Understanding Fringe Benefits Tax in Australia

.

Employers often provide perks like cars or loans as part of a total compensation package. However, the Australian Taxation Office (ATO) imposes a Fringe Benefits Tax (FBT) on certain employee benefits. Employers carry the burden of this tax, not the employees.

Not every perk qualifies as a taxable fringe benefit; it must have a clear connection to employment. Some benefits, known as “exempt benefits,” are FBT-free, while “minor benefits” may have lower FBT rates. Salary sacrifice arrangements, where employees trade salary for benefits, can also carry FBT implications. Employers, especially those in specific sectors like public benevolent institutions, should be knowledgeable about FBT so they can manage their tax obligations effectively.

Examples of fringe benefits

When discussing employee compensation packages, it’s important to consider not just the base salary, but also the range of fringe benefits that may be offered. These benefits often serve as valuable incentives for employee retention. However, they can also carry tax implications under the Fringe Benefits Tax (FBT), as set forth by the Australian Taxation Office (ATO).

Here are some examples of taxable fringe benefits, which can impact an employer’s FBT liability:

- Educational fee reductions

- Vehicle-related costs and parking facilities

- Discounts offered to employees on products or services

- Accommodation and meal provisions

- Recreational activities and events

- Loan waivers or debt cancellations

- Options to purchase company shares

- Medical and health-related benefits

- Recognition awards for accomplishments

- Access to sports and fitness centers.

What does not qualify as a fringe benefit?

According to guidelines from the Australian Taxation Office (ATO), there are specific payments and benefits that do not fall under the category of fringe benefits and are thus exempt from Fringe Benefits Tax (FBT) liability. For example, an employee’s regular salary, employer contributions to retirement funds, severance payments, and shares acquired via an employee share scheme are not considered fringe benefits.

In addition, dividends from investments, benefits extended to volunteers or independent contractors, and certain benefits dispensed by religious institutions are also excluded from the classification of fringe benefits.

It’s worth noting if a business provides a benefit to an employee that would have been tax-deductible had the employee paid for it themselves, then the company does not incur the FBT liability for that benefit.

Understanding what does and does not constitute a fringe benefit is crucial for proper tax planning for both employers and employees.

Why do employers offer fringe benefits?

While managing fringe benefits may require additional administrative effort, the advantages they bring to a company often outweigh the challenges. These non-cash benefits can serve as a means of retaining and attracting employees. For example, offering fringe benefits can make a job offer more appealing, encouraging more applications from top-tier candidates. Additionally, the costs associated with providing fringe benefits, as well as the Fringe Benefits Tax (FBT) paid, can often be claimed as income tax deductions by the employer.

Beyond the financial incentives, providing fringe benefits can contribute to a more supportive and engaging workplace culture. When employees feel valued and well-cared for, it can positively impact productivity. In specific cases, fringe benefits can also yield tax advantages for employees, potentially reducing their overall income tax burden.

Reasons why companies offer fringe benefits

Fringe benefits aren’t just perks; they also bring tax implications. When companies provide such benefits, they can usually deduct the costs and any Fringe Benefits Tax (FBT) paid from their taxable income. The taxable value of these benefits plays a role in determining the company’s FBT liability. On the employees’ side, reportable fringe benefits can influence their taxable income, potentially reducing the income tax they owe.

Understanding the liability of Fringe Benefits Tax (FBT)

When a business provides assets for its employees’ personal pleasure or advantage, they can trigger Fringe Benefits Tax (FBT). For example, the provision of a company car for private trips, school fee reimbursements, or offering preferential loan terms might subject the company to FBT. However, certain benefits, like employment-centric tools such as laptops, software, and job-related travel expenses, might be exempt if predominantly used for work purposes.

The classification of a perk as a fringe benefit can be complex, especially if it’s not explicitly employment-related. Complexity rises when the recipient has multiple roles, like being an employee as well as a shareholder or a beneficiary of a trust linked to the provider.

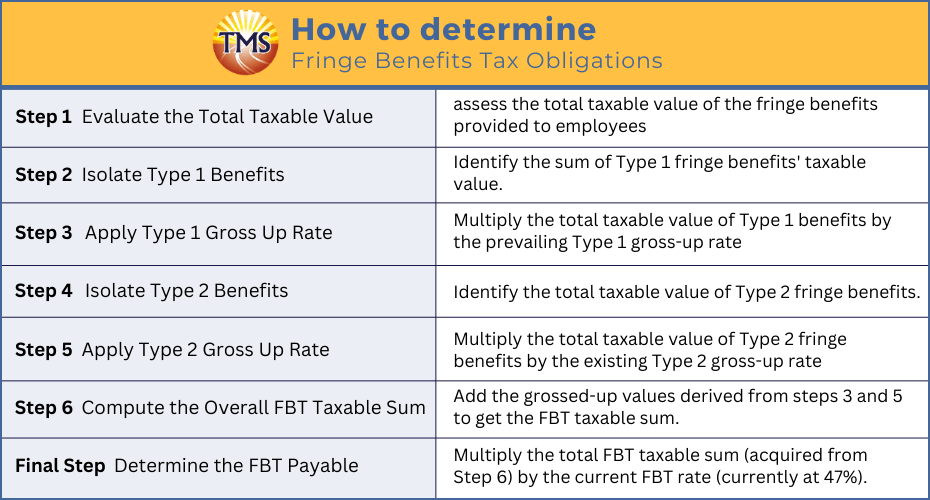

Determining your Fringe Benefits Tax (FBT) obligations in Australia

It’s important to understand that fringe benefits are segregated into two categories: Type 1 and Type 2.

Follow these steps to calculate your FBT liability:

Step 1: evaluate the total taxable value

Begin by assessing the total taxable value of the fringe benefits provided to employees. This serves as the baseline for further calculations.

Step 2: isolate type 1 benefits

Identify the sum of Type 1 fringe benefits’ taxable value. For these benefits, employers are entitled to claim a Goods and Services Tax (GST) credit.

Step 3: apply type 1 gross up rate

Multiply the total taxable value of Type 1 benefits by the prevailing Type 1 gross-up rate (as of now, it is 2.0802). This gives you the grossed-up taxable value for Type 1 benefits.

Step 4: isolate type 2 benefits

Identify the total taxable value of Type 2 fringe benefits. You cannot claim a GST credit for these particular benefits, which might include GST-free or input-taxed supplies.

Step 5: apply type 2 gross up rate

Multiply the total taxable value of Type 2 fringe benefits by the existing Type 2 gross-up rate (currently at 1.8868). This will yield the grossed-up taxable value for Type 2 benefits.

Step 6: compute the overall FBT taxable sum

Add together the grossed-up values derived from steps 3 and 5 to arrive at the comprehensive FBT taxable sum.

Step 7: determine the FBT payable

Multiply the total FBT taxable sum (acquired from Step 6) by the current FBT rate (currently at 47%). This reveals the FBT amount you’re obliged to pay.

Make sure to keep up-to-date records and consult the Fringe Benefits Tax Assessment Act for any changes in rates or procedures.

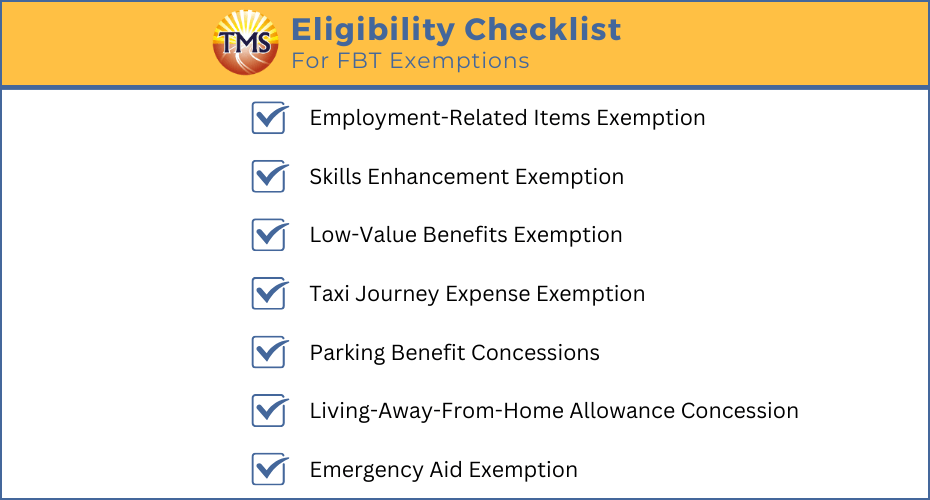

Understanding FBT exemptions: are you eligible?

Employers have the potential to qualify for certain concessions or exemptions for the benefits they extend to their employees, depending on specific situations.

Below are some common FBT exemptions that may be relevant:

- Employment-Related Items Exemption: This pertains to items predominantly used by employees for work-related purposes.

- Skills Enhancement Exemption: This exemption is for employers investing in training or educational opportunities for employees facing redundancy or those anticipated to be made redundant soon.

- Low-Value Benefits Exemption: Benefits valued under $300 might be eligible for this exemption.

- Taxi Journey Expense Exemption: This is applicable if the taxi ride begins or concludes at the employee’s official place of work.

- Parking Benefit Concessions: Exemptions related to car parking might be available under specific criteria.

- Living-Away-From-Home Allowance Concession: In certain scenarios, there may be a potential reduction.

- Emergency Aid Exemption: This covers benefits given to employees in the aftermath of natural calamities, accidents, serious health concerns, or significant civil disturbances.

Employers should regularly review these exemptions and seek professional advice to ensure they’re in compliance with current regulations.

Examples of fringe benefits

If your organisation operates on a not-for-profit basis, you maybe eligible for an exemption from Fringe Benefits Tax (FBT) up to a certain cap.

The following types of organisations generally qualify for this exemption:

- Public benevolent institutions: organisations of this type are often eligible for FBT exemptions.

- Health promotion charities: such entities focusing on public health matters may also be exempt.

- Public or not-for-profit hospitals: institutions providing healthcare services to the public can also be eligible.

- Public ambulance services: services dedicated to public emergency transportation often qualify for this exemption as well.

Reporting and payment procedures for Fringe Benefits Tax (FBT)

The FBT year runs annually from 1 April to 31 March. If your business offers fringe benefits to its employees and you suspect you will incur an FBT liability, it’s advisable to clarify your obligations and register with the Australian Taxation Office (ATO). Financial advisors or tax professionals can assist in the registration process. Once you’ve extended fringe benefits to your workforce, you’re obligated to submit an FBT return form.

Typically, the FBT return must be submitted by 21 May. However, if you’re working with a tax agent, you may qualify for an extended submission deadline. For those who are new to paying FBT, or if last year’s FBT payment was below $3,000, a single annual payment is required upon filing your FBT return.

On the other hand, if your FBT liability exceeds $3,000, quarterly payments will be required through your activity statements for the subsequent FBT year.

FBT reporting obligations in year-end income statements

While only employers are required to pay Fringe Benefits Tax (FBT), there are reporting considerations that affect both employers and employees. Specifically, if the value of fringe benefits given to an employee surpasses $2,000 in a single FBT year, this figure must appear on the employee’s annual income statement under the Reportable Fringe Benefits Amount (RFBA) section.

Importantly, the RFBA is not considered taxable income for the employee and does not impact their income tax or Medicare levy directly. However, the presence of Reportable Fringe Benefits can have a ripple effect on other financial considerations. These may include: family tax benefits, Medicare levy surcharge, private health insurance rebates, child support obligations, superannuation co-contributions, Higher Education Loan Program (HELP) repayments, and various tax offsets.

If an employee anticipates that Reportable Fringe Benefits could adversely affect their financial situation, an arrangement can be made with the employer to offset their FBT liability. In such cases, the employee can contribute a corresponding amount from their post-tax salary to cover the fringe benefits, thereby reducing their own Reportable Fringe Benefits and the employer’s FBT obligation.

Impact of Fringe Benefits Tax on salary sacrificing

Salary sacrifice, also known as salary packaging, aims to offer employees a tax-efficient blend of income and benefits. Common elements include car fringe benefits via novated leases, expense payments like mortgages, car parking benefits, and superannuation contributions.

While some items like superannuation are typically FBT-free, others like cars are not. In such cases, employers often pass on the FBT costs to employees. As the current FBT rate is 47%, salary packaging a car might not be beneficial unless you’re in the highest tax bracket. Therefore, even though FBT is the employer’s liability, it may reduce your salary to cover these costs as part of your salary sacrifice agreement.

Both employers and employees should consult with tax experts to maximise the benefits and minimise the drawbacks of salary sacrifice arrangements.

FBT and superannuation contributions

Salary-sacrificed contributions to a compliant super fund aren’t typically subject to FBT. However, FBT may apply if contributions are made for a spouse or into a non-compliant fund. These count toward an annual pre-tax super cap of $27,500. Exceeding this cap could result in extra tax, as cautioned by the ATO.

Employees should ensure the sum of their salary-sacrificed contributions and other pre-tax contributions, such as regular employer contributions and personal contributions, do not exceed this cap. If they do, the Australian Taxation Office (ATO) warns that additional tax may be imposed.

Strategies for employers to lower FBT obligations

Employers can reduce or even eliminate their FBT liability by asking employees to make monetary contributions toward the cost of the benefits they receive. Each dollar contributed directly lowers the taxable value of the benefit.

Alternatively, employers can opt to increase salaries in lieu of providing fringe benefits. There are also various FBT exemptions and concessions previously discussed that can mitigate or eliminate the need to pay FBT.

Next Step is to Contact TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

This outline is for general information only and not as legal, tax or accounting advice. It may not be accurate, complete or current. It is not official and not from a government institution. Always consult a qualified professional for specific advice tailored to your unique circumstances.

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.