Entertaining, Meals and FBT

.

An everyday occurrence across the business landscape in Australia is the practice of taking both existing and potential clients out for a meal to cement the business relationship, with the cost of this meal often covered by one party.

Equally, business owners commonly reward by taking high performing employees out for lunch and covering the cost.

ARE THE COSTS OF THESE MEALS TAX DEDUCTIBLE?

After all, it was a genuine business expense surely, I can claim back the GST and claim a tax deduction?

The case outlined above is a clear example of “Meal Entertainment”. Unless the business owner wants to pay the appropriate amount of fringe benefits tax (FBT) no deduction is allowed and the GST cannot be claimed.

The provision of meal entertainment is defined as:

- providing entertainment by way of food or drink

- providing accommodation or travel related to, or to facilitate the provision of, such entertainment

- paying or reimbursing expenses incurred by the employee for the above.

Considering this, some of the more common practices that are included as meal entertainment would be:

- taking your employees out for coffee or lunch

- meeting with clients at a café or restaurant for a meal or drink

- social functions, such as Christmas parties, where food or drink is supplied

FBT CONSEQUENCES

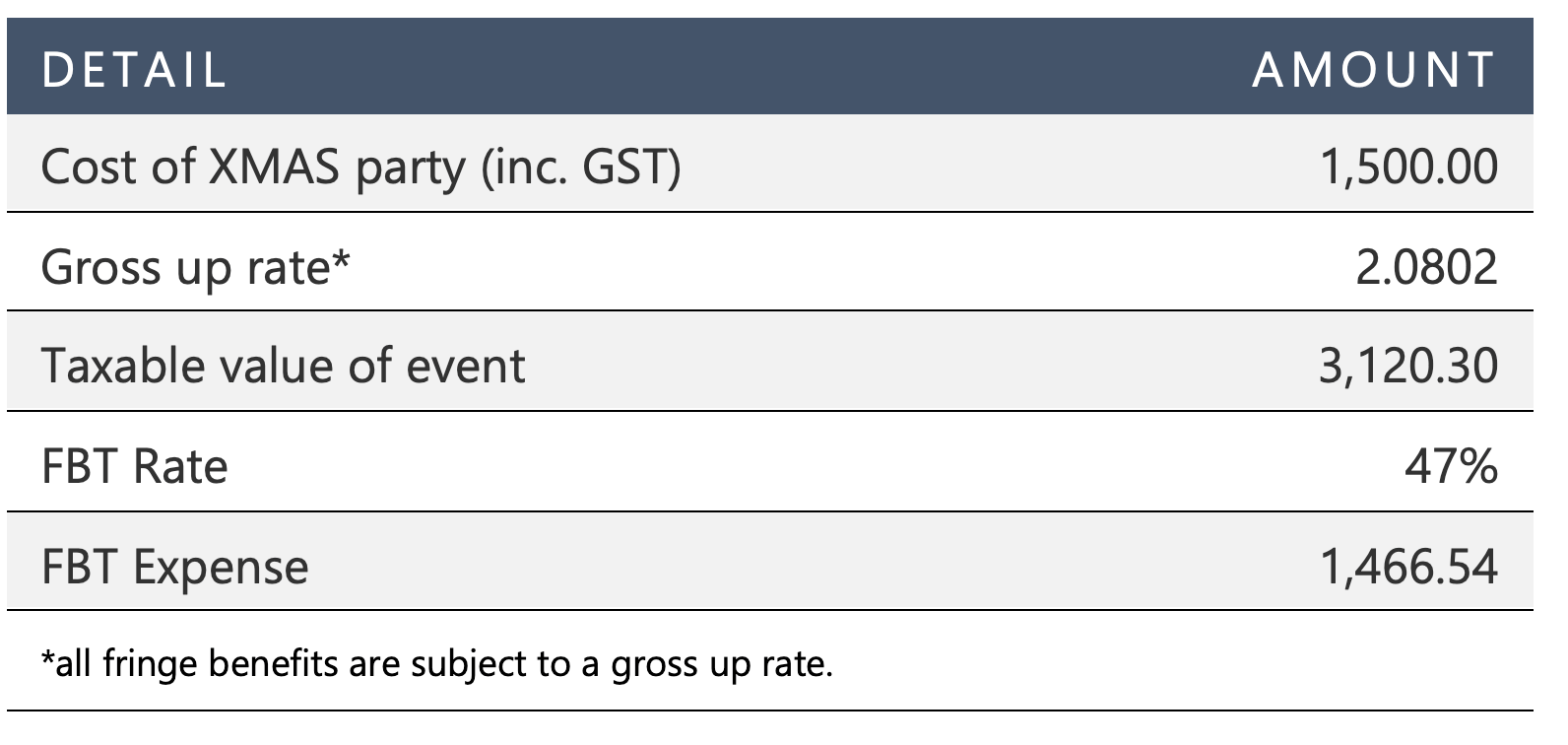

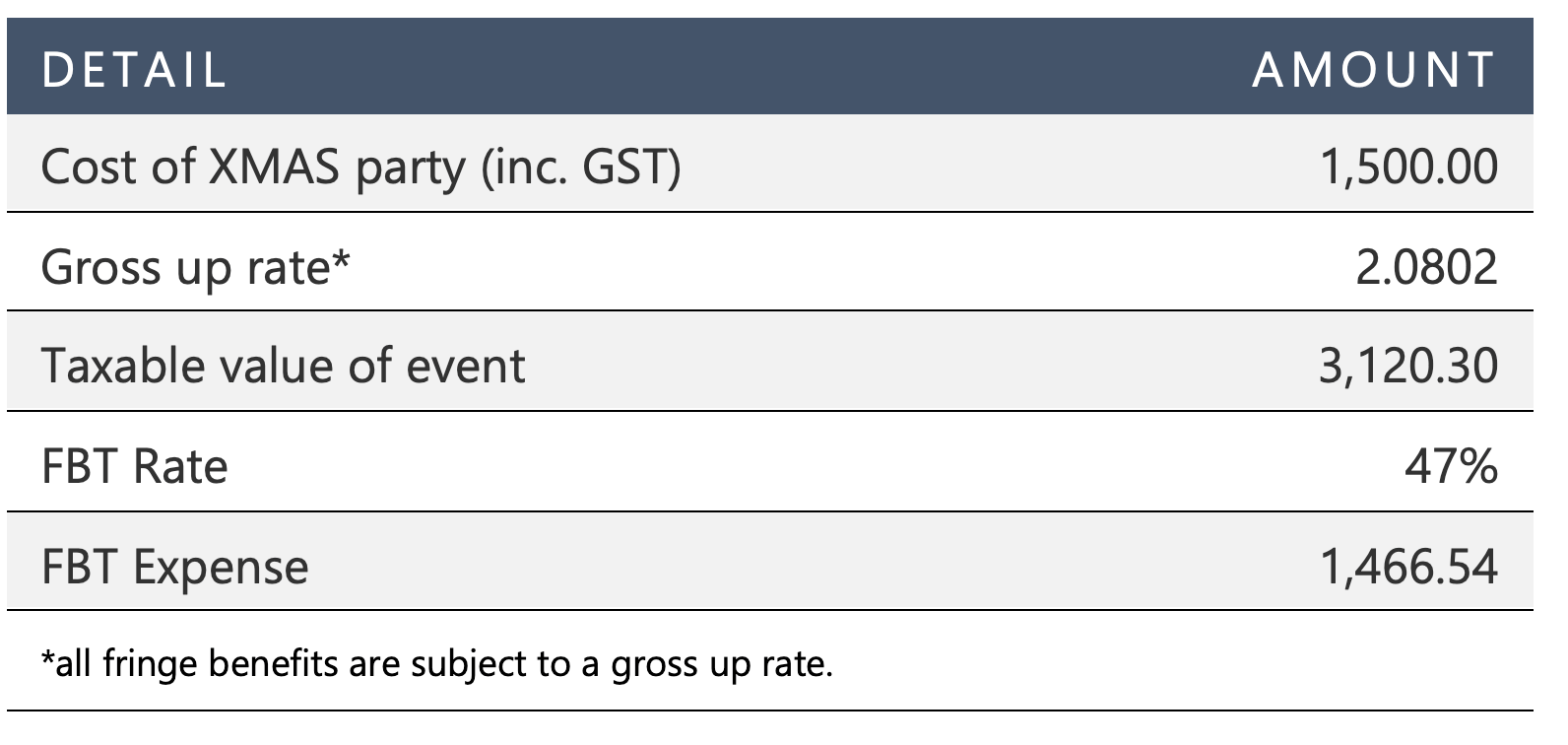

Where FBT is paid the cost of the meal entertainment benefit (in this case the Xmas party) is deductible and the GST can be claimed on your next BAS.

As you can see from the example above, even considering that the event is now tax deductible, the FBT cost associated with providing the meal entertainment benefit is more than the cost of the party. Obviously, we want to avoid paying the FBT where possible.

FBT CONSEQUENCES

Where FBT is paid the cost of the meal entertainment benefit (in this case the Xmas party) is deductible and the GST can be claimed on your next BAS.

As you can see from the example above, even considering that the event is now tax deductible, the FBT cost associated with providing the meal entertainment benefit is more than the cost of the party. Obviously, we want to avoid paying the FBT where possible.

EXEMPTIONS

The two most common exemptions available that eliminate the FBT liability are outlined below:

MINOR AND INFREQUENT

There are some exemptions allowed that will reduce the taxable value of meal entertainment benefits to Nil. However, where this is the case, no tax deduction can be claimed, and neither can the GST.

The most common exemption is the minor and infrequent exemption which states:

- The cost of the benefit is less than $300 (per person)

- The benefit is not provided frequently

Both conditions above must be satisfied for the meal entertainment benefit to be exempt. For example, taking an employee out to lunch to reward high performance would be exempt as it would be an infrequent occurrence and the cost would be less than $300.

Alternatively, if taking your employees out to lunch is a regular weekly occurrence for which the employer covers the cost, this no longer satisfies the infrequent condition above and the benefits are subject to FBT, even though the cost is less than $300 per person.

IN HOUSE MEALS

Simple meals (e.g. sandwiches and juice) provided to your employees within your office to enjoy at lunch are not subject to FBT and are deductible.

Be cautious though if meals become more complex, such as including alcohol or multiple courses, as these may alter the characteristic of the benefit being provided and the tax deduction may be lost.

In conclusion, the provision of meal entertainment benefits can be a taxation minefield. We strongly suggest that if you have questions regarding your business practices and how you reward your employees please contact your advisor at FIRM NAME today.

NEXT STEPS

To find out if your business need to lodge FBT return for year 2023,

Please Click here Or Book a Free 15 minutes consultation.

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.