FBT for Small Business: What You Need to Know to Stay Compliant

.

As a small business owner, you’re probably familiar with the various tax obligations that you need to comply with. One such obligation is Fringe Benefits Tax (FBT), which can be a little confusing. FBT treatment may vary for different entities, such as not for profit organisations, religious institutions, and rebatable employers. In this article, we’ll cover what you need to know about FBT for small businesses, including what it is, who pays it, and how it works.

What is FBT

Fringe Benefits Tax (FBT) is a tax paid by an employer on non-cash benefits provided to employees, their associates or family members, in addition to their salary or wages. These benefits are taxed separately from the employee taxable income and are subject to a different tax rate.

Small business owners like you must be aware of FBT because it can have a significant impact on your tax liabilities. You are required to register for FBT if you provide fringe benefits to your employees and must maintain accurate records of all fringe benefits provided and pay the appropriate amount of tax on these benefits.

Taxable value and FBT rate

Taxable value is the value of the fringe benefit provided and is used to calculate the FBT payable. It is usually calculated based on the cost of providing the benefit, less any contributions made by the employee.

The FBT rate is currently 47% and is applied to the taxable value of the fringe benefit provided. This rate may be subject to change so you must always check for updates.

Difference between FBT and income tax

The main difference between FBT and income tax is that FBT is a tax on non-cash benefits provided to employees, while income tax is a tax on an individual’s income.

Income tax rates are progressive, meaning that the more an individual earns, the higher the tax rate they will pay on their income, while the FBT rate is fixed at 47%.

Who pays FBT?

As a small business owner, it’s important to understand who pays FBT. FBT is paid by you, the employer, and it’s a separate tax from income tax, which is paid by your employees. FBT is calculated based on the value of the fringe benefits that you provide to your employees.

If you provide your employee with a company car for personal use, that car is considered a fringe benefit and you may be required to pay FBT on its value. It’s important to be aware of your FBT obligations as an employer, so that you can stay compliant and avoid any penalties or fines.

Example of FBT Liability Calculation for Small Business Owners with Family Tax Benefits

Let’s say you own a small business and you provide your employees with some fringe benefits, such as access to company cars for personal use and payment of their school fees. These benefits fall under the category of Fringe Benefits Tax (FBT). When it comes to tax time, you’ll need to calculate your FBT liability and report it to the ATO.

This means including any reportable fringe benefit amounts in your employee’s payment summary, as well as any taxable income deductions that you’ve claimed. It’s important to keep accurate records of the fringe benefits you’ve provided, including school fees paid on behalf of your employees, to ensure that you are meeting your FBT obligations. By doing so, you’ll avoid any penalties for not paying the correct amount of FBT and can also take advantage of any FBT concessions that may be available to you.

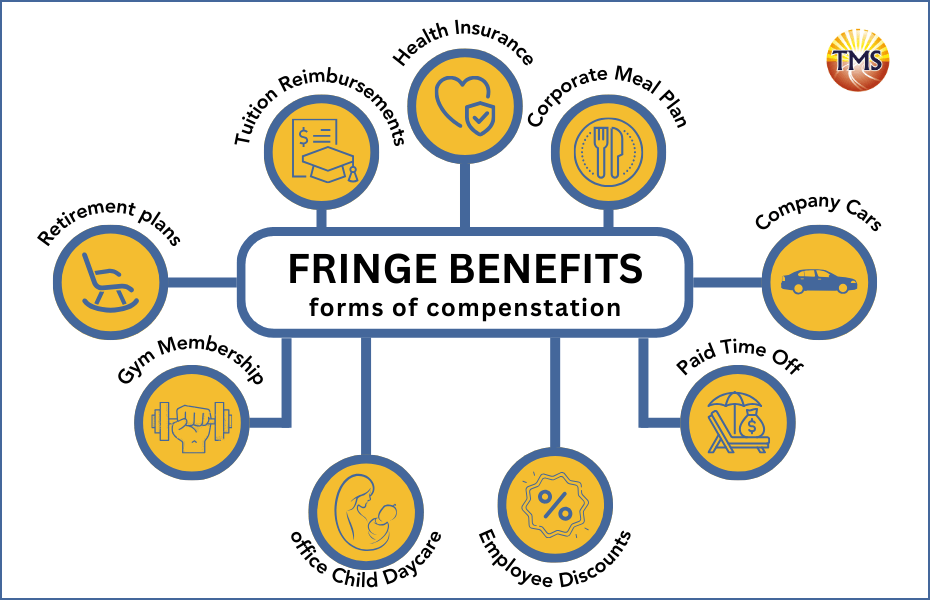

Types of Fringe Benefits

Fringe Benefits can take many forms and are designed to provide employees with additional value and incentives beyond their salary.

- FBT on cars or other vehicles for personal use, parking and tolls

- Entertainment-related fringe benefits

- Expense payment fringe benefits

- Loan and debt waiver fringe benefits

- Accommodation and location related fringe benefits

- Property fringe benefits

- Residual fringe benefits

Get tips and know the traps when Providing Cars to Employees.

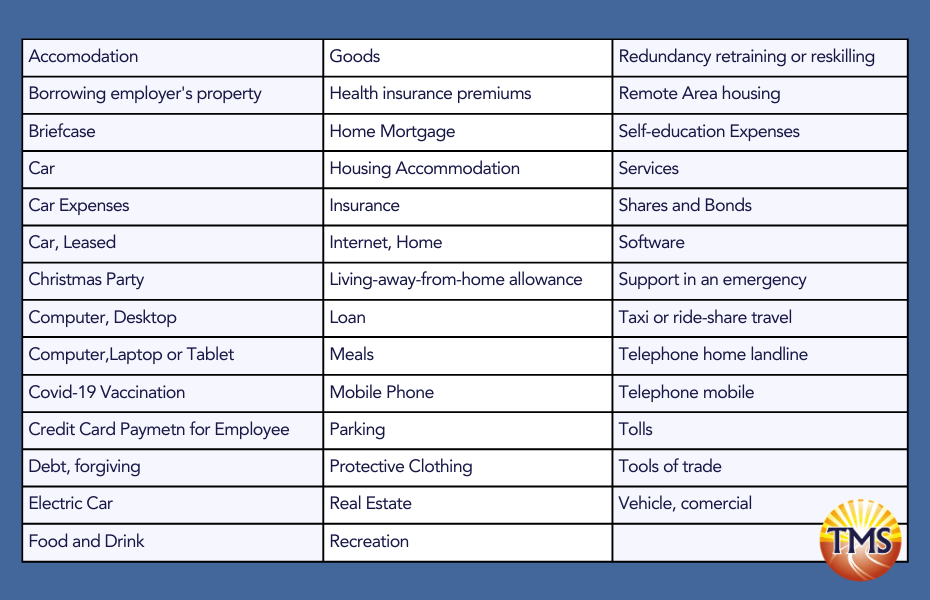

Examples of common benefits subject to FBT

Here is a list of common benefits that an employer may offer to their employees:

Benefits of offering fringe benefits

While providing fringe benefits can be an additional expense for an employer, they are often considered an investment in the well-being and productivity of their workforce, which can yield long-term benefits for the company.

Attracting and Retaining Employees – Fringe Benefits can be a competitive tool to attract top talent and retain valuable employees.

Enhancing Employee Satisfaction and Morale – Additional perks and incentives beyond the base salary can lead to higher employee engagement, loyalty, and productivity.

Tax Advantages – For example, certain retirement plans or health insurance plans may offer tax benefits that can help offset the cost of providing these benefits to employees.

Compliance with legal requirements

Some fringe benefits may be required by law, such as certain types of insurance coverage or paid leaves.

Example of how to provide perks to your employees while staying compliant with tax laws

Sarah, the owner of a small marketing agency – Bright Ideas Marketing Agency Pty Ltd, provides her employees with fringe benefits, including private health insurance, gym memberships, and flexible work arrangements. These benefits are considered separate from the employee’s taxable income and are subject to Fringe Benefits Tax (FBT) paid by the employer.

Sarah can also take advantage of tax benefits, such as a private health insurance rebate or income tax deductions, which can help offset the cost of providing these benefits to her employees.

She needs to report the total taxable value of fringe benefits provided to her employees as part of their Reportable Fringe Benefits Amount (RFBA) in their financial year income statement. Sarah also needs to calculate the FBT liability on the taxable value of the benefits provided and ensure that the tax is paid on time to avoid any penalties or fines.

By providing these fringe benefits, Sarah is also complying with certain legal requirements, such as the provision of private health insurance, paid leaves, or child support payments, which are essential for maintaining a healthy and productive workplace.

Fringe Benefits Tax (FBT) obligations and compliance

Small business owners need to be aware of FBT to ensure they are staying compliant with tax laws. Failure to comply with FBT regulations can result in penalties, fines, and other consequences.

FBT can be a significant cost for small business owners but with right understanding and planning, unexpected costs can be avoided.

Reportable Fringe Benefits Amount (RFBA)

RFBA refers to the total taxable value of fringe benefits provided by the employer which needs to be reported on the employee’s Payment Summary and included in their individual income tax return.

Calculating the Fringe Benefits Tax

- Determine the taxable value of the fringe benefits provided by adding up the value of each fringe benefit provided to employees.

- Calculate the grossed-up taxable value of fringe benefits. This involves adding the taxable value of the benefits to the amount of Goods and Services Tax (GST) that would be payable if the benefit was sold at market value.

- Apply any exemptions or concessions that may apply to the fringe benefits provided. There are some types of fringe benefits that are exempt from FBT, such as certain work-related items or minor and infrequent benefits. Additionally, some concessions may apply to certain types of benefits.

- Calculate the FBT liability by applying the current FBT rate to the grossed-up taxable value. The FBT rate is currently set at the highest individual income tax rate, which is 47%.

- Take into account any employee contributions towards the cost of fringe benefits, which can reduce the FBT liability.

- Review the calculated FBT liability with your tax accountant to ensure that all calculations are correct and that all exemptions and concessions have been applied correctly.

- Ensure that the FBT liability is paid on time to avoid any penalties or fines

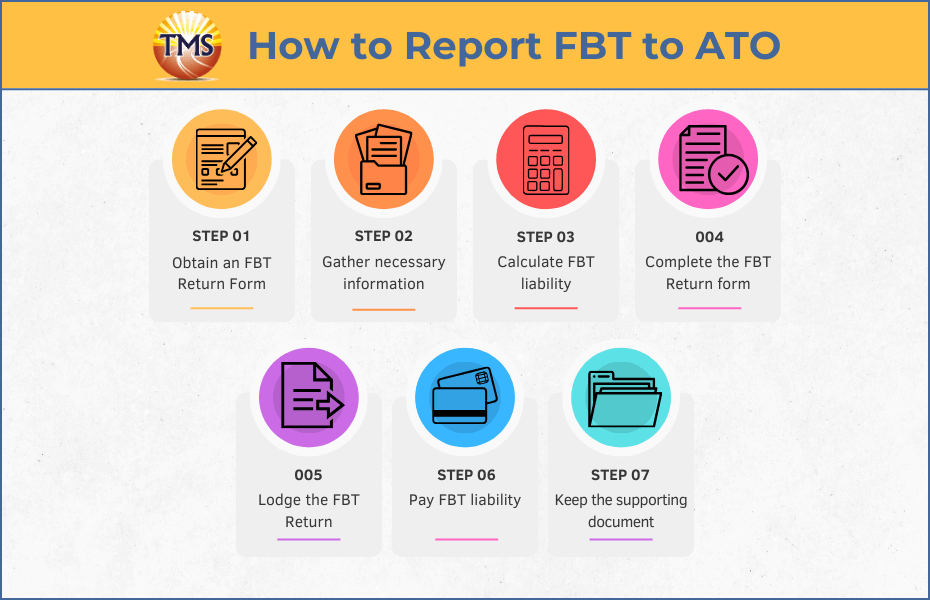

Reporting and paying Fringe Benefits Tax (FBT) to the ATO

To report FBT to the Australian Taxation Office, employers need to complete an FBT Return form, which can be obtained from the ATO website or by contacting the ATO directly. Employers should gather all necessary information, before proceeding to calculate their FBT liability and carefully complete the FBT Return form with accurate information.

The form should be lodged with the ATO by the due date, generally 21 May, or 25 June if lodged electronically. Employers also need to pay the FBT liability by the due date and keep records of relevant information for a minimum of five years.

Deadlines for lodgement and payment

The FBT year runs from 1 April to 31 March of the following year, and is separate from the income tax year, which runs from 1 July to 30 June. The due date for lodging an FBT return is 21 May following the end of the FBT year on 31 March, while the due date for paying any FBT liability is 28 May.

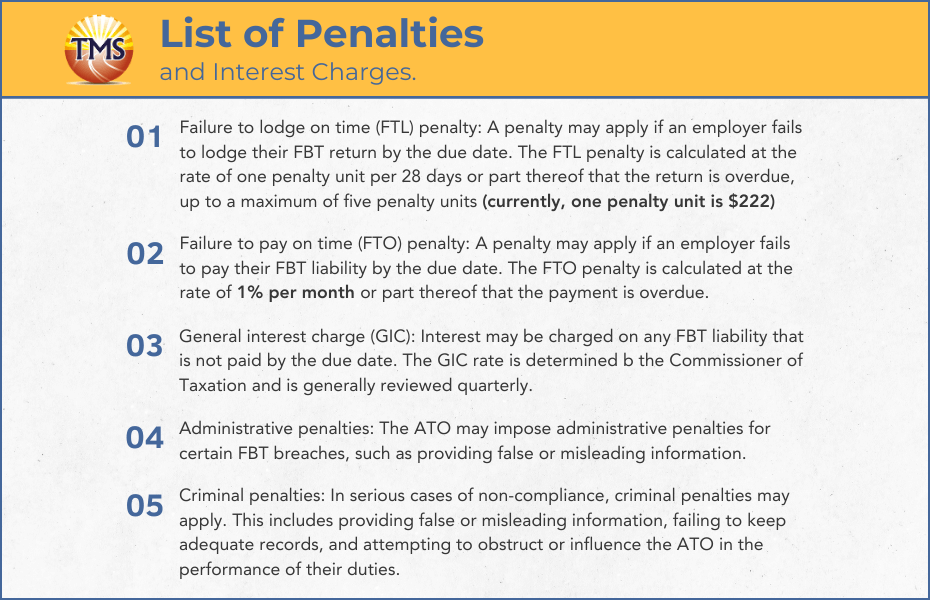

Penalties for non-compliance

Failure to comply with FBT obligations may result in penalties and interest charges.

FBT concessions and exemptions for small businesses

Small businesses may be exempt from FBT on certain work-related items, such as portable electronic devices, computer software, and protective clothing. These items must be primarily used for work purposes and be provided to employees for their work-related use.

Employers may also be exempt from FBT for minor and infrequent benefits that are provided to employees, such as Christmas gifts or birthday presents. To be eligible for this exemption, the total value of the benefits provided to an employee must be less than $300 for the FBT year and the benefits must be infrequent or irregular.

New businesses that have been in operation for less than 12 months and have an aggregated turnover of less than $10 million may be eligible for a range of concessions, including an exemption from FBT on certain work-related items and a reduced FBT rate of 17% for other benefits.

Who are TMS Financials?

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and strategic financial structuring. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

This outline is for general information only and not as legal, tax or accounting advice. It may not be accurate, complete or current. It is not official and not from a government institution. Always consult a qualified professional for specific advice tailored to your unique circumstances.

Related Articles

Maximise your savings with energy-efficient assets using the small business energy incentive

Maximise your savings with energy-efficient...

New ATO guidelines on the revised fixed rate method for work from home claims

New ATO guidelines on the revised fixed rate...

New guidelines on home EV charging rate

New guidelines on home EV charging rate....

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.