How Section 100A changes affect trust distributions to adult children and grandparents

.

Section 100A

Section 100A is an anti-avoidance rule in Australian tax law. It can apply when a beneficiary’s trust entitlement arises from a reimbursement agreement. A reimbursement agreement typically involves an arrangement where a beneficiary is made presently entitled to trust income, but someone other than that beneficiary receives a benefit in connection with the arrangement, or at least one of the parties enters into the agreement with the purpose of reducing tax.

If section 100A applies, the net income that would otherwise have been assessed to the beneficiary is instead assessed to the trustee at the top marginal tax rate.

Trust distributions to adult children and grandparents

S.100A applies when adult children or grandparents don’t directly benefit from trust distributions. It becomes complex if economic gains end up benefiting others, like parents benefiting from a distribution meant for an adult child.

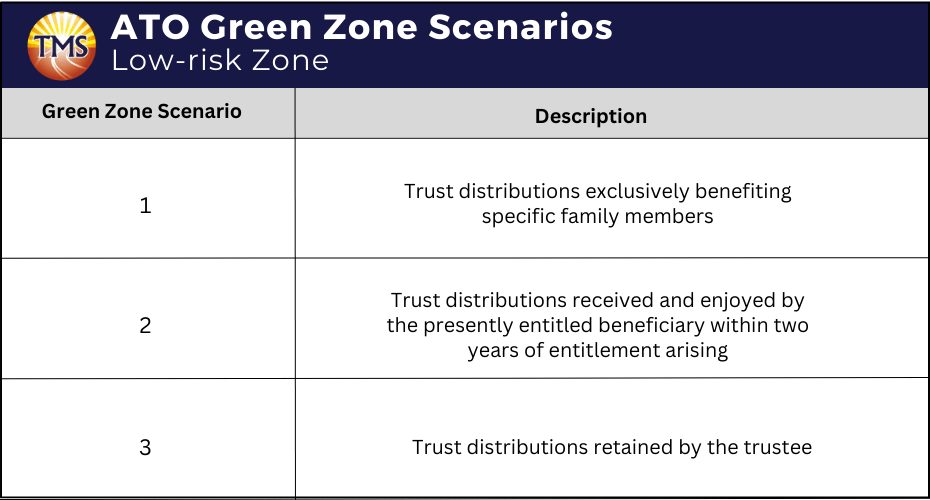

Distributing trusts to adult children and grandparents encounters challenges in satisfying the low-risk criteria of the Green Zone, particularly in relation to family members and economic benefits. Meeting these criteria poses a slightly greater challenge than managing trust distributions to a trust ‘controller’:

- Green Zone Scenario 1: Trust distributions with a specific focus on benefiting designated family

- Green Zone Scenario 2: Trust distributions that the entitled beneficiary receives and enjoys within two years of entitlement arising

- Green Zone Scenario 3: Trust distributions held in abeyance by the trustee

Tax advisory: ATO’s emphasis on trust distributions to adult children

The Australian Taxation Office (ATO) has raised specific concerns regarding trust distributions targeted at adult children of trust “controllers.” The issue arises when these distributions do not directly benefit the adult child, such as instances where trust funds are used to reimburse parents for private school expenses.

The ATO’s apprehensions arise from the potential exploitation of adult children to minimise tax liabilities on the trust’s net taxable income. This risk materialises when the trust controllers, typically parents, distribute funds to an adult child whose income is primarily derived from trust distributions, especially if they are involved in study and part-time work.

Distributions exclusively benefiting specific family members

According to the ATO, the application of S.100A to nullify a distribution to an individual beneficiary, such as an adult child or grandparent, will not occur as long as the funds are utilised for:

- The benefit of the beneficiary, their spouse, and/or dependants

- Personal contributions to a superannuation fund

- Donations to a deductible gift recipient

Tax advisory: parents typically not classified as ‘dependants’

In situations where trust distributions are directed towards adult children or grandparents, benefiting the trust ‘controllers’ (referred to as ‘Mum or Dad’), the Green Zone Scenario doesn’t typically apply. This is due to the fact that the Green Zone is only applicable if ‘Mum or Dad’ is recognised as a dependant of the presently entitled beneficiary. In most instances, parents wouldn’t meet the criteria for dependency, whether for their adult child or parent.

In this context, a ‘dependant’ is defined as a beneficiary’s child or stepchild under 18 or a person financially reliant on the beneficiary.

Example: Beneficiary receiving trust benefits

In this specific case, Daniel Bennett acts as the sole trustee of the Bennett Family Trust, with beneficiaries including Daniel himself and his 28-year-old daughter, Emma.

On 30 April 2023, the trust’s trustee opted to distribute $50,000 of trust income to Emma.

Emma’s trust allocation was directed to Daniel as a reimbursement for a loan she provided to him during the year. Daniel used the borrowed funds to upgrade his home office.

Now, the question emerges: would the ATO contemplate invoking S.100A to invalidate Emma’s trust distribution?

Upon evaluation, the ATO deemed this scenario as low risk for S.100A considerations. The rationale is that Emma used the distribution to settle a loan from Daniel, effectively deriving benefit from the trust entitlement by reducing her debt to him. The ATO emphasised that the outcome would remain consistent, regardless of how Emma used the loan—whether for the enhancement of her home office or any other purpose.

Distributions enjoyed by presently entitled beneficiary within a two-year period

The ATO examines trust distributions enjoyed by the presently entitled beneficiary within a two-year period, establishing criteria for categorisation in the low-risk Green Zone for S.100A compliance, subject to the ordinary family or commercial dealings exclusion.

Green Zone Scenario 2 specifically deals with cases where funds are retained for less than two years. To qualify for the low-risk Green Zone Scenario 2 for a trust distribution to an individual beneficiary, whether an adult child or grandparent, both of the following conditions must be fulfilled:

- The beneficiary ‘receives their entitlement’ within two years of becoming presently entitled

- The beneficiary ‘uses the entitlement’ upon receipt

These requirements are crucially discussed in the context preceding trust distributions to a trust ‘controller.’

Tax tip: Using the ‘two-year period’ for distributions

Trustees can use this two-year timeframe without restrictions on the recipient’s marginal tax rate. This strategic approach aligns with efficient family wealth management, avoiding taxpayer alerts, and yielding tax savings while reducing liabilities.

This planning also serves to mitigate risks associated with outstanding present entitlements in family trusts, providing a subtle means to enhance family wealth within the confines of tax law and standard family trust structures.

Trust distributions retained by the trustee for a duration of two years or longer

Green Zone Scenario 3 takes effect when a trustee retains a trust distribution for an individual beneficiary (adult child or grandparent) for two years or more. This seamlessly aligns with traditional family trusts, optimising bank account funds for lower marginal tax rates. It specifically tackles anti-avoidance provisions and considerations for teenage bank accounts, aiming for reduced tax burdens with protective measures for outstanding trust distributions. The strategy maximises benefits for household expenses within a discretionary trust, emphasising the significance of trust reimbursement agreements.

Moreover, it navigates the complexities of the Income Tax Assessment Act, efficiently managing trust income for tax savings and addressing liabilities while incorporating proven income splitting strategies. It ensures the realisation of economic benefits for relevant family members, avoiding potential alerts from taxpayers and addressing both current and historical risks. These elements contribute to meticulous tax planning, ultimately aligning with the overarching goal of adeptly managing family wealth.

Tax advisory: caution on trust distributions to adult children or grandparents

Meeting specific conditions for trust income distributed to an adult child or grandparent, retained by the trustee for two years or more, may encounter challenges when compared to distributions to a ‘controller’ of a trust. Notably, using a trust distribution for working capital, investment, or lending, while carrying inherent tax risks, can fall within the low-risk Green Zone if both of the following apply to the beneficiary (adult child or grandparent):

- The beneficiary or their spouse is a trustee or controls the trustee

- The adult child is employed in the trustee’s business

Acknowledging concerns about potential behavioral changes, such as waiving control to children for classification purposes, the ATO deems such practices as high risk. Similar considerations are applicable to trust distributions retained for a grandparent.

Failure to meet the low-risk Green Zone criteria doesn’t automatically escalate to the high-risk red zone. Instead, a case-by-case S.100A risk assessment becomes imperative, taking into account the impacts on tax payments across the group and recurrent arrangements. This advice underscores the necessity of professional guidance for tax planning, particularly when dealing with family wealth, family trusts, and various marginal tax rates.

If you suspect the need for such a risk assessment, reach out to us today.

Postponing trust distribution for home purchase – Low-Risk Green Zone

The ATO recognises a low-risk green zone scenario when a trust distribution is deferred for an adult child intending to use it for a home purchase. It’s essential to note that this provision does not extend to distributions to grandparents. In this context, the ATO deems it low risk when an adult child delays asserting their entitlement until they are prepared to invest in a home, ensuring the retention of the right to recover the amount.

Even if the adult child’s reduction of the tax-free threshold has an impact on the overall tax on trust net income, it remains within the Green Zone. S.100A is unlikely to be applicable, as it involves a straightforward delay in receiving the original entitlement, aligning with typical family or commercial dealings.

Regarding the adult child’s right to recovery, actions inconsistent with their eventual entitlement, such as interest-free loans to others, indicate the forfeiture of this right. This arrangement, designed to secure a tangible benefit for the adult child, falls within the Green Zone.

For compliance and transparency, it is advisable to seek professional advice, especially when other family members may adopt similar approaches. This methodical and transparent approach aligns with low marginal tax rates, making it suitable for most family groups, and takes into account commercial dealing exclusions for tax return purposes.

Tax tip: ATO eases stance in final compliance guidelines

In the initial S.100A compliance guidelines, the ATO introduced an additional condition for the outlined scenario to qualify for the Green Zone. This condition mandated the allocation of funds representing the present entitlement in a separate sub-trust exclusively for the benefit of the adult child. The requirement to establish such a sub-trust is no longer in force.

However, exercising caution is imperative, as highlighted in the compendium, emphasising that the trustee’s use of funds and any indications that the entitlement might not be received are factors to consider regarding the potential applicability of S.100A.

Next Step is to Contact TMS Financials

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

Ready to Navigate S.100 Tax Challenges?

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.