Using an Associate Lease to boost family income

.

An associate lease is a tax effective way to acquire a vehicle while boosting the income earned by the family.

HOW THIS IS ACHIEVED

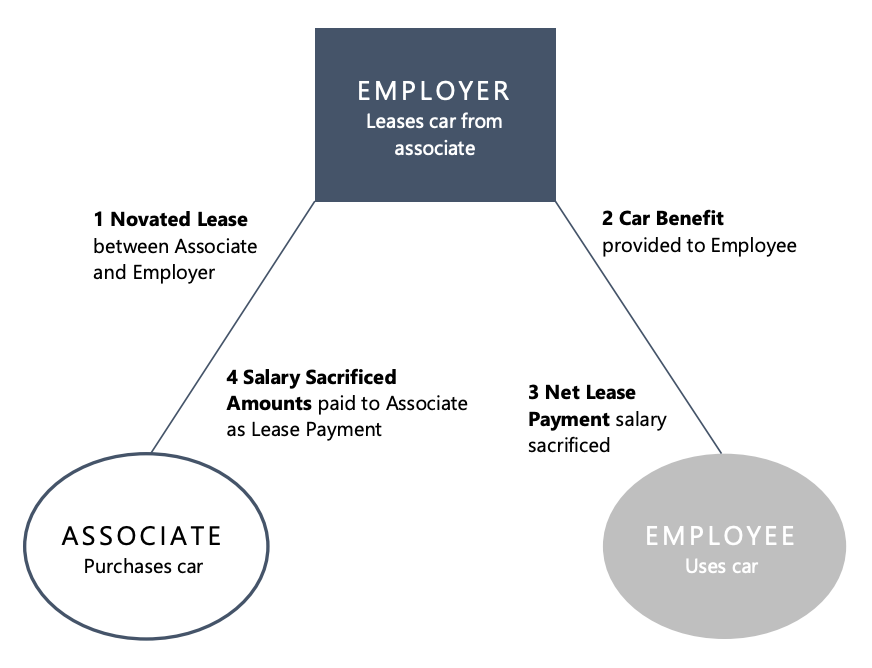

The following 4 steps outline how this is achieved:

- An associate of an employee (i.e., usually their spouse) purchases a car from an arm’s length party using their own cash reserves;

- The associate then leases the car to the employee’s employer, who then provides the same car back to the employee as a car fringe benefit. Any FBT payable in relation to the car fringe benefit is calculated in the usual way under either the Operating cost or Statutory formula method; an

- The employee is required to salary sacrifice the GST-exclusive amount of any car expenses (including the lease or other payments made to the associate of the employee), as well as any FBT that is payable by the employer in relation to the car fringe benefit; and

- The associate of the employee then includes any lease (or other related) payments made to them by the employer as assessable income and claims the appropriate deductions with respect to the leased car against this income.

MEET JERRY AND BETH

|

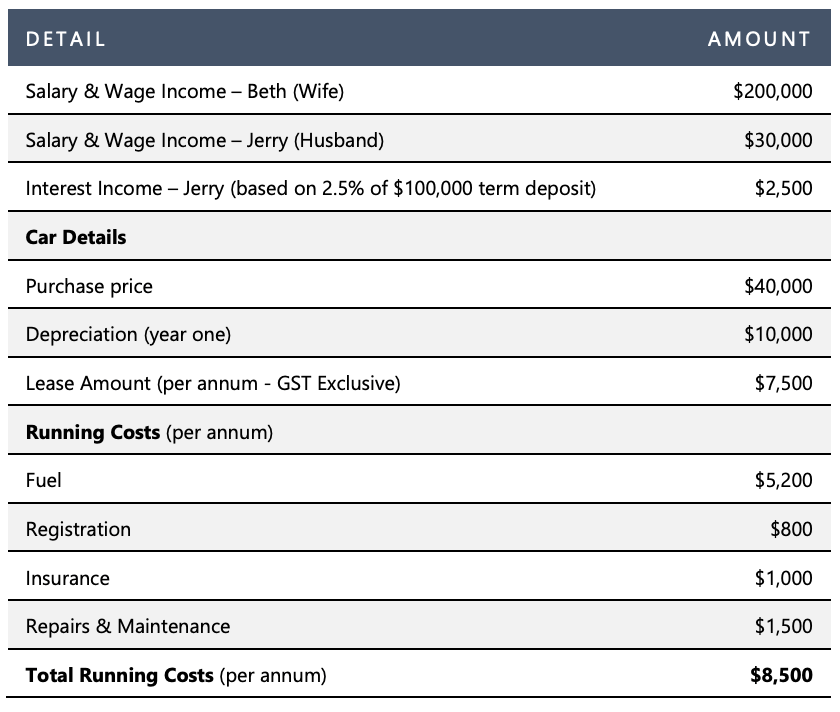

Assumptions |

Outcomes |

For working out the benefits of the associate lease we will assume that Beth & Jerry have no other deductions to offset against their salary and wage income.

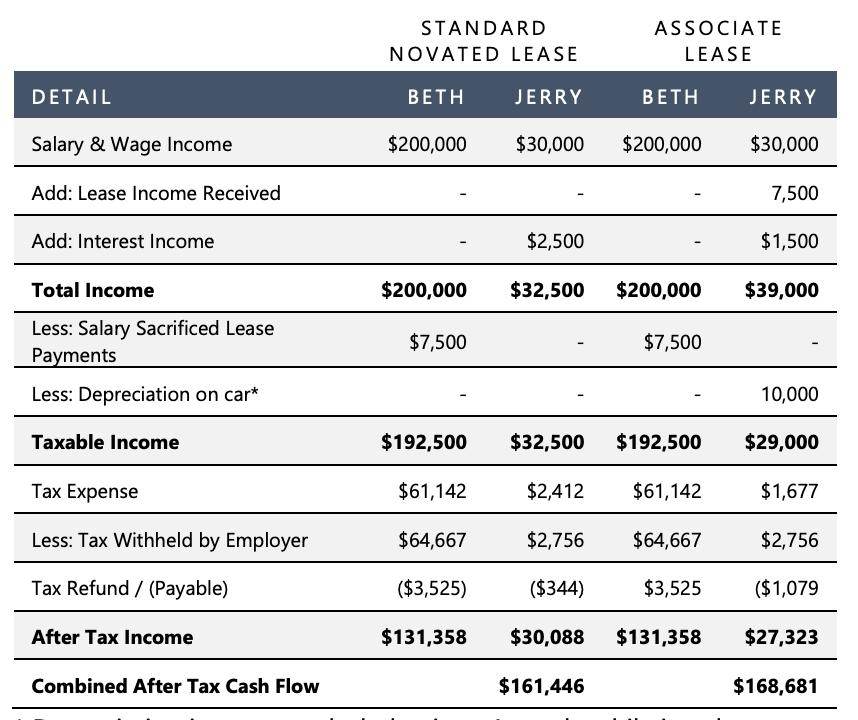

IMPACT ON JERRY, THE ASSOCIATE

Whilst Jerry’s interest income has reduced (to reflect the $40,000 spent on buying the new car) the after-tax income for the group is $7,235 higher by executing the associate lease. This is because the return on leasing the car is higher than the return achieved by investing in the term deposit.

As the car is being used to generate assessable income (i.e. lease income), depreciation of the car becomes a deduction for Jerry to offset against his income. For this example we have used the 25% depreciation rate rather than an immediate write off.

We do want to point out that the general tax avoidance provisions in Part 4a may be applied to this strategy. However, the example above clearly illustrates that the primary reason for executing this strategy was to maximise investment returns and after-tax cash flows so in our opinion could be a defence against Part 4a.

However, if Jerry obtained arm’s length finance to purchase the car, Part 4a may apply, because the lease income he received would be simply on paid to his finance company. As such, there would be no significant increase in after tax cash flows, just the tax benefits.

IMPACT ON BETH, THE EMPLOYEE

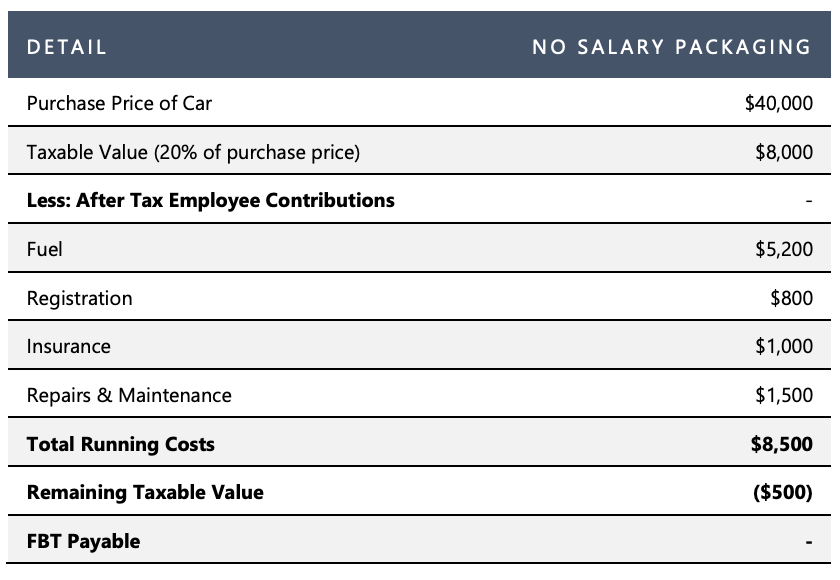

HOW IT AFFECTS BETH’S EMPLOYER

As the remaining taxable value is less than nil, there are no FBT issues for Beth’s employer. It is important to note that if the running costs fall below the taxable value amount in any FBT year then Beth should physically pay the difference to her employer to ensure no FBT issues arise.

INCOME TAX SAVINGS FOR BETH

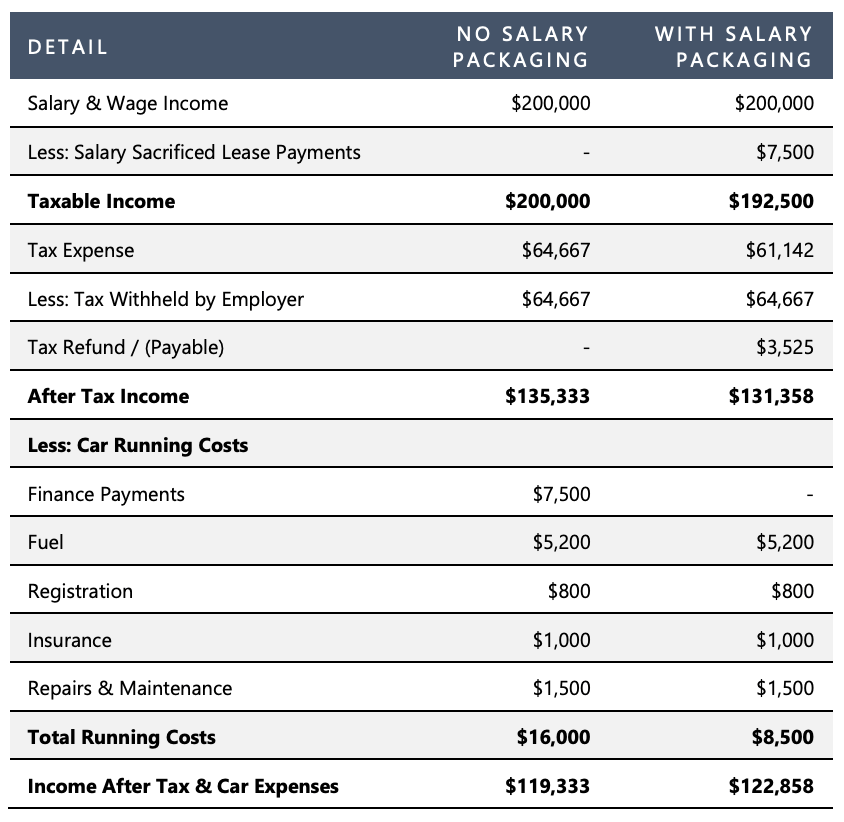

Finally, the benefits of Beth salary sacrificing her car in the first place are outlined here:

|

By salary sacrificing Beth’s new car, she has increased her cash surplus after tax and car expenses by $3,525. This is the same if it is packaged as an associate lease or a standard novated lease. |

NEXT STEPS

To find out if your business need to lodge FBT return for year 2023,

Please Click here Or Book a Free 15 minutes consultation.

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.