2023 small business technology investment boost update

.

There are new ways to help small businesses invest in technology. These are called the small business technology investment boost and the business technology investment boost. These boosts are for small businesses. A business qualifies if its total sales are up to $50 million, even though right now, only businesses with sales up to $10 million are called small businesses.

A business that has sales up to $50 million is known as a small or medium business. If a business wants to get the benefits of these boosts, it should be a small or medium business in the year they spend the money.

Do you think your business will earn less than $50 million this year?

To check if you can get the boosts, see if your total earnings for this income year will be under $50 million. You should make this guess either at the start of the year or when your business began, if it’s a new one.

Think about a few things to help you decide:

- How much did you earn in past years?

- Any changes in your sales trends.

- How often your staff changes.

- If you’ve changed your business hours.

- If your location had problems like droughts or bushfires.

- If your industry is not doing well or has more competition.

Considering the above factors can help you figure out if your earnings might stay below the $50 million mark for the year.

Did your business earn less than $50 million this year?

Even if a business didn’t pass the previous year turnover test or the guess for this year’s earnings, there’s still a chance. If, at the end of this income year, your total earnings are under $50 million, you could be seen as a small or medium business. This means you might still get the boosts, even if you didn’t think you would based on earlier tests. Remember, these boosts aim to help businesses improve their business technology and overall operations.

Are you spending on employee training? Get a tax boost!

The Skills and Training Boost is a special tax perk for small or medium businesses. If you spend on external training for your team, you can get an extra 20% off on your tax for those eligible expenses. The goal? Help businesses make their teams better and more productive.

This offer is available for costs from 7:30 pm (ACT time) on 29 March 2022 to 30 June 2024. To get this 20% tax bonus, make sure:

- You’re spending for the Skills and Training Boost.

- You ask for this tax bonus in the right income year.

Next, we’ll go over the details on how businesses can make sure they qualify for this offer.

How can you get the 20% tax bonus for training?

The Skills and Training Boost gives a 20% tax bonus, but only for certain costs tied to training your team if you’re a small or medium business. To get your costs seen as eligible expenses for this boost, there are some rules you need to follow. Let’s dive into these conditions.

Is your business small or medium-sized this year?

To be eligible for the Skills and Training Boost and get the 20% tax bonus on training, your business needs to be considered small or medium-sized during the income year when you spend the money on training. So, make sure you check your total earnings and ensure it’s below $50 million for the year when you are spending on training your employees.

Did you spend on training at the right time?

The Skills and Training Boost is a short-term tax break. To benefit from it, any eligible expenses on training must happen between 7:30 pm (ACT time) on 29 March 2022 and 30 June 2024.

It’s also important that any sign-ups or plans for the training start at or after 7:30 pm (ACT time) on 29 March 2022. So, be sure your training expenses fit within these timeframes to make the most of this boost.

Is your business spending on external training for employees?

The Skills and Training Boost gives you a tax break for costs on outside training for your team, as long as your business is small or medium-sized. Employee here just means anyone who works under a normal work contract.

You can get this tax boost for spending on:

- Face-to-face training in Australia

- Online training, no matter where your employee is

Even if your team members are abroad for work or working remotely from another country, they can still do online training that counts for the tax boost. Also, if the training is a mix of in-person and online, and the in-person part is in Australia, both parts can count for the tax boost.

Investing in employee training? Here’s what qualifies for the skills and training boost

The Skills and Training Boost provides a targeted tax break for small or medium businesses keen on upskilling their employees. But what qualifies as eligible expenditure?

Training must be external. The Skills and Training Boost is specific to expenses related to external training of employees. If you’re unclear about what constitutes an ’employee,’ think of them as individuals under a contract of service with your business, essentially your regular staff.

External training that qualifies can be:

- In-Person training: If your employees are located in Australia, any face-to-face training sessions they attend would be considered.

- Online training: The beauty of the digital age is that location doesn’t have to be a barrier. Whether your employees are in Australia or are operating from overseas locations, if they’re enrolled in online training, those expenses can be eligible.

- Hybrid training: Mixing both in-person and online sessions? If the face-to-face sessions are held in Australia, expenses for both components might qualify.

Remember, this is all part of the government’s push to encourage businesses to adopt more training and digital operations. So, if you’re thinking about incorporating more digital tools, cloud-based services, or even focusing on cyber security systems to support business continuity, now might be the time. The Skills and Training Boost, along with other incentives like the business technology investment boost, are great ways to offset some of those costs.

To make the most of these benefits, always ensure your aggregated annual turnover aligns with the requirements and that you’re meeting all conditions set for the income year in question. And if you’re exploring other avenues like the technology investment boost or contemplating expenditures on digital enabling items, always keep a close eye on the specifics of what qualifies. Every boost to your business operations, be it through training or technology investment, can potentially bring financial benefits if navigated correctly.

Training expenses: what’s deductible for the Skills and Training Boost?

For businesses looking to benefit from the Skills and Training Boost, understanding the nuances of what’s deductible is essential. Here’s a rundown of the requirements:

Full deductibility is a must: For a business to tap into the Skills and Training Boost, the training expenditure should be completely deductible for the employer under existing taxation provisions. What does that mean? Essentially, the expense should be 100% deductible either in the current income year or a future one.

General deductibility of training expenses: Typically, training expenses for employees fall under the umbrella of regular business operating expenses. So, if you’re spending on training to further your business interests, it’s likely these expenses are fully deductible.

How the bonus deduction works: Here’s where it gets interesting. If you’ve spread the deduction for the training over several years, the 20% bonus deduction from the Skills and Training Boost isn’t delayed. You claim it upfront, in the income year when the training expense is first incurred. In essence, you get to enjoy the bonus deduction immediately, even though the main expense might be spread out over a longer period.

Potential Fringe Benefits Tax (FBT) liability: It’s not all straightforward, though. Employers need to be vigilant about FBT. There could be situations where training provided doesn’t align closely with an employee’s current job duties. If the connection between the training and the employee’s role isn’t strong enough, you might be looking at an FBT liability. It’s always worth checking the specifics of any concessional FBT treatments available.

As businesses steer through the intricacies of taxation law, maximising benefits from initiatives like the Skills and Training Boost can provide an essential financial cushion. Just remember to keep the fine print in mind and seek expert guidance if needed.

Training eligibility: provider registration requirements for the Skills and Training Boost

The Skills and Training Boost is not a carte blanche for all types of training. One of the most crucial factors determining eligibility is the training provider’s registration status.

Here’s what businesses need to know:

Mandatory Registration of the Training Provider: If you’re looking to claim the Skills and Training Boost for training expenses, it’s essential that the training is delivered by a registered training provider. So, what qualifies as registered?

- Higher education providers: If the provider is a registered higher education provider, they should have an official registration with the Tertiary Education Quality and Standards Agency.

- Vocational Education and Training providers (VET): These are slightly more varied, but the essence is that the provider must be registered with at least one relevant authority. Here are the possibilities:a. They might be an NVR registered training organisation with the Australian Skills Quality Authority.b. They could be affiliated with the Victorian Registration and Qualifications Authority as a registered education and training organisation.c. Alternatively, being a registered training provider with the Training Accreditation Council of Western Australia works too.

Scope of Registration Matters: It’s not just about being registered. For a VET provider, the type of training they offer must align with what they’re registered to provide. So, if you’re engaging a registered VET provider, it’s essential to ensure that the specific training you’re investing in falls within their registered scope. The good news? The training doesn’t necessarily have to lead to a formal qualification, as long as it’s within the provider’s registered ambit.

Eligibility based on payment dynamics for the Skills and Training Boost

Understanding the intricacies of how training expenses should be charged to the employer can be crucial when looking to capitalise on the Skills and Training Boost. Here’s what employers need to know:

Direct or indirect charges from registered providers

Eligible training expenses under the Skills and Training Boost aren’t just about the nature of the training or the qualification of the provider. It’s also about how the employer is billed. The employer should either receive a direct bill from the registered training provider or be charged indirectly through a third party. Simply put, the chain of payment must trace back to a registered training provider.

Inclusion of additional training-related costs

There’s more to training than just the course fee. Sometimes, there are other essential components like study materials, equipment, or specialised software. These associated costs can also be counted as eligible expenditure, but there’s a catch. They are considered eligible only if they are part of the charge made by the registered training provider. For instance, a textbook required for a course can be part of the eligible expenditure if the training provider includes its cost in their invoice to the employer.

The key takeaway for employers is to scrutinise their training invoices carefully. Ensuring that the registered training provider either directly or indirectly charges all costs can help businesses make the most of the Skills and Training Boost.

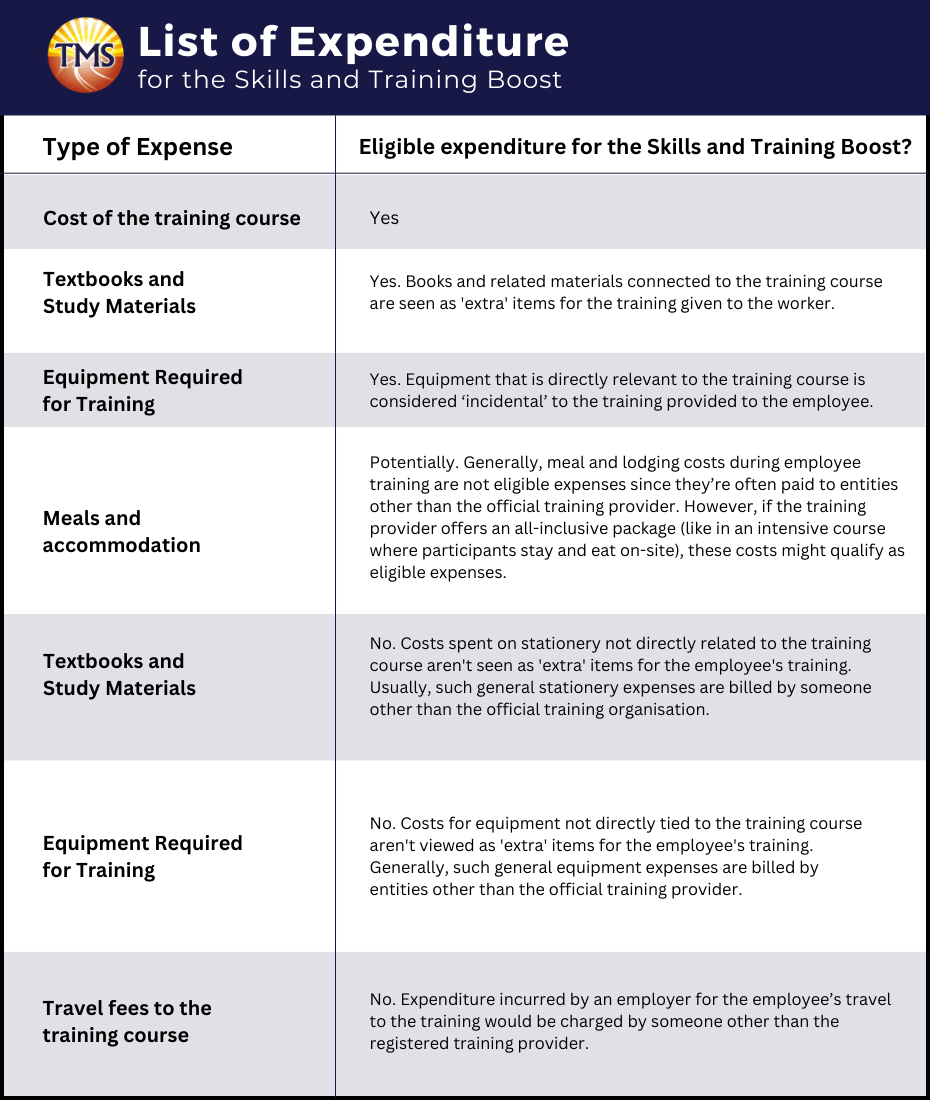

List of expenditure potentially qualifying for the Skills and Training Boost

Here’s a comprehensive table showcasing various types of expenditure that might be eligible for the 20% bonus deduction offered by the Skills and Training Boost. It’s crucial to bear in mind this list is not exhaustive, and the eligibility of each expenditure item hinges on meeting all relevant criteria of the Skills and Training Boost.

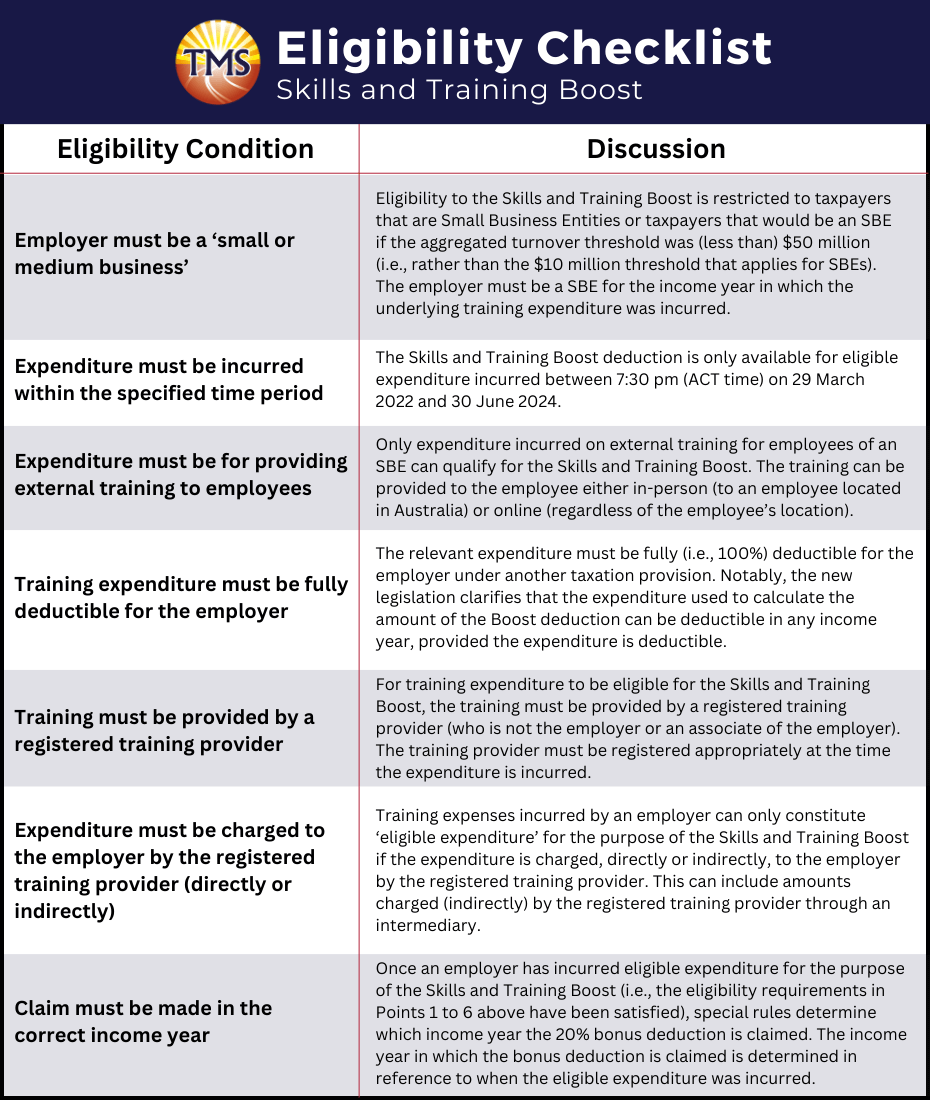

Skills and Training Boost eligibility checklist

Here’s a comprehensive checklist that employers can use to verify their eligibility for the 20% bonus deduction offered by the Skills and Training Boost:

How to claim a deduction for the Skills and Training Boost?

Employers looking to benefit from the Skills and Training Boost, a government incentive for small or medium businesses, can claim a 20% bonus deduction on eligible expenditure incurred for external training of employees. This is an additional advantage on top of the standard deductions available for such expenses.

To calculate the bonus deduction, employers need to identify the total amount of eligible training expenditure and then apply a 20% rate to it. This expenditure should strictly align with the prerequisites set out for the Skills and Training Boost, including the requirement for the training to be provided by a registered training provider and the stipulation that the employer must be a small or medium business at the time the expense is incurred.

There is no upper limit set for the Skills and Training Boost, distinguishing it from the Technology Investment Boost. This implies that the small or medium business can claim the 20% bonus deduction on the entire amount of eligible training expenditure, irrespective of its size.

The claiming process for this bonus deduction is conducted through the business’s tax return. The deductions can be claimed in the income years of 2023 and 2024, corresponding with when the eligible training expenditure was actually incurred by the business. Employers need to maintain thorough documentation and records of all training expenses, ensuring they are ready to provide these in case of any audits or reviews conducted by taxation authorities.

Next Step is to Contact TMS Financials

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

Want to maximise your tech investment benefits

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.