Directors guide to voluntary administration – TMS Financials

.

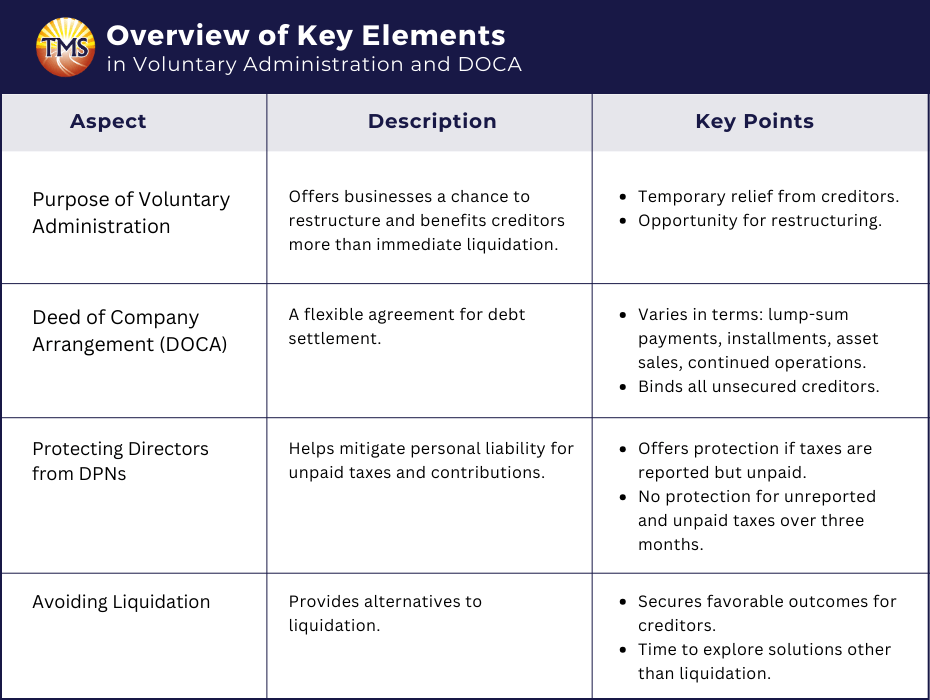

Voluntary administration is a process where an independent voluntary administrator assumes control of a company in financial difficulty or on the brink of insolvency. This crucial step provides the company breathing space and enables the company’s directors or any external party to evaluate and pursue strategies for saving the company or undergoing small business restructuring.

If no viable solution emerges, the voluntary administrator undertakes to manage the company’s affairs in a way that is more advantageous for the creditors than if the company were put into immediate liquidation. A central strategy in this process is the Deed of Company Arrangement (DOCA), a pact between the company and its creditors, including both secured and unsecured creditors, to resolve the company’s challenges. This pact is initiated upon entering voluntary administration and is closely overseen by a deed administrator, who is often the same individual as the voluntary administrator. The deed administrator’s ongoing role is crucial in managing the company’s affairs and ensuring the terms of the DOCA are met.

Directors may opt to appoint a voluntary administrator as they recognise their company’s unstable financial situation or impending insolvency. In some instances, a liquidator or secured creditor may initiate the appointment. This approach is part of a comprehensive effort to confront the company’s financial troubles and consider a voluntary administration as an alternative to thrusting the company into liquidation, aiming to achieve the most favorable outcome for all creditors.

During the voluntary administration process, creditors meetings are held to keep the creditors informed and to vote on the company’s future. Insolvent trading claims may also arise during this process, which the voluntary administrator will need to manage. The goal of this process is to provide the best possible outcome for all parties involved, including the creditors in a voluntary administration scenario.

What does a voluntary administrator do?

Once appointed, a voluntary administrator investigates and informs the creditors about the company’s status. This includes insights into the company’s business, assets, and financial health. The voluntary administrator presents three key options to the creditors, who may be employees or contractors:

- End the voluntary administration and return control to the company’s directors.

- Approve a Deed of Company Arrangement (DOCA), enabling the company to resolve its debts partially or fully and continue operations without the burden of those debts.

- Liquidate or shut down the company, appointing someone to manage the distribution of assets and settlement of debts.

The voluntary administrator is responsible for providing their opinion on each option and recommending the best course of action for the creditors.

Their role involves:

- Identifying potential solutions to the company’s issues

- Evaluating proposed strategies for the company’s future

- Considering the outcomes of these strategies in comparison to the consequences of company closure

About five weeks after the voluntary administration process begins, a creditors’ meeting is held to decide the company’s fate. If the situation is complex, this meeting might be delayed.

The voluntary administrator has the authority to make significant decisions for the company, like selling the business or parts of it, before the creditors determine its future. They are also tasked with reporting any misconduct related to the company’s operations. Upon completing their role, the voluntary administrator must provide a comprehensive report of their actions and expenses.

What happens when a voluntary administrator is appointed?

The appointment of a voluntary administrator gives the company a crucial pause to strategise its future actions. During this period:

- General creditors are barred from initiating or continuing legal actions against the company unless the administrator approves or a court grants permission.

- Owners of non-perishable goods used by the company, including those leasing such items to the company, cannot reclaim their possessions.

- In most cases, creditors with a security interest in the company’s assets are unable to seize these assets.

- Neither creditors nor other qualified entities can initiate legal proceedings to liquidate the company.

- If a creditor holds a personal guarantee from the company’s director or another individual for the company’s debts, they cannot enforce this guarantee without court approval.

This period provides a safeguard for the company, allowing it to address its financial challenges without the immediate pressure of creditor actions or the threat of liquidation.

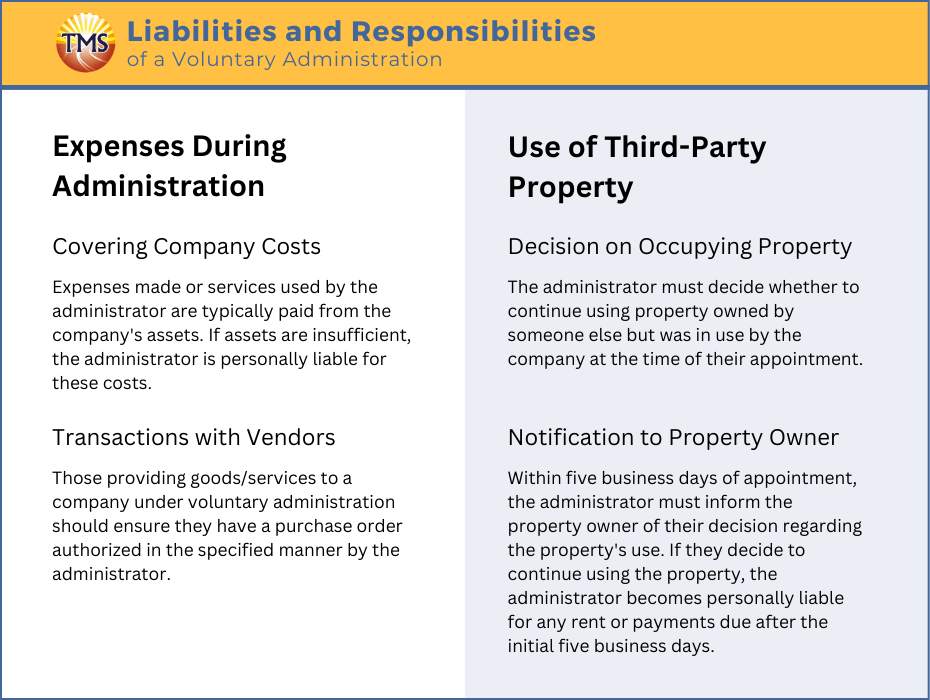

Responsibilities of a voluntary administrator regarding liabilities

When a voluntary administrator assumes control of the company, they may incur expenses related to purchasing goods or services necessary for the company’s operations. These expenses are part of the voluntary administration process and are typically paid using the company’s available assets. However, if the sale of the company’s assets doesn’t generate sufficient funds, the voluntary administrator bears personal responsibility for these costs.

If you’re supplying goods or services to a company under voluntary administration, it’s important to obtain a purchase order authorized by the administrator in their specified manner. The voluntary administrator must also decide on the continued use or occupation of property that belongs to someone else but was in use by the company at the time of their appointment.

The administrator is required to notify the property owner within five business days of their appointment, regarding their decision to either continue or cease using the property. Should they opt to continue, the administrator becomes personally liable for any rent or payments due after those initial five days.

Understanding the voluntary administration process

The voluntary administration process is designed to be quick and efficient, typically concluding in just over a month. By the end of this period, the company will either enter liquidation or will have established a Deed of Company Arrangement (DOCA) with its creditors.

However, in complex cases, the Administrator may need to delay the Second Meeting of Creditors (also known as the Decision Meeting). Such postponement is possible with the approval of either the courts or the creditors.

The fundamental goal of these timelines is to ensure swift resolution of the company’s issues while providing sufficient time for stakeholders to receive and assess all necessary information. This balance aims to facilitate informed decision-making by all parties involved in the voluntary administration process.

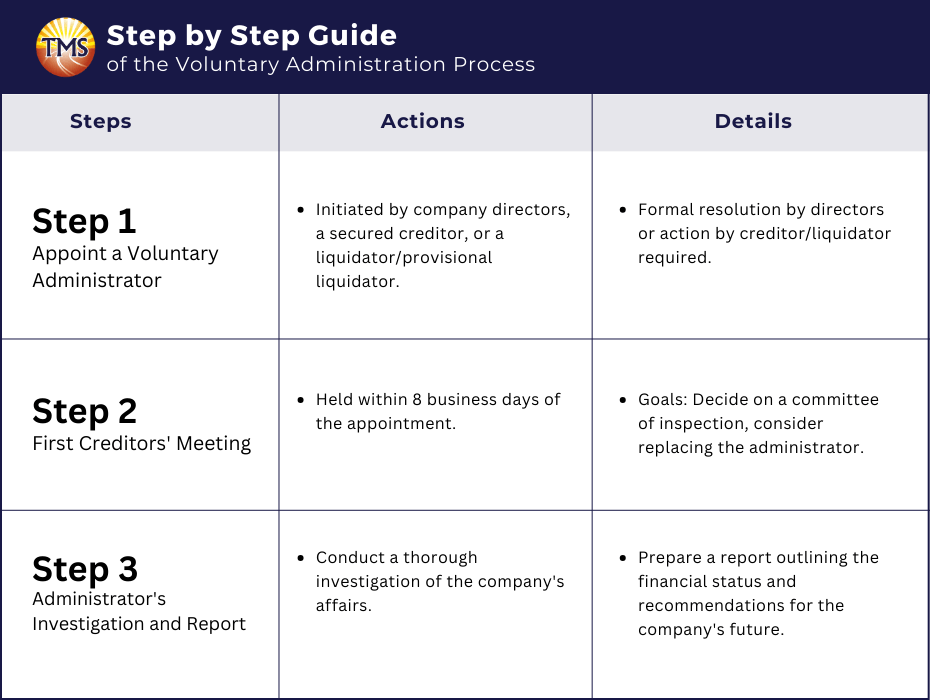

Step 1: in appointing a voluntary administrator

The appointment of a voluntary administrator can be initiated by:

- The company’s directors, who must pass a formal written resolution for this purpose

- A secured creditor holding a security interest over the majority or all of the company’s assets

- A liquidator or provisional liquidator already involved with the company

Following the selection of a voluntary administrator, the voluntary administration process officially commences.

Step 2: Conducting the first creditors’ meeting

The voluntary administrator must hold the first meeting with the company’s creditors within eight business days of their appointment. This meeting’s notice, issued at least five working days in advance, should be communicated to most creditors and published on ASIC’s Notices Publication site.

At this meeting, the administrator needs to disclose any personal interests or indemnities to ensure transparency. This allows creditors to evaluate the administrator’s independence and consider appointing an alternative administrator.

The main goals of the first meeting are to:

- Decide on forming a committee of inspection and its members

- Consider replacing the current administrator with a new one chosen by the creditors

Creditors looking to propose a new administrator should arrange a replacement in advance, who must also disclose any conflicts of interest. Changes to the administrator can only occur if the majority of creditors agree.

Creditors must submit their claims to gain voting rights at the meeting, which is either chaired by the administrator or a nominee.

Step 3: Conducting the administrator’s investigation and report

Following the first creditors’ meeting, the voluntary administrator undertakes a thorough investigation of the company’s affairs. This investigation aims to assess whether the company can settle its existing debts. Based on their findings, the administrator prepares a report for the creditors, outlining the current financial status of the company and providing recommendations for its future. These recommendations may include continuing the company’s operations as usual or proceeding with closure and liquidation.

The second creditors’ meeting in voluntary administration

The voluntary administrator, after analysing the company’s situation, advises creditors on the most suitable option for the company’s future. They then schedule a second meeting for creditors, usually about five weeks after the start of voluntary administration. This timeframe can extend to six weeks during holiday periods like Christmas or Easter. In more complex cases, the administrator may seek court or creditor approval to extend this period for more detailed reporting.

Prior to this meeting, the administrator must send key documents to the creditors at least five business days in advance. These include a meeting notice, a comprehensive report of their findings, and a statement. Additionally, forms for submitting creditor claims and proxy voting are provided. These preparations ensure that creditors are well-informed and ready to make crucial decisions.

This second meeting, also advertised on ASIC’s Published Notices website, can be held through various methods, including telephone, video conferencing, or web-based platforms. It’s a pivotal point in the voluntary administration process, where creditors decide the company’s fate – whether to continue operations, enter into a Deed of Company Arrangement (DOCA), or proceed with liquidation. The outcome of this meeting significantly shapes the company’s future direction.

Preparing the voluntary administrator’s report

The voluntary administrator is tasked with preparing a comprehensive report that encapsulates key aspects of the company’s business, property, financial status, and overall affairs. This report is designed to provide creditors with sufficient information to make an educated decision about the company’s future. It serves as a critical tool in guiding the decision-making process, ensuring all parties involved are well-informed.

The report should also include a thorough analysis of any proposed plans for the company’s future. It will detail the potential outcomes of these plans, offering a clear picture of what each scenario could entail. Furthermore, the report should provide a comparative analysis to illustrate what creditors might expect if the company were to enter liquidation. This comparison is vital for understanding the potential returns in different scenarios.

It’s essential for creditors to carefully review this report before the Second Meeting of Creditors, or if they are planning to appoint a representative to attend on their behalf. Thoroughly understanding the contents of the voluntary administrator’s report is key to making an informed decision regarding the company’s path forward.

Preparing the voluntary administrator’s statement

The statement prepared by the voluntary administrator is a key document that outlines their perspective and reasoning regarding the options available to creditors. It should clearly state their recommendation on the best course of action for the creditors’ interests. The options typically include:

- Terminating the voluntary administration and returning control to the company’s directors

- Approving a Deed of Company Arrangement (DOCA), if one is proposed

- Liquidating the company and appointing a liquidator

The statement should also contain any additional information that could assist creditors in understanding these options more comprehensively. This includes potential transactions that might be subject to reversal by a liquidator, such as preferential payments to certain creditors, unfair loans, insolvent trading, or illegal phoenix activity.

In cases where a DOCA is proposed, usually by the company’s director or other parties, the voluntary administrator must provide a detailed statement about each proposal. This enables creditors to make well-informed decisions. DOCAs can vary, offering solutions like partial or complete debt repayment over time, and may allow the company to continue its operations. The terms of a DOCA can differ based on the specific circumstances of the company.

It’s crucial for you to obtain as much information as possible about the terms of any proposed DOCA prior to the creditors’ meeting. If you feel that the information provided in the voluntary administrator’s report or statement is insufficient for making informed decisions about the company’s future, you should contact the voluntary administrator for more details before the meeting.

Entering voluntary administration to avoid insolvent trading

Directors have a responsibility to prevent their company from trading while insolvent, as failing to do so can lead to severe consequences. To mitigate the risk of insolvent trading, companies facing financial challenges often opt for voluntary administration. This proactive step demonstrates that the directors are taking responsible actions to avoid insolvent trading.

By appointing a voluntary administrator, the company halts the accumulation of new debts, providing a protective measure for both the company and its directors. This process grants the company valuable time to assess its situation, make informed decisions about its future, and implement strategies to overcome financial difficulties. Voluntary administration thus serves as a crucial tool for businesses to responsibly manage financial crises and avoid the pitfalls of insolvent trading.

Addressing creditor concerns through voluntary administration

Voluntary administration is more than just a temporary halt to creditor demands for companies in distress. It involves appointing an independent expert, the voluntary administrator, whose role is to conduct a thorough review of the company’s operations and assets. Their objective is to determine the most effective solution to the company’s issues, with a primary focus on the interests of the creditors.

This process allows the company to shift its focus from merely responding to immediate pressures, such as creditor demands, market fluctuations, and other external factors, to actively addressing and resolving its underlying problems. This includes finding solutions to issues with creditors.

Meanwhile, creditors are kept in the loop about the company’s situation through regular reports from the administrator. These reports provide detailed insights, enabling creditors to understand the current state of the business. Importantly, they also have the opportunity to participate in key decisions regarding the company’s future. This might involve supporting a Deed of Company Arrangement (DOCA), opting for liquidation, or agreeing to return control to the company’s directors. Voluntary administration thus offers a structured environment for both the company and its creditors to collaboratively work towards a resolution.

Entering a Deed of Company Arrangement (DOCA) through voluntary administration

Voluntary administration serves a dual purpose. Firstly, it offers struggling yet potentially viable businesses a chance to restructure and survive. Secondly, it seeks to manage the company’s affairs in a way that is more beneficial to its creditors than immediate liquidation would be. During voluntary administration, companies get a temporary reprieve from creditor pressures and debt collection, allowing them to consult with the voluntary administrator and consider options like a Deed of Company Arrangement (DOCA).

A DOCA is a key potential outcome of the voluntary administration process. It’s a flexible agreement where the company negotiates to settle its debts, either partially or fully. Once the terms of a DOCA are fulfilled, the company is released from these debts.

The terms of a DOCA can vary widely. They might include lump-sum payments, structured installments, selling assets to pay debts, or even continuing business operations for revenue generation to settle debts.

It’s important to note a DOCA binds all unsecured creditors, including those who did not vote in favor of it. However, it does not affect the rights of creditors holding personal guarantees from the company’s directors or others; these creditors can still pursue their claims independently of the DOCA.

Protecting directors from Director Penalty Notices in financial distress

When companies experience financial difficulties, especially with cashflow and insolvency issues, they may struggle to meet their obligations to the Australian Taxation Office (ATO), including unpaid PAYG (Pay As You Go) taxes and superannuation contributions. In such situations, the ATO can issue Director Penalty Notices (DPN) to hold company directors personally accountable for these unpaid dues.

Entering voluntary administration can be a strategic move for directors facing a DPN, particularly when it pertains to amounts that were reported to the ATO but remained unpaid within three months of the reporting period’s end. Under these circumstances, voluntary administration can potentially mitigate the director’s personal liability, offering a form of protection.

However, this protective measure has its limits. If the taxes or contributions are both unreported and unpaid for over three months, voluntary administration does not provide the same safeguard against personal liability for directors. In these cases, directors remain vulnerable to personal claims by the ATO for these unmet financial obligations.

Avoiding liquidation through voluntary administration

While liquidation remains a potential outcome, the voluntary administration process offers companies the opportunity to consider alternatives before creditors make a final decision on liquidation, based on the recommendations of the voluntary administrator.

The main objective of voluntary administration is to secure the most favorable outcome for creditors. Therefore, if other options, such as entering into a Deed of Company Arrangement (DOCA) or reinstating the company under the directors’ control, prove more advantageous than liquidation, voluntary administration acts as a crucial intervention. This process provides a window of time for the company to explore and evaluate these alternatives, potentially steering away from immediate liquidation. It’s an opportunity for the company to carefully weigh and pursue different solutions that could be more beneficial for all involved parties.

Who are TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.