Exploring Small Business Grants NSW

.

A business grant is money given by the government to help small businesses. This financial help from the government aims to help small businesses expand, develop new ideas, or get back on their feet after tough times. This kind of financial assistance exists to boost local work opportunities and give small business owners the funds they need for business growth.

At any given time there are multiple kinds of grants which small business owners can apply for in NSW. These depend on various things like what kind of business you have, how many people work there, and where it’s located. The NSW Government has several general grants that small businesses can apply for as well. Examples include the Small Business Fees and Charges Rebate and SafeWork Small Business Rebate.

In early 2023, there are special grants for certain types of businesses, like tech start-ups and those in primary production like fishing. Keep in mind that grants can change or end, so it’s good to stay up-to-date on what’s available. There are eligibility criteria to meet, and it’s important for eligible businesses to know the closing dates for applications.

This support from the NSW Government and the Australian Government is part of broader support programs aimed at business development and growth. Other forms of financial support, like loans, may also be available, but a grant doesn’t need to be paid back so it’s a good resource for eligible small businesses looking for financial aid to cover operational costs or meet other eligible costs.

What can a grant do for my business?

Is a grant different from a loan?

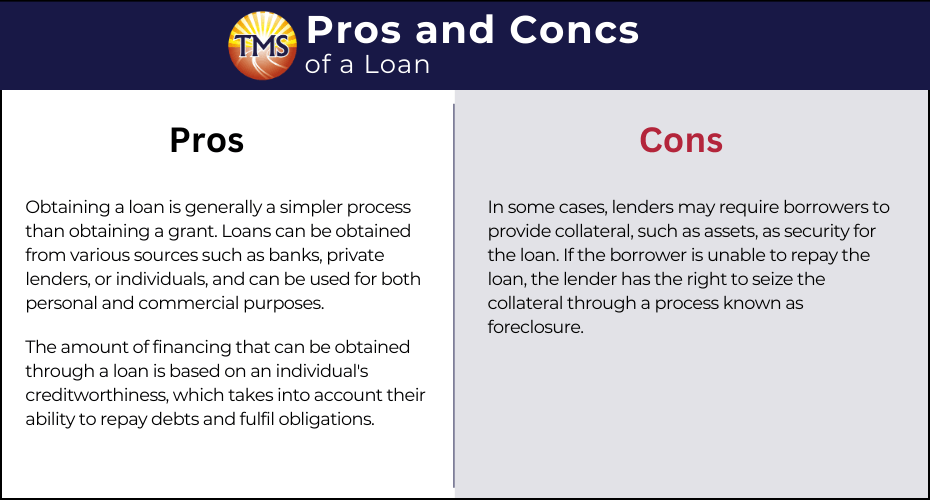

Pros and cons of loans

- Pros of getting a loan:

- It’s usually easier to get a loan than a grant.

- You can borrow from different places like banks, private people, or other lenders, for personal or business needs.

- How much you can borrow depends on your credit score, which looks at how good you are at paying back money.

- Cons of getting a loan

- Sometimes, you might need to give something valuable, like your car or house, as a promise to pay back. This is called collateral.

- If you can’t pay back the loan, the lender can take that valuable asset through a step called foreclosure.

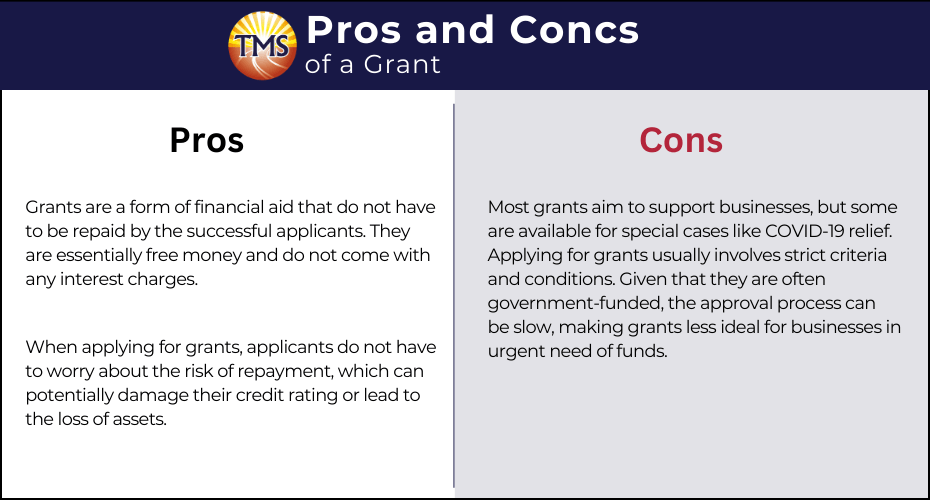

Pros and cons of grants

The good things about grants

The not-so-good things about grants

How to look for small business grants online

- Services NSW: look for the “Service NSW for Business” section

- NSW Government: search under “Grants and Funding“

- Australian Government Business: use the “Grants and Programs Finder“

How to sign up for small business grants in NSW

- Find the grant you want on the Services NSW or NSW Government website.

- Look at the rules to make sure you can apply.v

- Get together all the papers you need.

- Go to the website of Services NSW or NSW Government and find the grant’s page. Usually, there’s a button that says “Apply online” or “Start online application.” Click it and do what it tells you to.

Eligibility and documents needed for NSW small business grants

Here’s what you generally need to know:

Eligibility

- A valid Australian Business Number (ABN) in NSW.

- Being part of the business area that the grant aims to help.

- Already doing, or planning to do, things that the grant wants to support.

- Being active in business actions that are in line with the grant’s purpose.

- Going through tough times due to unexpected events like a disease outbreak or wildfires, especially for grants aimed at helping recovery.

Documents you’ll need

- Proof that you meet the rules to apply for the grant.

- Info about your business and any papers that go with it.

- Papers that show the costs you’re asking to get money back for.

- IDs for yourself or other key people in the business.

Tax implications of NSW small business grants

If a grant isn’t classified as NANE income, it’s possible you’ll need to pay tax. To ensure you understand your tax responsibilities, it’s wise to get in touch with the ATO or seek advice from a professional familiar with business taxation matters.

Boosting your business with the Accelerating Commercialisation Program

When you seek commercialisation advice, eligible candidates are paired with an AusIndustry Customer Service Manager or an Accelerating Commercialisation Facilitator. Their role is to offer tailored guidance, focusing on your enterprise and the optimal ways to monetise your intellectual property.

If you’re among the chosen grant candidates, you can expect to get funding that matches your project’s budget up to $1 million. If you’re a Research Commercialisation Entity or an Eligible Partner Entity, the matching funds can go up to $500,000.

To qualify for this initiative, your novel product is essential, and you’ll need to pass the turnover test. This means your combined annual earnings shouldn’t exceed $20 million over the past three financial years. For application details, visit the business.gov website.

Early-stage tech startups: The Minimum Viable Product grants

If your grant application succeeds, you’ll get funding that matches up to 50% of the agreed-upon project expenses, capped at $25,000. You’ll receive 30% of this funding right at the start, and the remaining 65% will be given once you’ve completed and verified your MVP.

To find out how to apply, head over to the NSW government website.

Strategic growth with SMART Projects and Supply Chains

Upon joining, your business will be paired with a facilitator. This expert will support you in identifying market opportunities, addressing skill shortages, tackling challenges, and crafting a path to success.

Additionally, the initiative includes Growth Grants, offering up to $20,000 in financial support to help you carry out your growth plans.

For application details, visit the NSW government website.

Boost your business with the High Growth Accelerator

For more details and application procedures, head over to the NSW government website.

Elevate your research with the CSIRO Kick-Start

But the benefits don’t stop at funding. Participating businesses also gain access to CSIRO’s vast expertise, helping you research and develop new products, services, or processes, as well as test them in real-world applications. Plus, if you’ve completed your initial project successfully, you can apply for a second round of funding—so long as the total cost of your project doesn’t exceed $50,000.

Boost your rural research with Agrifutures Australia RD&E Investment

The investment amount is variable and is determined based on the priority level of the research. Agrifutures Australia updates its list of research priorities for various industries on an annual basis, helping to ensure that the most impactful and necessary research receives funding.

For more information and to apply, visit the business.gov.au website.

Grants for Aboriginal or Torres Strait Islander Peoples

You can check your eligibility for this type of registration on the official government website.

In addition to this, the Indigenous My Business (IBA) program offers a comprehensive package of support, which includes guidance, training, and financial assistance. This program is specifically designed for entrepreneurs and business owners with Indigenous or Torres Strait Islander heritage and aims to assist in the growth and development of their businesses.

NSW Business Grants for Female Entrepreneurs

NSW business grants for Energy Sustainability

By offering these grants, the NSW Government aims to make renewable energy a financially viable option for a wide range of businesses and organisations.

NSW storm and flood disaster recoveryd

If your small business or not-for-profit organisation has been directly affected by recent weather-related disasters, you may be eligible for this financial assistance.

For more information on how to apply and to determine your eligibility, consult the Service NSW website.

Contact details for grant information in NSW

Here’s how to get in touch:

- Phone: call Service NSW at 13 77 88 for local inquiries or +61 2 8894 1555 for international calls.

- In-Person: visit a Service NSW center near you for face-to-face support and guidance.

- Mail: for written inquiries or information, you can write to Service NSW at GPO Box 7057, Sydney NSW 2001.

Next Step is to Contact TMS Financials

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

Ready to explore NSW small business grants?

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.