Understanding how to withdraw super

If you meet reasonable eligibility criteria, such as experiencing severe financial hardship or special circumstances like severe disability, you may be able to access your super early. In these cases, you will need to submit a withdrawal form to your superannuation fund. Some people opt for lump sum withdrawals, while others prefer establishing a retirement income account to receive regular income payments.

The Australian Taxation Office (ATO) offers tax-free investment earnings on these accounts to a certain extent, although the marginal tax rate can apply in some situations. There are also account-based pension options that convert your superfund into a retirement income stream, ensuring you have regular pay-outs to cover your living expenses. All of these arrangements should ideally be in line with the guidelines specified by the ATO and should align with your own financial needs and plans.

Using Super to pay off debt

If you were a temporary worker in Australia and have now departed, there’s a possibility you could access your super ahead of time.

It’s crucial to understand that tapping into your super before your designated time might adversely impact your retirement income. Therefore, it should be viewed as a last-resort measure. Prior to making such a significant choice, consulting with a seasoned financial advisor or attorney is highly advised.

A growing number of fraudulent schemes have been targeting Australians, promising early access to super funds. Always ensure you’re dealing with certified professionals and remain cautious of those proposing such services.

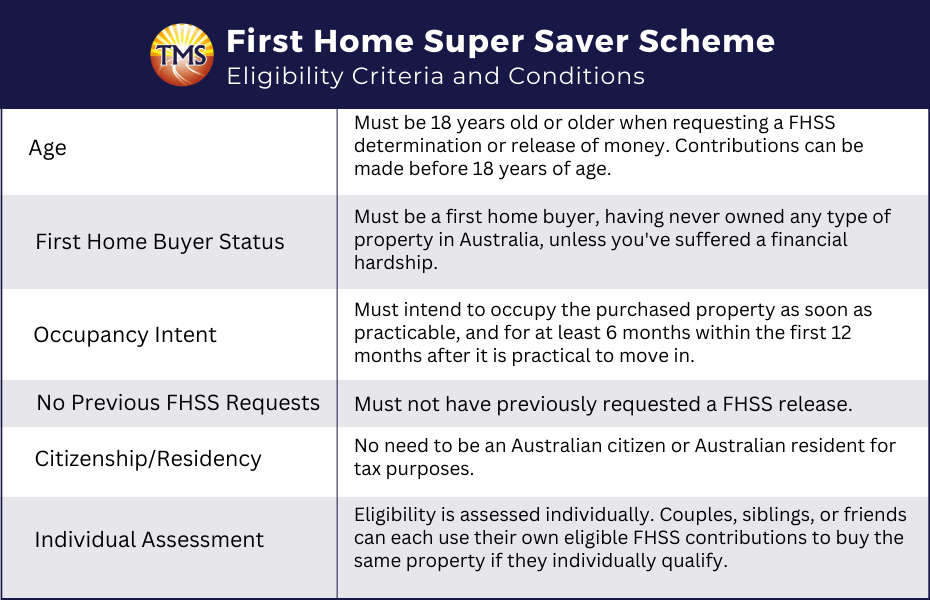

First Home Super Saver Scheme

To take advantage of this scheme, individuals must satisfy certain eligibility criteria.

From any given financial year, you’re permitted to apply for the release of up to $15,000 from your voluntary contributions towards your home. The cumulative cap across all years stands at $50,000. Moreover, when accessing your super early for this purpose, the Australian Taxation Office ensures that you also receive the earnings related to those contributions.

Always ensure that before making super withdrawals, especially for large purchases like a home, you understand the nuances and potential future implications for your retirement savings and income stream.

Criteria for early access to your super

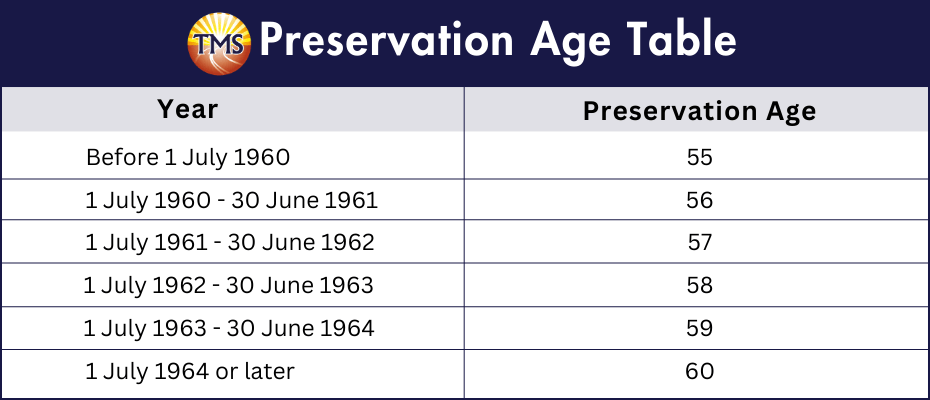

What determines your preservation ages

By knowing and understanding the rules and your preservation age, you can better plan for both your retirement and any immediate financial needs you may face.

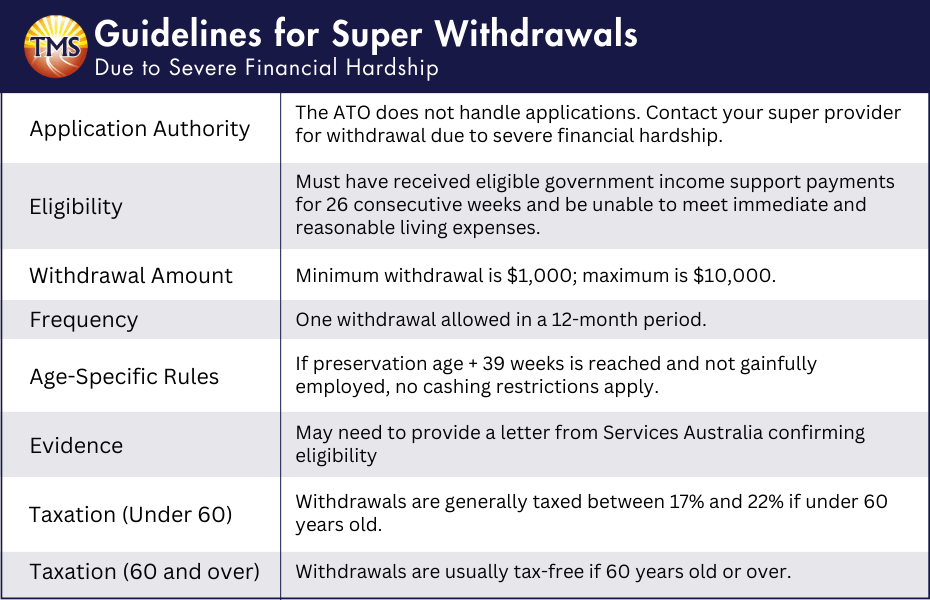

Guidelines for super withdrawals due to severe financial hardship

To qualify for this type of withdrawal, you must meet specific eligibility criteria. This includes having received eligible government income support for 26 weeks consecutively and facing difficulty in covering immediate and reasonable living expenses for yourself and your family.

The withdrawal limits are set between a minimum of $1,000 and a maximum of $10,000. Furthermore, only one withdrawal is allowed within a 12-month timeframe. However, if you’ve reached your preservation age plus 39 weeks and were not in gainful employment at the time of your application, there aren’t any cashing restrictions.

Your super provider might request evidence to validate your claim. In such cases, you should reach out to Services Australia to obtain a letter confirming your eligibility. Any funds withdrawn under conditions of severe financial hardship are taxed as a regular super lump sum. There aren’t any special tax rates for these withdrawals. For individuals below 60 years of age, the taxation rate on these withdrawals typically ranges between 17% and 22%. If you are 60 years or older, the withdrawals from your super are generally tax-free.

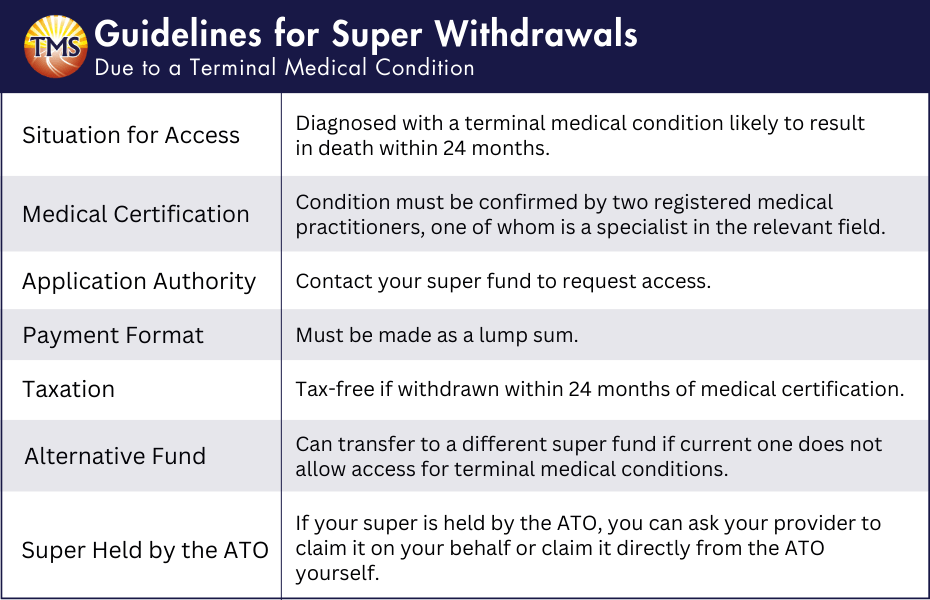

Guidelines for withdrawing your super due to a terminal medical condition

If you’re diagnosed with a condition considered terminal from a medical standpoint, there’s an opportunity for you to access your super fund. Such a terminal medical condition is characterised by an ailment or injury that, based on the assessment of two registered medical practitioners (with one being a specialist in the area of the condition), is expected to lead to death within a 24-month timeframe from the date the condition was certified.

For accessing your super under these circumstances, directly reach out to your superfund provider. Withdrawals for terminal medical conditions need to be in the form of a lump sum. Moreover, if you choose to withdraw within the 24 months post-certification, the amount is tax-free.

It’s worth noting that if your current superannuation fund doesn’t permit withdrawals for terminal medical conditions, transferring your super to another fund that does may be an option. If the ATO holds your super and you’re experiencing a terminal medical condition, you can have your provider claim it for you or make a direct claim to the ATO.

Guidelines for compassionate grounds super withdrawals

You could also qualify if you’re facing immediate home loan payments or council rates that could lead to the loss of your home. Additional scenarios include making necessary accommodations for a disability for yourself or a dependent, as well as covering costs tied to the passing, funeral, or burial of a dependent.

Staying alert to scams and unethical schemes

Also, exercise caution if someone approaches you with offers for services, such as early access to your super, in exchange for a fee. Often, such services may be accessible without any charge.

Should you encounter unsolicited communications, whether via phone calls, text messages, or emails, promising assistance for early release of your super, refrain from disclosing any personal details or clicking on any provided links.

Considerations for accessing your super early

Risks of illegal early super access

Self Managed Super Fund (SMSF) considerations

For inquiries about accessing your super when the fund transitions to an account-based pension, if your retirement income stream from the super will sufficiently cover living expenses, or if you’re seeking general super-related guidance, our network of financial professionals is ready to assist.

Next Step is to Contact TMS Financials

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

Considering accessing your super early?

Schedule a FREE consultation with TMS Financials today to get personalised guidance

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

How high-income earners can boost their super through salary sacrifice

How high-income earners can boost their super...

Using the downsizer super contribution: A guide for homeowners over 55

Using the downsizer super contribution: A guide...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.