What is GST or Goods and services tax

What is a GST Credit

This is important for business owners because it helps them save money, manage their finances better, and stay competitive in the market.

Eligibility for GST Credits

How to Maximise GST Credits

Ensure GST Registration to be eligible for GST credits, businesses must register for Goods and Services Tax with the Australian Taxation Office (ATO) if their annual turnover exceeds the registration threshold. Ensuring proper registration is the first step towards maximising GST credits.

Maintaining detailed records of all business expenses and purchases is crucial. These records should include tax invoices and receipts that clearly show the supplier’s ABN, a description of goods or services, transaction date, total amount paid, and GST amount. Accurate record-keeping is essential for supporting GST credit claims.

Claim Input Tax Credits (ITCs):

Input tax credits refer to the GST paid on business expenses and not personal expenses. When you make purchases or incur expenses for goods and services used in your business activities, you generally pay GST on those purchases.

Fuel Tax Credits (FTCs):

FTC allows eligible businesses to claim credits for the fuel tax (excise or customs duty) included in the price of fuel used in their business operations, machinery, plant, equipment, or heavy vehicles.

You may claim for fuel tax credits if you are registered for GST, using the fuel for business operation, and you have the necessary records to support your claims.

Luxury Car Tax (LCT) Credits:

Certain vehicles, such as those designed for primary use as a taxi or for the transportation of disabled individuals, may be eligible for a luxury car tax credit.

To claim for LCT credits, it is not required to be registered for GST. However, there are other criteria you must consider such as:

- You have a credit entitlement. Either you overpaid LCT on a purchase of a luxury car or you paid LCT on the purchase or importation of a luxury car which you could have quoted for, except you were not registered for GST purposes at the time.

- No one else has claimed the credit, and you haven’t passed the tax onto another person.

- Your credit claim is lodged within four years of purchasing or importing the luxury car.

- You have kept supporting documentation for the credit claim, which must be retained for five years.

- Original documentary evidence must be provided with the application, and it will be returned after processing.

Lodging Business Activity Statements (BAS)

The lodgment can be done online through the ATO’s Business Portal or using compatible accounting software. Any GST liability or refund is payable or receivable at the time of lodgment.

Timeframes and due dates

Corrections and adjustments to GST credits

Tax invoices for claiming GST credits

Also, you should maintain accurate records of GST paid on purchases, such as invoices and receipts, to substantiate the claims for GST credits. The ATO may request supporting documentation to verify the GST credits reported in the BAS.

GST Audits and Compliance

ATO (Australian Taxation Office) audits

Compliance requirements for GST credits

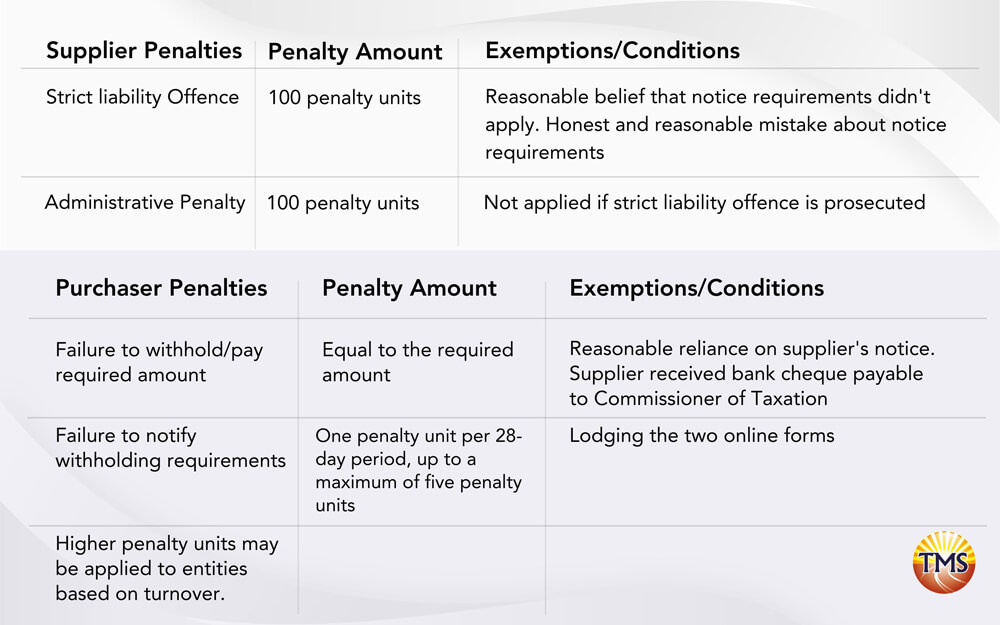

Penalties and consequences for non-compliance

GST Credits and Tax Deductions

Next Step is to Contact TMS Financials

Book a free financial health review to see the difference we can make in your financial future.