Home | Tax Planning | Why Use A Bucket Company?

Why Use A Bucket Company?

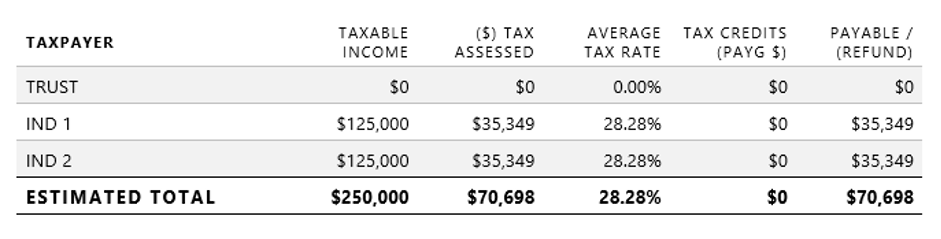

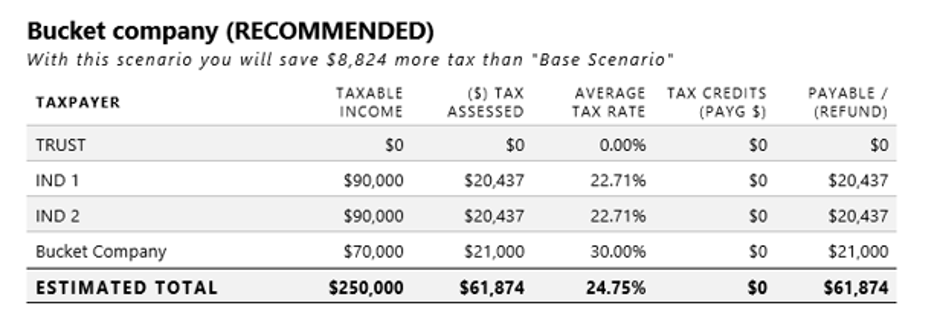

Assume a trust earns $250,000 in profits from business or investment.

OPTION 1. Distribute profits 50/50 to individuals 1 and 2 ( inc Medicare Levy payable) = $70698 (28.28%)

OPTION 2. Distribute $90,000 each to individuals 1 & 2 and distribute balance of $70,000 to a “bucket” company at a 30% tax rate . Total tax payable = $61,874 ( 24.75%)

Value of strategy is $8,824 in tax saved!

“Bucket”

Company

$70,000 Income from Trust

taxed at lower rates of

30% or 27.5%

Uses Cash to:

- Invest in shares, properties and loan funds to other companies

- Should never operate a business or engage in risky activities.

Related Articles

Understanding Fringe Benefits Tax in Australia

Understanding Fringe Benefits Tax in Australia. Employers often provide perks like cars or loans as part of a total compensation package. However, the Australian Taxation Office (ATO) imposes a...

FBT for Small Business: What You Need to Know to Stay Compliant

FBT for Small Business: What You Need to Know to Stay Compliant. As a small business owner, you’re probably familiar with the various tax obligations that you need to comply with. One such...

Taking Money Out of Your Private Company: How to Avoid Division 7A Penalties

Taking Money Out of Your Private Company: How to Avoid Division 7A Penalties. Why You Can’t Simply Take Money Out of Your Company? As a business owner, you may be wondering why you can’t just take...

Unlock the Benefits of a Bucket Company: Maximise Tax Savings and Protect Your Assets

Unlock the Benefits of a Bucket Company: Maximise Tax Savings and Protect Your Assets. What can you do to maximise profits and minimise tax burden for your trust-operated business? Are you making a...

Key tax due dates for Construction Trade Professionals for 2024

Key tax due dates for Construction Trade Professionals for 2024. As a tradesperson running your own construction business, as an electrician, plumber, or bricklayer, you need to manage your tax...

Rental property tax considerations for property investments

Rental property tax considerations for property investments. Cameron recently bought a coastal property in Byron Bay, listing it for short-term rentals while managing his construction business in...

Instalment Activity Statements (IAS) for Individuals & Businesses

Instalment Activity Statements (IAS) for Individuals & Businesses. What is an Instalment Activity Statement? An Instalment Activity Statement or IAS is a pre-printed document sent out by the...

Maximising Your Returns: Exploring the Benefits of Franked Dividends in Australia

What is a Franked Dividend and How does it work?. Franked vs unfranked dividends — When the company issuing the dividend has paid tax, the investor who holds the shares will receive a franked...

ATO Client to Agent Linking: Protecting Your Financial Security

ATO Client to Agent Linking: Protecting Your Financial Security. If you're thinking about changing accountant, it's important you're aware of recent changes the Australian Taxation Office (ATO) is...

Disclaimer

We have provided this document as a fundamental guide that is intended to assist people in improving their understanding of the tax laws and how they operate. When considering what actions to take, however, more factors should be considered.

This is not intended to be a comprehensive document that can be taken as tax advice, financial advice, or any other kind of advice. The content does not consider any of your circumstances and is only generic in nature.

This document is not to be taken as advice under any circumstances. If you consider acting based on anything written in this document, we suggest you seek professional advice first.

If you have any questions, you can contact TMS Tax Accounting and Financial Services by phone 02 9725 6169 by email at admin@tmsfinancial.com.au.

We will not accept liability for anyone relying on the contents of this document.