Investment property tax guide for property investors

.

If you’re considering investing in property, it’s essential you know about the various taxes involved. In Australia, owning a rental or investment property not only brings potential tax advantages, but also certain tax responsibilities. You must be aware of how income tax applies to your rental income, and the implications of Capital Gains Tax (CGT) when you sell the property. Understanding land tax and its thresholds, as well as the numerous investment property tax deductions available, such as for interest payments and property management fees, is crucial. You should also know how to claim deductions on your annual tax return for costs related to maintaining and managing your property. Our detailed guide will provide you with the necessary insights to navigate these aspects effectively and maximise the benefits from your property investment.Investment property tax benefits and costs

Interest payments and holding costs

Claiming depreciation on rental assets

Claiming for construction and renovations

If you have undertaken construction or renovation on your rental property, these expenses might qualify for deductions. Generally, these capital works deductions are spread over 25 to 40 years, depending on various factors like the construction start date and the building’s purchase date.

Offsetting losses with negative gearing

Tax considerations for property investment

Owning investment property in Australia involves various tax implications. Here’s a breakdown of some potential financial considerations:

Capital Gains Tax (CGT)

When you sell your investment property, any profit made is likely subject to Capital Gains Tax (CGT). We’ll delve deeper into CGT later in this article.

Tax on rental income

The income from your rental property is taxable. This rental revenue is added to your other income sources, such as wages or investment earnings, and taxed according to your income tax bracket.

Asset depreciation

You can claim depreciation on assets like appliances and furniture for tax deductions on your tax return. However, it’s vital to keep detailed records and a depreciation schedule for these assets.

Deductibility of property expenses

While certain property-related expenses are tax-deductible, others are not. Expenses associated with asset depreciation or improvements to the property structure can be claimed as deductions. Conversely, costs incurred during the property’s purchase or sale typically aren’t deductible.

GST considerations

If you’re leasing out a commercial property, you might need to consider Goods and Services Tax (GST) implications.

Tax laws can be intricate, so for any uncertainties, it’s advisable to seek advice from a tax professional or consult the Australian Taxation Office (ATO).

4 types of tax on investment property

Owning an investment property requires awareness of the different taxes you may face. Being knowledgeable about these taxes helps you prepare and plan your finances more effectively. Below is an overview of the four primary types of tax associated with investment properties.

Rental income and income tax

The income you earn from your rental property is taxed in the same manner as your regular income. When lodging your income tax return, you must include this rental income alongside other earnings, such as your salary or profits from other investments.

If your property’s expenses exceed its rental income, leading to a loss (referred to as “negative gearing”), you can deduct this loss from your total income. This may reduce your overall tax liability. Some investors prefer this strategy to “positive gearing,” where the property yields a profit, as it can lower their overall tax burden.

The Australian Tax Office (ATO) permits property investors to deduct various property-related expenses from their rental income, aiding in maintaining the profitability of their investment.

Immediate deductions

Immediate deductions are expenses claimable in the same financial year they occur. These include advertising costs for tenants, council and water rates, land tax, interest on mortgages, and expenditures for repairs and maintenance.

Long-term deductions

Some costs can be spread out over several years. “Depreciation” is a prime example, allowing you to deduct a part of the property’s value yearly to compensate for wear and tear and the aging of the building and its fixtures.

However, it’s important to note not all expenses are deductible. Costs such as the initial stamp duty when buying the property, your mortgage payments, or any expenses covered by the tenant cannot be deducted.

Capital Gains Tax (CGT)

Capital Gains Tax (CGT) is a crucial factor to consider if you’re planning to sell your rental property.

When you sell your rental property for a profit, that profit is recognised as a “capital gain,” which must be reported on your annual tax return. The additional tax incurred due to this profit is known as Capital Gains Tax or CGT.

The Australian Tax Office (ATO) provides certain rules that may allow property investors to reduce or even avoid some or all of the CGT.

Here are key exceptions and special rules:

Main Residence (MR) exemption

This exemption applies if the property served as your primary residence.

Capital Gains Tax property 6-year rule

Under this rule, you can treat a property as your main residence, which allows you to apply the main residence exemption from Capital Gains Tax.

The six-month rule

This rule provides flexibility when transitioning between properties.

50% CGT discount

The 50% Capital Gains Tax discount permits you to reduce the capital gain on your property by half for tax calculation purposes, provided the property was held for over 12 months. This discount aims to promote long-term property investment.

To learn more about how Capital Gains Tax (CGT) affects inherited property, check out our article “Understanding Capital Gains Tax on inherited property.”

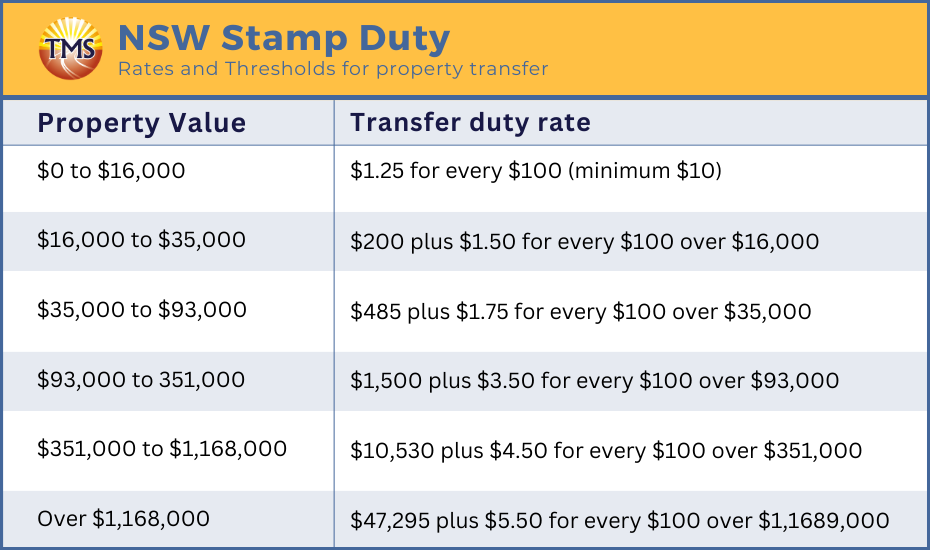

Stamp duty tax

Stamp duty tax is a critical expense to consider when purchasing an investment property. It functions similarly to a sales tax for property transactions. This tax is applicable when the ownership of the property transfers from the seller to the buyer, and is sometimes referred to as transfer duty.

The Australian Taxation Office (ATO) does not permit this cost to be claimed as a tax deduction on your income tax return. Therefore, it’s important for property investors to ascertain the amount they’ll need to pay for stamp duty before proceeding with a property purchase, as it can significantly influence their rental income and overall expenses.

Check out our Stamp duty property buyers guide to learn more.

Alex’s case study

Alex purchases a rental property in New South Wales for $330,000. The stamp duty amounts to: $9,795.

If Alex were buying his very first property, he would qualify for the First Home Buyer Assistance Scheme, which offers specific tax advantages.

In NSW, this scheme is applicable to:

-

New homes valued under $800,000

-

Existing homes under $650,000

-

Vacant land under $400,000

From this example, it’s clear that stamp duty varies based on several factors:

-

The state where the property is located

-

The purchase price of the property

-

Whether you’re a first-time buyer

Typically, every property transfer, including those within families or between different ownership structures, incurs stamp duty, with only limited exceptions.

While stamp duty is a primary concern for property investors, it’s also crucial to be mindful of other tax obligations, such as Capital Gains Tax, land tax, and claiming various tax deductions. Consulting with a tax agent or financial advisor is advisable to effectively navigate the complexities of property taxes, maximise your rental income, and ensure you claim all eligible expenses and deductions.

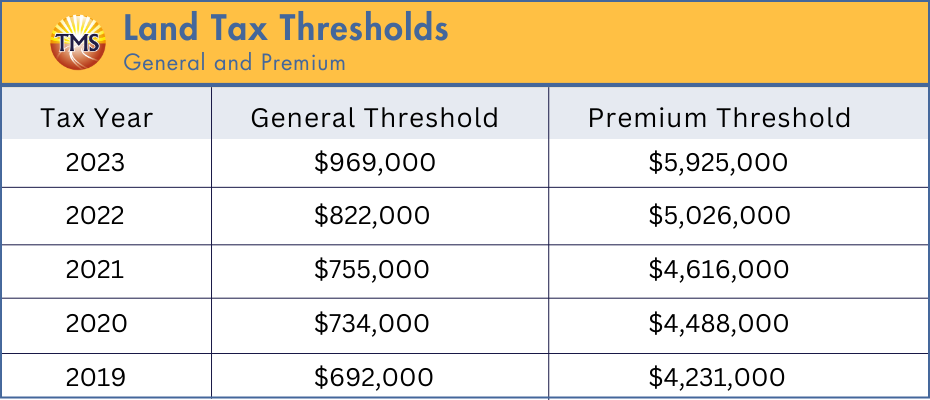

Land tax

Land tax, distinctly different from stamp duty, represents an ongoing obligation for property owners. Unlike stamp duty, which is a one-time fee paid upon purchasing a property, land tax is a recurring charge, levied annually based on the land’s unimproved value. This value excludes any enhancements like buildings or landscaping. It’s crucial for property owners, especially those holding investment properties, to understand when they need to pay land tax and at what rate.

Each state and territory in Australia sets its own land tax rates and thresholds, which are detailed on their Revenue Office websites. Notably, the Northern Territory stands out as it does not require property investors to pay land tax, a significant factor that can influence rental income and the overall financial viability of an investment property, including potential tax deductions.

For property investors, comprehending the intricacies of land tax, including when to pay land tax and the specific land tax rate in their region, is essential. These aspects directly impact the profitability of investment properties, annual tax returns, and obligations related to Capital Gains Tax (CGT). Knowledge of land tax rates, alongside other tax considerations like common deductions and overall property tax responsibilities, is crucial for an effective investment strategy. To gain a deeper understanding of land tax thresholds and how they influence your investment property, delve into our comprehensive article on this topic.

Maximise your tax savings on investment properties by downloading our comprehensive Investment Property Tax Deductions checklist today.

Next step is to contact TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.