What is a Car Fringe Benefit?

.

A car fringe benefit commonly arises when an employer makes a car they own or lease available for the private use of an employee. If you conduct your business through a company or trust, you may be an employee of the company or a trust.

A car is made available for private use by an employee on any day the car:

- is used for private purposes by the employee or associate

- is not at your premises, and the employee is permitted to use it for private purposes

- is garaged at their place of residence, regardless of whether they have permission to use it privately

Calculating the Taxable Value

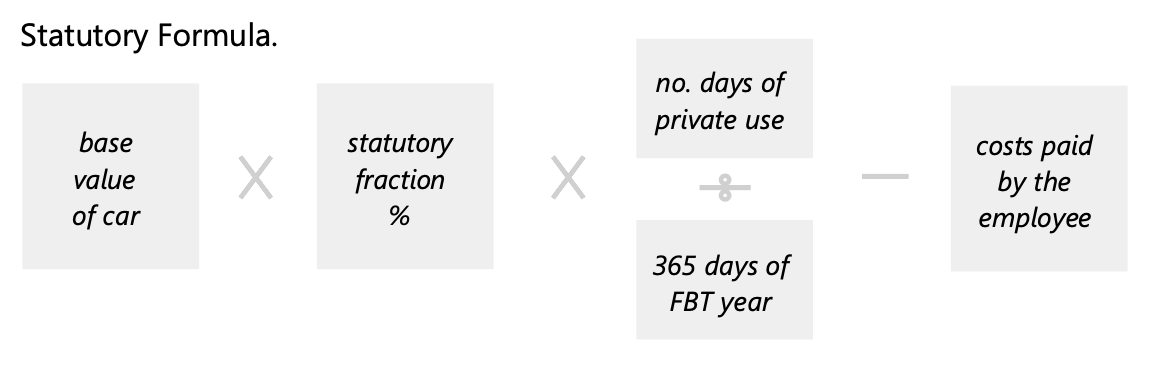

You can calculate the taxable value of a car fringe benefit using either a statutory formula or operating cost method.

STATUTORY FORMULA METHOD

Base Value. If you’ve owned the car for less than 4 years when the FBT year began, the base value is the original cost price of the car, or 2⁄3 of the cost price if owned for more than 4 years.

Cost price. The original purchase including GST and luxury car tax but excluding, stamp duty, registration, acquisition costs such as delivery and non-business accessories like paint, fabric and rust protection or window tinting.

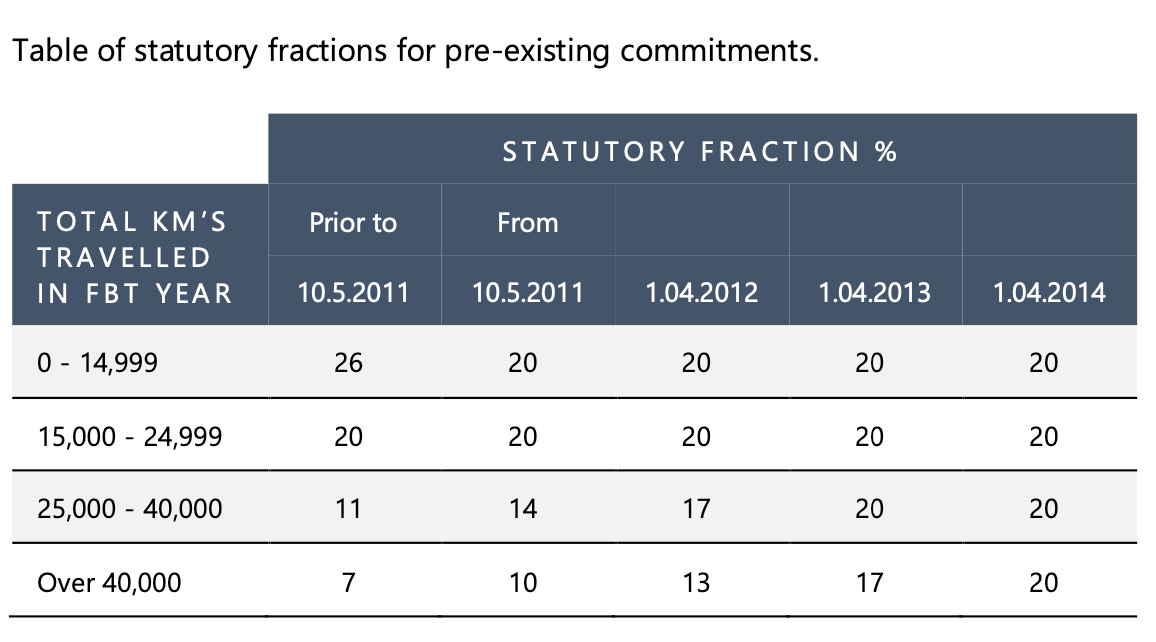

Statutory Fractions. From 1 April 2014, there’s been a flat rate of 20% applied regardless of how many km’s were travelled in the FBT year, except where there is a pre-existing commitment in place before 7:30pm, 10 May 2011.

OPERATING COST METHOD

Operating costs. Includes actual costs such as running costs (repairs, maintenance, fuel, registration and insurance), and deemed costs such as depreciation and interest.

If the car is owned under lease, the leasing costs for the period it’s used to provide fringe benefits are also included in the operating cost.

For cars owned by the employer, deemed depreciation is calculated by multiplying the depreciated value of the car at the start of the FBT year by the deemed depreciation rate applied at the time the car was purchased. Deemed interest is calculated by multiplying the depreciation value of the car by the statutory FBT benchmark interest rate of 4.8% for 2021.

Logbooks. A log book must be maintained for a continuous 12-week period to represent the use for the full FBT year and to determine the applicable business percentage of a car.

Private use. Generally, any use of the car that is not for income-producing purposes such as travel to and from work is normally private use, even where the employee undertakes minor errands like collecting the mail.

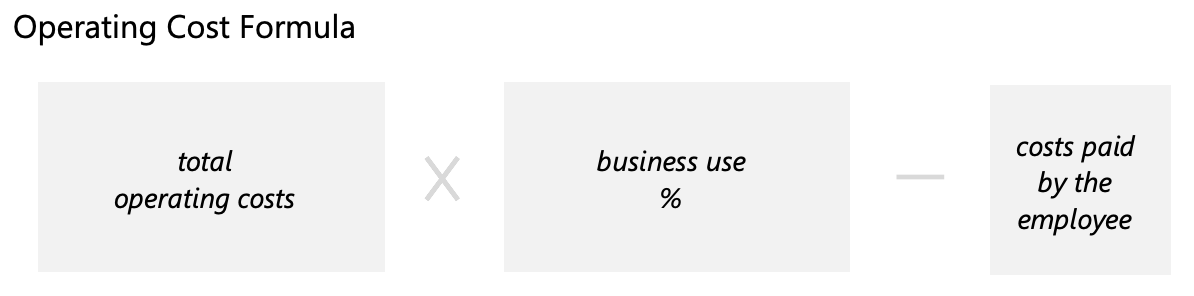

Employee reimbursement. Any unreimbursed car expenses incurred, or contribution made by the employee can reduce the taxable value of a car fringe benefit under the operating cost method, as illustrated.

An employer can use the operating cost method for a year where a log book hasn’t been maintained, however there is no reduction in the taxable value of the car for any business journeys made.

EXEMPT CAR BENEFITS

WORK RELATED TRAVEL IN COMMERCIAL CARS

A car benefit will be exempt where the vehicle is a taxi, panel van, utility or other road vehicle designed to carry a load, other than passengers of less than one tonne, and the employee’s private use is limited to incidental or minor work-related travel such as between home and work that is infrequent and irregular.

CARS USED FOR EMERGENCY SERVICES

Cars used for emergency services which are garaged or kept at or near an employee’s residence are exempt car benefits, where the car used is a police, ambulance or firefighting services vehicle; is fitted with flashing warning lights and a siren and has exterior markings which indicate its use.

CARS SUPPLIED BY PERSONAL ENTITIES

A personal service entity is unable to deduct car expenses from more than one car used by an individual. The second car benefits are exempt in relation to an FBT year.

Who are TMS CPA Accountants?

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

Get an expert advice on how to structure and manage car fringe benefits

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.