PAYG means “Pay As You Go,” which the Australian Taxation Office uses to collect payments from taxpayers. Conversely, it is beneficial since paying tax ‘as you go’ over the year entails not settling the lump sum amount at one go but was spread out in instalments, making it practicable to meet income tax obligations. Thence, you may end up with little income tax liability to pay at financial year end or, better yet, a tax refund for overpayment.

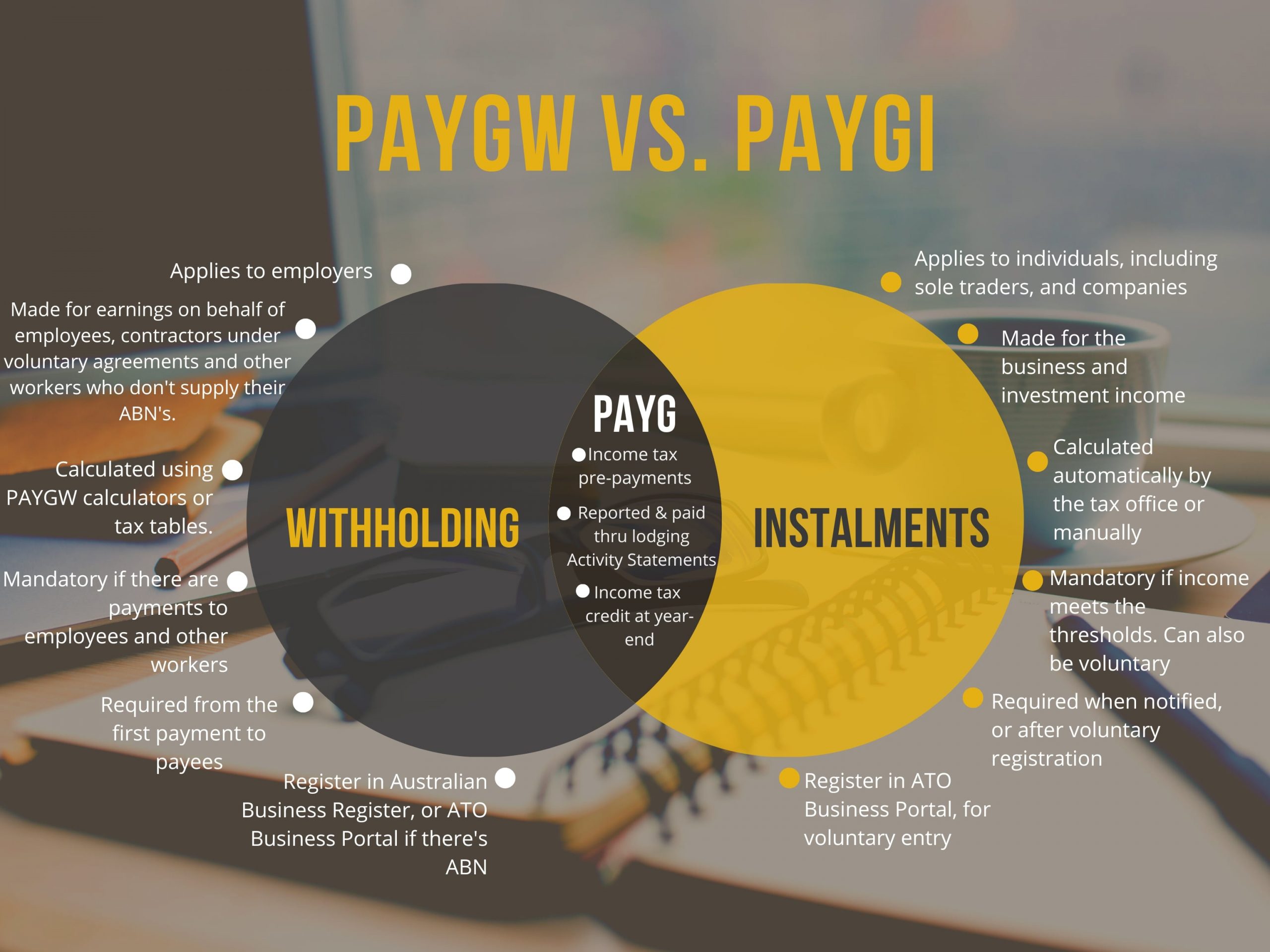

There are two kinds of Pay as you go (PAYG) payments: PAYG Withholding (PAYGW) and PAYG Instalments (PAYGI).

What is PAYG Withholding?

If you’re an employer, Pay as you go (PAYG) withholding is the amount you withhold from gross payments you made to:

- Employees,

- Other workers such as contractors you have entered into voluntary agreements to withhold amounts, and

- Businesses or contractors that don’t supply their Australian Business Number (ABN).

In doing this, you can help the above by withholding amounts from their earnings to anticipate their tax liabilities and paying the withheld amounts directly to the ATO on their behalf, which will be credited at year-end through their annual tax return.

What are PAYG instalments?

Pay as you go (PAYG) Instalments are prepayments of the tax on your business and investment income made in regular instalments through the financial year, usually by quarter. This system helps you as business owners, investors or sub-contractors plan ahead of your taxes to avoid paying a large tax bill at the end of the year.

How to calculate PAYG?

Determining the amount to withhold

PAYG withholding is calculated based on one’s expected income level for the year and will be offset in the income tax payable at year-end. Knowing the right amount to withhold is vital to prevent you from getting penalties.

The Australian Tax Office provides withholding calculators that help you determine the amounts to withhold from your payments made to employees and other workers. Alternatively, you can use the tax tables provided.

How PAYG Instalments work

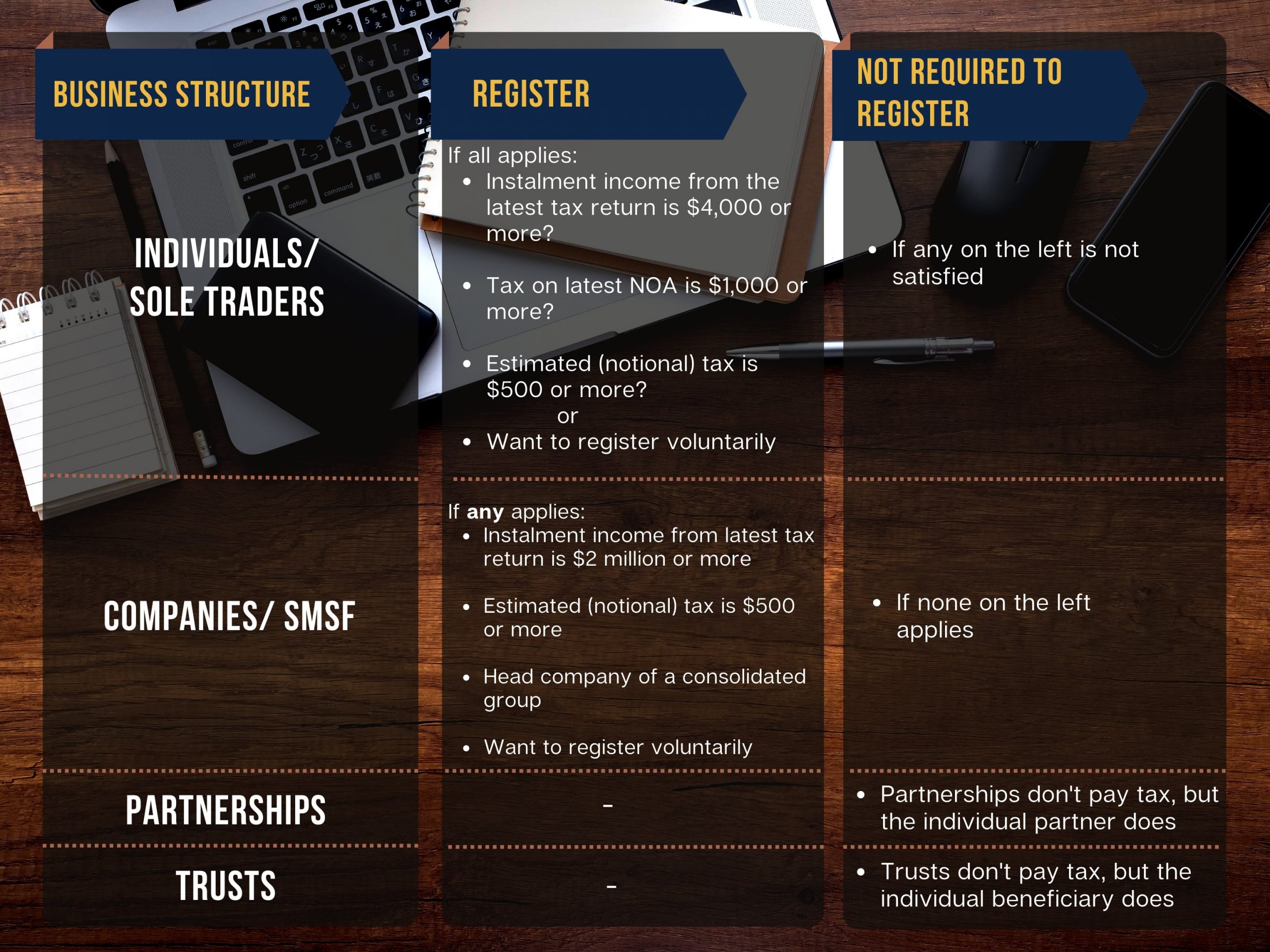

PAYG instalments may be computed and entered automatically by the ATO based on the information you declared on your latest tax return, that is if your instalment income (or gross business and investment income, exclusive of GST and any capital gains) reported exceeds a certain amount from the entry thresholds.

There are two options the ATO may calculate PAYGI, specifically:

Option 1: Instalment amount – they do the calculation and hand the amount to pay, or

Option 2: Instalment rate – they provide the instalment rate to which your instalment income shall be multiplied. This option fits you if your income varies a lot because the amount will be proportional to the income.

Either way, you can vary the amount if it’s too high or too low, depending on your financial circumstances.

Preferably, PAYGI can also be voluntary, wherein you need to estimate your income tax to pay using the PAYG instalments calculator or manually, then make your request.

How to register for PAYG?

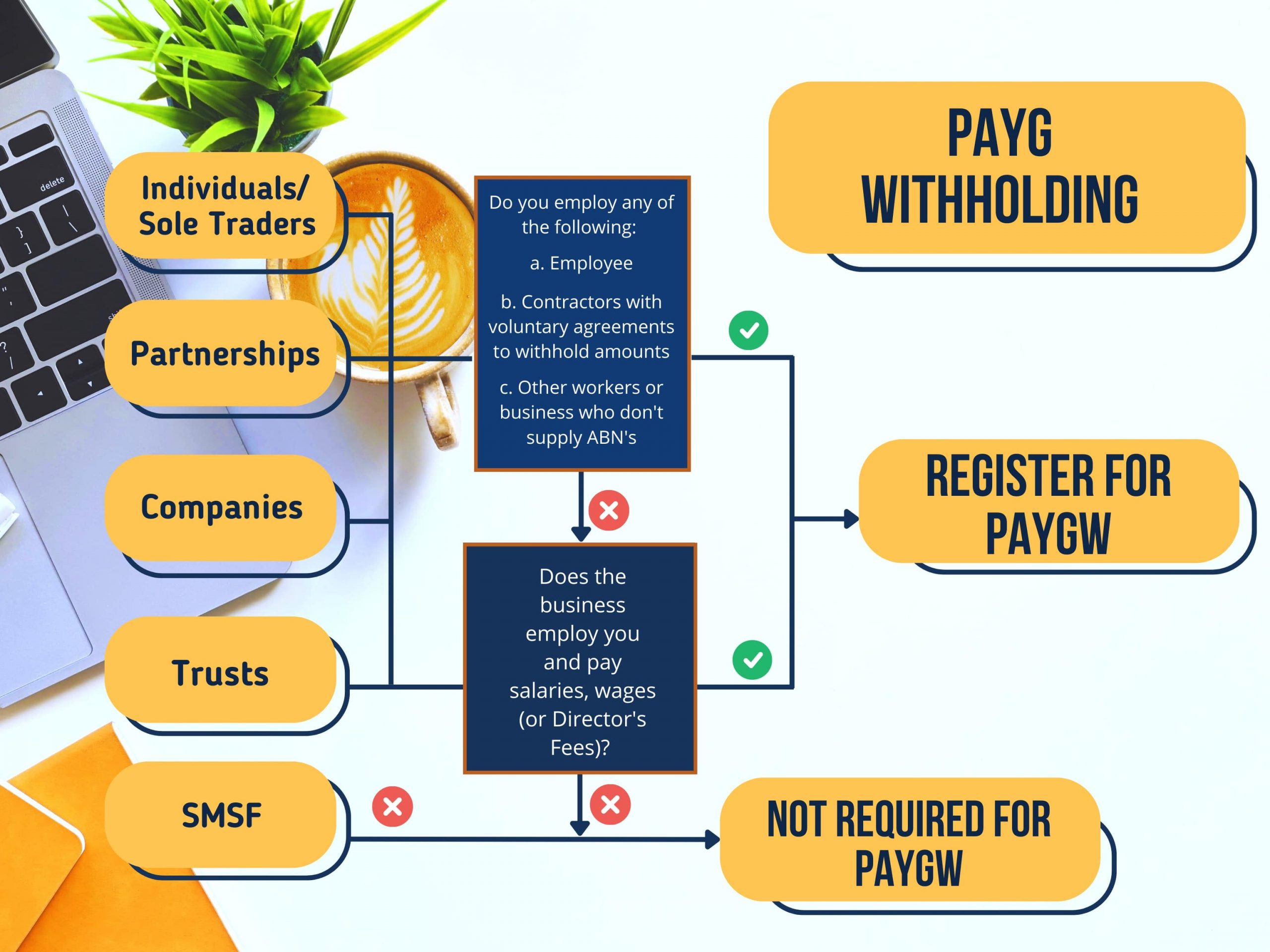

To comply with PAYG withholding obligations, you as an employer have to register for PAYG withholding when you knew you’re required to withhold amounts from your payments to employees or other businesses.

Before making any payment, you should register first through the Australian Business Register on the ATO website. Additionally, if ABN is available, you can use the ATO’s Business Portal to register.

You also need to:

-

report and pay the withheld amounts by lodging activity statements

-

provide PAYG payment summaries (now called an ‘income statement’) to your employees and other workers, and

-

submit an annual report to the ATO.

In case you cease to be an employer, your PAYG withholding registration shall be cancelled.

How to get a PAYG summary from MyGov

Your payees can get PAYG summaries by signing in to myGov > ATO online services > Employment > Income statement.

Please be mindful that if you started STP reporting, then you’re no longer required to provide PAYG payments summaries as the information will be directly sent and available through the ATO Online services.

Enter PAYG Instalments

ATO will notify you if you’re automatically required to make PAYG instalments payments through:

(1) your myGov Inbox,

(2) your Online services or Standard Business Reporting software, or

(3) a paper letter sent in your mail.

An SMS reminder will also be delivered if your phone number is available.

For voluntary entry, you can make a request through:

(1) myGov account for individuals, including sole traders (Select Tax > Manage > Enter PAYG Instalments)

(2) your registered tax agent

(3) contacting the ATO at 13 28 66 for businesses (13 28 61 if not in business)

Who are TMS Financials?

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and financial planning. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

This outline is for general information only and not as legal, tax or accounting advice. It may not be accurate, complete or current. It is not official and not from a government institution. Always consult a qualified professional for specific advice tailored to your unique circumstances.

Want to know what’s the best structure for your business?

services can benefit you

Related Articles

Understanding Fringe Benefits Tax in Australia

Understanding Fringe Benefits Tax in Australia. Employers often provide perks like cars or loans as part of a total compensation package. However, the Australian Taxation Office (ATO) imposes a...

FBT for Small Business: What You Need to Know to Stay Compliant

FBT for Small Business: What You Need to Know to Stay Compliant. As a small business owner, you’re probably familiar with the various tax obligations that you need to comply with. One such...

Taking Money Out of Your Private Company: How to Avoid Division 7A Penalties

Taking Money Out of Your Private Company: How to Avoid Division 7A Penalties. Why You Can’t Simply Take Money Out of Your Company? As a business owner, you may be wondering why you can’t just take...