New rules were established for taxing capital gains linked to trusts starting from the income year 2011.

In general, these updated regulations didn’t change the tax obligations for capital gains distributed by the trustee of a specific trust to a foreign resident. However, confusion can arise when determining the taxation of capital gains from certain Australian trusts allocated to foreign residents.

By “foreign residents,” we mean individuals who don’t qualify as an Australian resident for tax purposes. Achieving tax residency in Australia isn’t solely dependent on having an Australian passport or citizenship. For example, you might not be an Australian citizen, but if you stay in Australia for a certain period or under certain conditions, you could be considered a tax resident.

Furthermore, the distinction between a temporary resident and a permanent resident plays a role in comprehensive Capital Gains Tax obligations. It’s crucial to understand the nuances in this area, especially when considering exemptions such as the main residence exemption.

Different rules apply to discretionary trusts and fixed trusts when distributing income

Previously in Australia, if a discretionary trust gave out a capital gain to a foreign resident beneficiary, there wasn’t usually an Australian Gapital Gains Tax (CGT) duty on it, especially if the gain was from sources outside of Australia.

In contrast, for fixed trusts, the main point to consider when distributing a capital gain to a beneficiary living outside Australia is if the gain is tied to what’s called Taxable Australian Property (TAP). Taxable Australian Property includes assets such as homes, apartments, commercial structures, and land located in Australia. If a fixed trust distributes a capital gain related to an asset that isn’t classified as Taxable Australian Property, then that gain is typically not taxed in Australia.

Determining tax implications for trust distributions to foreign residents

Under the new Australian taxation guidelines, how can we identify when a distribution by a trust to a foreign resident beneficiary will be subject to tax?

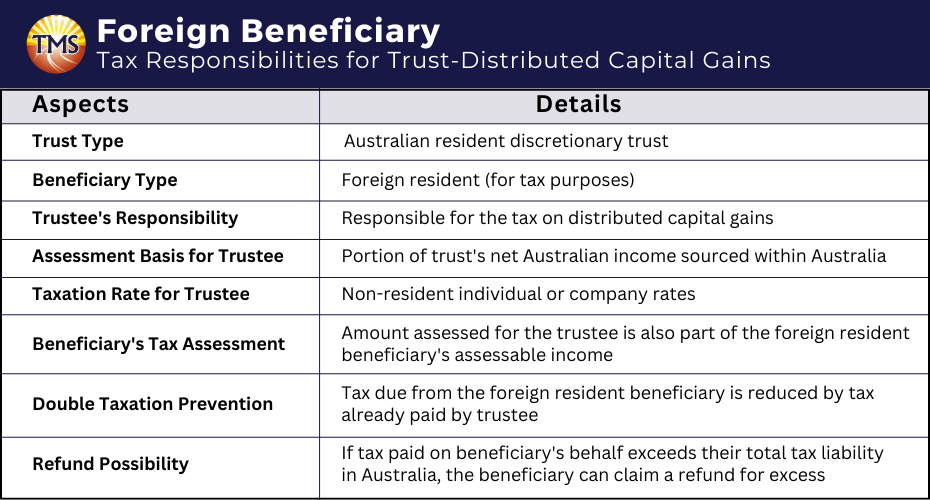

This section will focus on the rules and criteria for assessing the tax implications of capital gains distributed from an Australian resident discretionary trust to a beneficiary who is a foreign resident for tax purposes.

Tax implications for discretionary trust capital gains distributed to foreign beneficiaries

If an Australian resident discretionary trust distributes capital gains to a beneficiary who’s considered a foreign resident for tax purposes, the trustee becomes responsible for the tax. This assessment pertains to a portion of the trust’s net (taxable) Australian income that’s sourced within Australia. The tax is levied at rates suitable for non-residents, which can be either non-resident individual or company rates.

This amount for which the trustee is assessed also becomes part of the assessable income for the foreign resident beneficiary. This situation leads to both a trustee assessment and a beneficiary assessment for tax purposes. However, to avoid dual taxation on the same capital gain, the tax due from the foreign resident beneficiary is reduced by the tax already paid by the trustee. If the tax paid on behalf of the beneficiary exceeds their total tax liability in Australia, then the beneficiary can claim a refund for the overpaid amount.

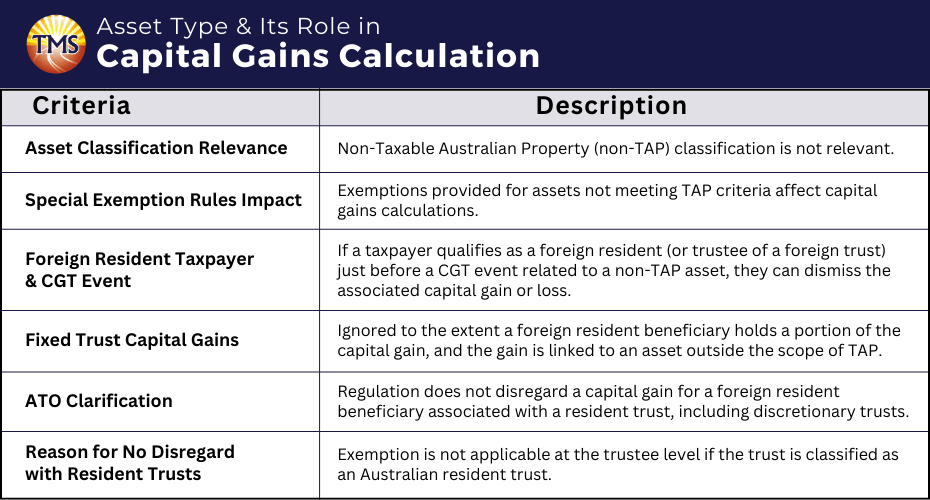

Asset classification and its impact on capital gains

Whether an asset is classified as non-Taxable Australian property (non-TAP) can significantly influence how capital gains are calculated. Special rules and exemptions apply to certain assets not deemed as Taxable Australian Property (TAP).

Here’s how it works:

-

If, just before a CGT event takes place, a taxpayer is recognised as a foreign resident (or acts as the trustee of a foreign trust), and the CGT event relates to an asset considered non-TAP, the taxpayer can overlook the resulting capital gain (or capital loss) from that specific CGT event.

-

Capital gains arising from a fixed trust, like a fixed unit trust, are excluded to the degree that a foreign resident beneficiary is entitled to a part of the capital gain, and the gain pertains to an asset the trust owns which isn’t identified as TAP.

However, it’s important to highlight the Australian Taxation Office (ATO) has clarified that these rules don’t lead to the disregard of a capital gain for a foreign resident beneficiary tied to a resident discretionary trust. This applies both from the trustee’s viewpoint and the beneficiary’s. This is because the exemption doesn’t hold at the trustee level if the trust is recognised as an Australian resident trust.

Case Study – Distributing capital gains to a foreign beneficiary

The ‘Sydney Harbour Investment Group’ (referred to as the ‘trust’) is identified as an Australian resident discretionary trust. Among the trust’s beneficiaries is James, who has lived in the United Kingdom for many years and is recognised as a foreign resident for tax purposes.

On 15 May 2015, the trust acquired ‘listed shares’ in a company registered on an international stock exchange. Later, on 20 June 2023, the trustee sold these shares, realising a capital gain of $200,000. By using the 50% Capital Gains Tax (CGT) general discount, the capital gain was effectively reduced to $100,000. Importantly, these listed shares weren’t classified as Taxable Australian Property (TAP) and the capital gain was sourced internationally.

Come 30 June 2023, following the guidelines in the trust deed, the trustee determined the trust’s income, which included gross capital gains. It was then decided to specifically allocate the entire gross capital gain from the sale of the listed shares, amounting to $200,000, to James. As a result, James, recognised as a foreign resident beneficiary, became entitled to the full $200,000 gross capital gain.

Is the capital gain allocated to James (a non-resident) subject to Australian tax?

The answer is yes.

Here’s a breakdown of the taxation mechanism:

Trustee assessment

The trust checks the total gain of $200,000, which is the amount James made from the sale. Because James isn’t an Australian resident for tax purposes, he doesn’t get to use the Australian tax break called the CGT (Capital Gains Tax) discount. So, the trust uses the tax rates that are set for people who aren’t living in Australia. This means the trust has to pay a tax of $70,200 on the $200,000 that James earned.

Beneficiary assessment

James has to see how much he owes on the full amount he gained:

He gets an extra $200,000 because he got all (100%) of the trust’s gain after selling (which was $100,000). This amount is doubled to balance out the 50% tax discount that the trust used at the beginning.

James can’t ignore the extra $200,000. This is because this gain doesn’t come from a “CGT event,” which you need to get an exemption.

James uses the Australian CGT rules to see how much he owes on the extra $200,000. He also looks at any other money he might’ve made to find out his total gain. If he didn’t make any other money and doesn’t have any losses, then his total gain is $200,000. This means James can’t use the Australian CGT discount.

James has to pay tax on the $200,000 gain based on the rates for non-residents. So, he might owe $70,200. But, if the trust already paid the $70,200 (like we talked about earlier), then James can take that amount off his own tax bill. This way, he doesn’t get taxed twice on the same gain.

So, in the end, James has a tax bill of $70,200 for the gain he made. This is true even though James is from another country, the shares he sold weren’t Australian property, and the money he made was from outside Australia. It’s important to note that by giving the money to someone from another country, the benefit from the CGT discount was lost.

James should also check how this gain is seen for tax in the UK. Plus, he might want to look at the tax agreement between the two countries to see if he can get any relief.

Would things be different if the trust were a set amount trust instead of a choice-based trust in Australia?

If we change things and the trust was a set amount type, the outcome is very different. If the trust was a set amount type, there wouldn’t be any tax in Australia on the gain. This is because the gain, which wasn’t from Australian property, would be given to James without any tax owed.

Next Step is to Contact TMS Financials

Book a free financial health review to see the difference we can make in your financial future.