only once and can be kept forever, so you don’t need to obtain another one even if you change companies or become a director of two or more companies.

When to apply for Director ID?

To apply for a Director ID depends on the date you first became a director under the Corporations Act 2001:

- You need to apply now until 30 November 2022 if you were appointed as a director on or before 31 October 2021.

- If you become a director for the first within 1 November 2021 to 4 April 2022, you have 28 days from your appointment to apply.

- To become a new director, you must apply for a director ID before being appointed.

Can my accountant apply for my Director ID?

Your accountant or any of your authorised BAS, TAX or ASIC agents can’t apply on your behalf; you must apply on your own director id to verify your identity.

What happens if I don’t get a Director ID?

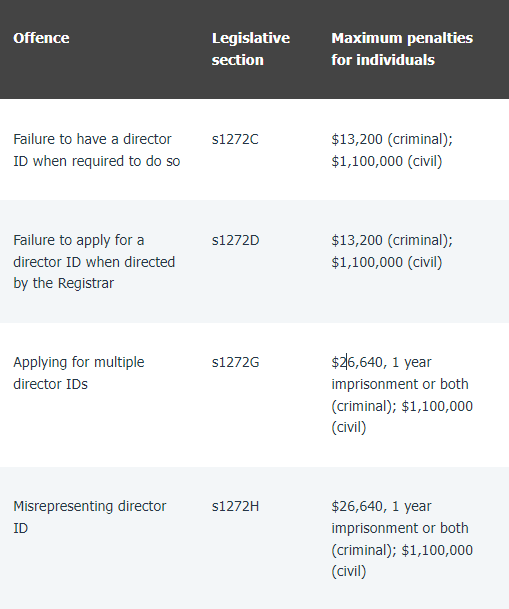

If you fail to apply for Director ID, ASIC will impose criminal and civil charges of up to $13,200 and $1,100,000 for each individual, respectively.

For the complete details on the possible penalties ASIC will enforce on new director ID offences, see the image below:

So it is vital that you act now, and if you can’t apply until 30 November 2022, if required to, you must apply for an extension using this form.

How can I apply for a Director ID?

Apply for Director ID online

You can apply online for Director ID by setting up a myGovID in the myGovID app with at least a Standard identity strength, but we suggest to use your Australian passport to verify for a strong identity strength.

Once you have your myGovID, you can now login into ABRS online and apply for a director ID.

>> Apply for your Director ID – Australian Business Registry Services (ABRS)

You need to provide additional personal information (not your company details) to proceed with your director ID application, so you must prepare it beforehand.

You will need following :

- your Tax File Number (TFN), and

- your residential address held by the ATO,

- plus information from 2 identity documents below if you only have a Standard myGovID identity strength.

Examples of identity documents include :

- Bank account details that the ATO has on record,

- an ATO notice of assessment,

- Superannuation account details, including the super fund’s ABN,

- a dividend statement,

- a Centrelink payment summary, and

- a PAYG payment summary.

See the complete list of required identity documents for verification here.

Other ways to apply for Director ID

If you live in Australia and can’t apply online, you can contact the ABRS to apply. If you currently live outside, apply using this paper application form and send it with certified copies of your identity documents.

Next Steps

Once you get your Director ID, you need to provide a copy to the record holder of any company you are a director of. These include your

- company secretary,

- contact person,

- another director, or

- authorised agent.

There’s no need to provide your director ID to the ASIC unless requested.

If you’re unsure if you already have a Director ID or need to apply for one, you can double-check in ABRS online and it should appear on the right-hand side under My Details in your dashboard.

TMS is here to help!

We may not be able to apply on your behalf, but we are here to assist you in completing the process. Just contact us, and let’s apply for your director ID.

If you’re a client of TMS and have already applied for a Director ID, please provide us with a copy for our records at admin@tmsfinancial.com.au if you have not yet done so.

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.