How does negative gearing work for young professionals entering the Australian property market

.

Negative gearing can be a practical approach for young professionals in Australia aiming to invest in property. By purchasing a negatively geared property, the rental income may not cover all the costs, such as mortgage interest, but you can use the shortfall as a deduction against your taxable income. This reduces your tax bill, making it easier to manage the financial burden in the short term. For those with higher personal income, the tax savings can be particularly beneficial.

In addition to the immediate tax advantages, people often emply negative gearing in the hopes of achieving long-term capital gains. As property values increase over time, the appreciation in market value can lead to profits when you sell, though Capital Gains Tax may apply. Many investors find this strategy attractive, as it balances short-term tax relief with the possibility of future wealth growth.

Before purchasing a negatively geared property, it’s essential to understand if your tax situation can benefit. Schedule a consultation with us today to learn more.

How does negative gearing work in property investment?

Negative gearing is a common investment strategy for young professionals looking to enter the property market. It involves purchasing a rental property where the expenses, such as mortgage interest and other costs, exceed the rental income generated. This results in a net rental loss, which can be used to reduce your taxable income by offsetting it against your salary or other earnings.

This strategy allows property investors to manage the short-term financial strain of owning a property that isn’t yet profitable. The tax savings from the net rental loss can help cover mortgage repayments, making it easier to hold onto the investment property while hoping for long-term capital gains as the property appreciates in value.

Although negative gearing doesn’t produce an immediate profit, it’s seen as a way to build wealth over time. However, it’s important to assess your financial situation and consider factors such as interest rate changes and cash flow before pursuing this strategy.

Why do Australians invest in properties that make a loss?

It might seem odd that many Australians choose to invest in properties that operate at a loss, but there are two main reasons why they do so: the potential for capital gains and the opportunity for the property to eventually become positively geared.

Capital gain

Investors often purchase negatively geared properties with the expectation that the property’s value will rise over time. When they eventually sell, the capital gain is hoped to be large enough to outweigh the initial losses. While Capital Gains Tax (CGT) will apply when the property is sold, there are legal ways to reduce this tax, such as using the Principal Place of Residence exemption or taking advantage of the “6-Year Rule.”

Positive gearing

Over time, as rental income increases or loan repayments decrease, a negatively geared property may start generating a profit, becoming positively geared. At this point, the property will no longer operate at a loss, and investors can enjoy both rental income and potential capital appreciation.

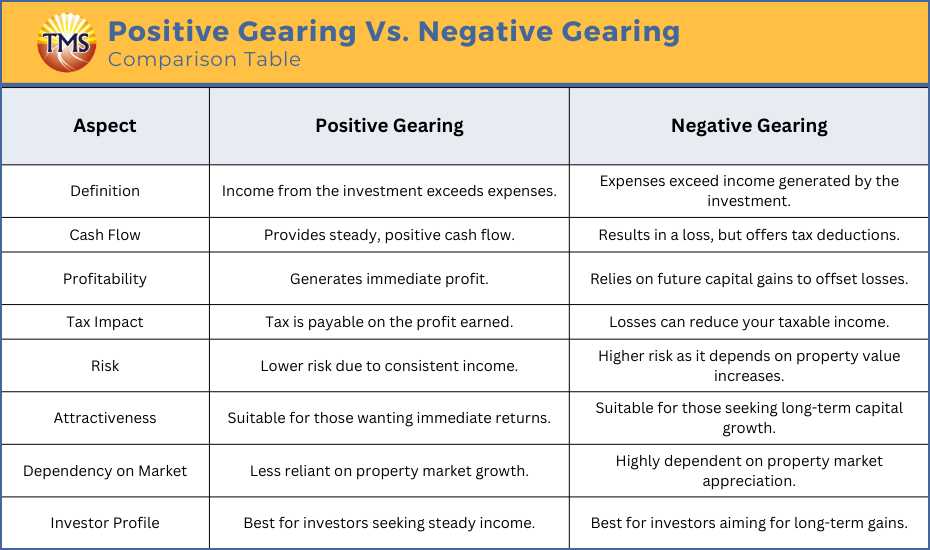

Positive gearing vs negative gearing: what’s the difference?

Positive gearing and negative gearing are two distinct property investment strategies in Australia. Positive gearing occurs when the income from an investment property, such as rental income, exceeds the costs associated with owning and maintaining it. This results in a profit, which adds to your overall income, but also means you’ll need to pay tax on the extra income.

In contrast, negative gearing happens when the expenses of owning the property, particularly interest payments, exceed the rental income, leading to a net rental loss. While negative gearing offers tax deductions, positive gearing provides immediate cash flow, making it appealing to investors who want immediate returns rather than relying on long-term capital appreciation. If you wish to discuss the viability of such an investment with a professional, we recommend you get in touch with a financial advisor.

What is required for negatively gearing an investment property?

Adequate rental and personal income

While negative gearing means making a loss, having sufficient rental income is still essential. The rental income generated from the investment property should cover a large portion of expenses, such as mortgage repayments, maintenance, insurance, and management fees. You will need enough personal income to cover any shortfall between costs and rental income that does not include interest repayments, as negative gearing only offsets interest repayments.

Tax liability

To make negative gearing worthwhile, you need to have a substantial tax liability. This means earning enough income from other sources, such as your salary, to benefit from the tax deductions. The losses from the negatively geared property can then reduce your taxable income and lower your overall tax bill.

Seek professional advice

Negative gearing can be complex. Consulting an accountant is crucial to fully understand the tax benefits and risks. They can help you with the asset structure that holds the investment, maximise tax savings, and stay informed about any changes in tax laws or regulations.

Case study: How negative gearing helped Sarah enter Sydney’s property market

Sarah, a 34-year-old financial analyst in Sydney, had been eager to enter the property market but was cautious due to the high prices. After researching various investment strategies, she discovered that negative gearing could help her overcome the financial barriers. In 2022, Sarah found a two-bedroom apartment in a rapidly developing suburb on the outskirts of Sydney. Priced at $670,000, it was slightly over her budget, but the location, with its proximity to public transport and future infrastructure, made it an appealing investment. The rental income was projected to be $460 per week, which wouldn’t fully cover the property costs, making it negatively geared.

Sarah calculated that her monthly mortgage repayments, along with other expenses like insurance and property management fees, would amount to around $3,100. However, the rental income would bring in just $1,990 each month, leaving her with a shortfall of $1,110. Despite this gap, Sarah’s annual salary of $125,000 put her in a high tax bracket, which allowed her to take advantage of negative gearing. After consulting with her accountant, she learned that she could offset the $13,320 annual loss from the property against her taxable income, resulting in substantial tax savings.

With careful budgeting, Sarah was able to manage the monthly shortfall without disrupting her lifestyle too much. The tax benefits from negative gearing in the first year helped reduce the financial pressure of the investment. Over the next few years, as the suburb grew and more infrastructure was developed, both the property’s value and the local rental market improved, allowing Sarah to gradually increase the rent and reduce the financial shortfall.

By 2027, the property’s value had risen to $760,000, and Sarah refinanced her loan at a lower interest rate. Although the property remained slightly negatively geared, the higher rental income and increased property value gave her the confidence to consider purchasing another investment property, using the experience and knowledge gained from her first investment.

Negative Gearing calculator

If you’re considering negative gearing, our calculator can help you see how it may affect your finances. It shows how much tax you could save and helps you understand the costs involved in your investment.

Use our Negative Gearing calculator today to get a clearer picture, and reach out to TMS Financials if you need help with your next steps.

Next step is to contact TMS Financials

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Book a Consultation

Disclaimer

This outline is for general information only and not as legal, tax or accounting advice. It may not be accurate, complete or current. It is not official and not from a government institution. Always consult a qualified professional for specific advice tailored to your unique circumstances.

Related Articles

How high-income earners can boost their super through salary sacrifice

How high-income earners can boost their super...

Using the downsizer super contribution: A guide for homeowners over 55

Using the downsizer super contribution: A guide...

How high-income earners can benefit from voluntary super contributions

How high-income earners can benefit from...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.