Making Sense of the Tax Free Threshold: Clarity for Taxpayers

.

The tax-free threshold is the amount of income you can earn each year without paying income tax. For most Australian residents, this threshold is set at $18,200. This means that if your total income for the 2023–2024 financial year is $18,200 or less, you won’t need to pay any tax. Consequently, if your annual earnings are below this figure, you won’t be subjected to income tax. However, if your income surpasses this limit, you’ll be taxed on the exceeding amount.

In Australia, the tax-free threshold varies between residents and non-residents. Typically, non-residents don’t qualify for the tax-free threshold.

How income tax is calculated

Income tax in Australia is based on the taxable income you earn during a financial year (1 July to 30 June). Taxable income, for tax purposes, includes sources such as salary, business proceeds, rental, and investment income, less any permitted deductions. If for some reason you’ve overpaid, a tax refund may be in order when you file your annual tax return with the Australian Taxation Office (ATO). However, if not enough tax was withheld by your employer during the income year, you might end up with a tax debt.

To figure out your income tax, start by determining your taxable income. This is done by deducting exemptions and deductions, such as investment management fees, you’re entitled to from your total income. Once you’ve got your taxable income, you can refer to tax tables provided by the ATO to see how much tax is payable.

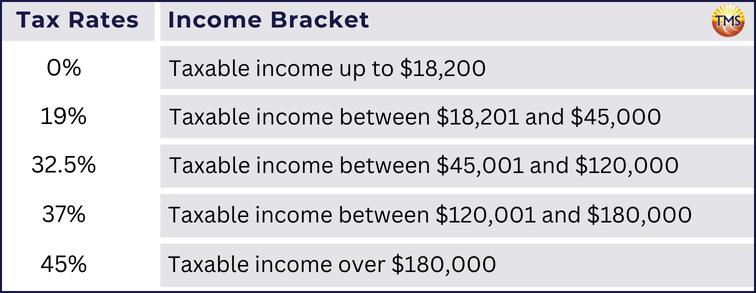

The tax rate applied depends on your income bracket. Australian residents are acquainted with the five tax brackets:

- 0% tax on taxable income up to $18,200 (claiming the tax-free threshold)

- 19% tax on taxable income between $18,201 and $45,000

- 32.5% tax on taxable income between $45,001 and $120,000

- 37% tax on taxable income ranging from $120,001 to $180,000

- 45% tax on taxable income above $180,000

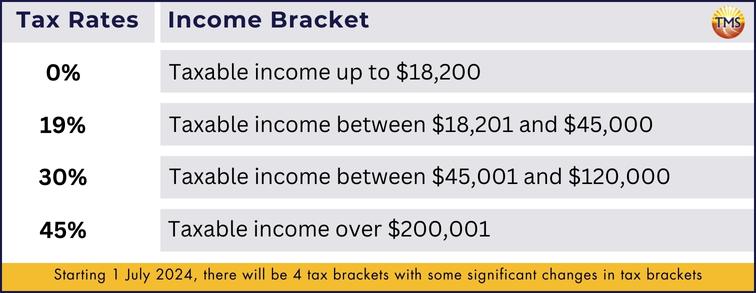

Note: The above tax rates are valid for the 2022-2023 financial year. However, from 1 July 2024, the structure will see a revision to four tax brackets:

- 0% tax on taxable incomes up to $18,200

- 19% on incomes from $18,201 to $45,000

- 30% on those between $45,001 and $200,000

- 45% on incomes surpassing $200,001.

How to claim the tax-free threshold

If you qualify for the tax-free threshold, you can stake your claim when filing your annual tax return. The tax-free threshold can be claimed on the tax return of anyone who is an Australian resident for tax purposes. It’s especially pertinent for those whose total income remained under the tax-free threshold during the designated financial year.

If you’re in the bracket eligible to claim the tax-free threshold for the 2023-2024 financial year, the first $18,200 of your taxable income is exempt from income tax. However, any income sources pushing your earnings above this amount will be subject to the prevailing income tax rates.

The tax-free threshold’s impact on PAYG withholding tax

Upon filing your annual tax return, the tax withheld from all your income sources will be evaluated. Based on this assessment:

- If too much tax was withheld, you might be eligible for a tax refund.

- If not enough tax was held back, you may receive a tax bill, necessitating payment of the difference.

If your income is $18,200 or less

Yet, if circumstances change and your annual income crosses the $18,200 threshold, it’s essential to hand a withholding declaration to one of your employers, signaling your intention to cease claiming the tax-free threshold from them.

Example: if your income is $18,000 or less

For his pension, he exercises his right to claim the tax-free threshold, leading to no tax being withheld.

However, for his part-time job where he doesn’t claim the tax-free threshold, $64 will be held back every fortnight as tax withheld.

Consequently, Walter’s cumulative taxable income for the financial year stands at $18,000. Due to his total income falling under the tax-free threshold, he won’t face any income tax liability, meaning a tax payable of zero. Upon filing his 2023 income tax return, he will be entitled to a tax refund, equating to the sum total of tax that was withheld over the year.

Forecasting the same income scenario for the upcoming financial year, Walter has the option to claim the tax-free threshold for his part-time work too. To action this, he simply needs to fill out a withholding declaration and present it to his employer. This will ensure no tax is subtracted from his pay.

Example: If your income is over $18,200 and too much tax is withheld

If your annual income exceeds $18,200 and an excessive amount of tax is withheld from your payments, there’s an avenue to seek rectification. You can initiate the process by completing a PAYG withholding variation application and forwarding it to the designated tax authority.

Upon submission, the Australian Tax Office (ATO) will assess your application. After the evaluation, they will determine the adjusted amount and communicate updated instructions to your payers on how much tax to withhold from your income sources.

It’s paramount to apply for this variation only when you’re confident about your projected total income and feel the current withholding rates are leading to a financial disadvantage.

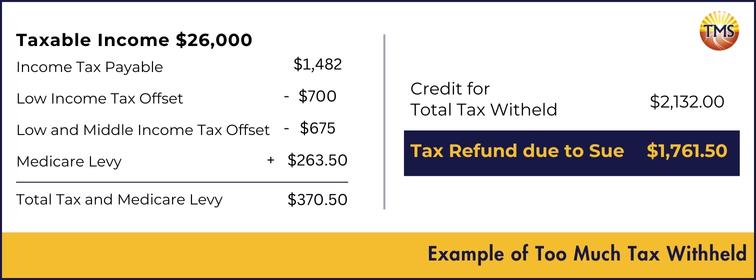

Example: too much tax withheld during the year

Anna works two jobs during the 2024–2025 financial year. As a part-time retail sales assistant, she earns $16,000 annually ($615.38 per fortnight). Additionally, she makes $10,000 per year ($384.62 per fortnight) from her role at a restaurant.

Anna claims the tax-free threshold for her retail job, resulting in no tax being withheld from that income source. For her restaurant job, she doesn’t claim the tax-free threshold, which leads to $61.54 being withheld each fortnight, totaling $1,600.04 for the year.

At the end of the financial year, Anna’s tax situation will be assessed as follows:

-

Total taxable income: $26,000

-

Income tax due based on the 2024–2025 tax rates: $1,232 (16% of $7,800, the amount over the tax-free threshold)

-

Medicare levy: $390 (1.5% of $26,000)

-

Total tax liability: $1,622

-

Tax withheld: $1,600.04

After lodging her tax return, Anna would owe $21.96 in additional tax.

This scenario reflects the updated 2024–2025 tax rates and thresholds, where the 19% tax rate was reduced to 16% and other changes were made to the tax brackets.

Addressing Potential Tax Shortfalls

To circumvent this scenario, consider requesting one or several of your payers to enhance the withholding amount from your payments. Ensure your request is documented, whether it be through electronic methods like email, traditional paper mediums, or computer-based forms.

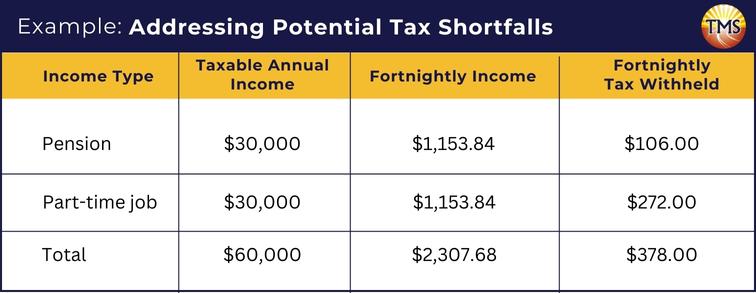

Example: Addressing Potential Tax Shortfalls

- $30,000 from the pension – Pierce’s payer applies the Medicare levy and tax-free threshold to his fortnightly payments.

- $30,000 from the part-time job – Pierce’s employer applies the Medicare levy and no tax-free threshold to his fortnightly payments.

When Pierce lodges his tax return for the income year, the actual amount of income tax he has to pay, or tax refundable to him, will be calculated as follows:

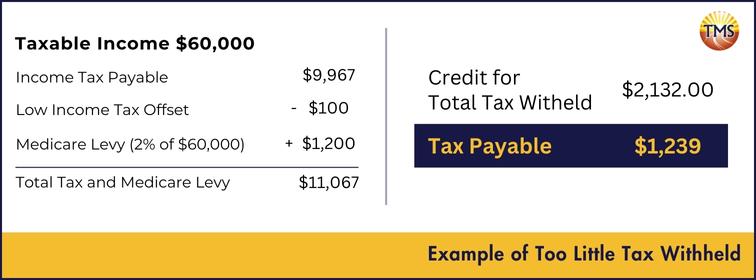

Taxable income $60,000

Income tax payable $9,967

Less, Low income tax offset $100

Plus, Medicare levy (2% of $60,000) $1,200

Total tax and Medicare levy $11,067

Credit for total tax withheld $9,828

Tax payable $1,239

How can I reduce my taxable income?

Maximise Tax Deductions

Tax deductions play a pivotal role in reducing your taxable income. These are expenses incurred directly in the pursuit of earning your income. Some common deductions encompass work-related travel, essential tools and equipment for your profession, and investment management fees for self-education expenses.

Enhance Superannuation Contributions

Your superannuation contribution, or super fund, usually face a lower tax rate than your regular income. By making extra contributions to your super, you can effectively lower your taxable income.

Delve into Salary Sacrificing

Opting for salary sacrificing means you agree to take a portion of your annual income as a benefit, not in cash. This strategy can cut down your taxable income since some benefits might be subjected to lower tax rates compared to your highest salary. Delving deeper into the implications of the Fringe Benefits Tax is essential, as outlined in our detailed article on the topic.

Leverage Tax Offsets

Tax offsets, often referred to as rebates, are specific amounts deducted from the total tax you’re liable to pay. Australia offers a variety of tax offsets, including the low-income tax offset and the senior Australians tax offset. By understanding and claiming the tax-free benefits you’re eligible for, you can significantly reduce your tax bill.

Deductions

By reducing your assessable income or amplifying your deductions, you can effectively lower your taxable income. For instance, negative gearing enables you to offset an investment loss against other income, leading to increased deductions and a decrease in taxable income. On the other hand, opting for salary sacrificing some of your annual income into superannuation decreases your assessable income. This strategy results in an indirect reduction of your taxable income for the financial year.

Should you decide to make personal tax-deductible contributions to your superannuation fund, taking into account the annual limit of $27,500, you can claim the tax-free deduction. This is done by completing an ATO form and forwarding it to your super fund. Subsequently, your super fund will tax your contribution at a concessional tax rate of 15%, a rate much more favorable than most individual income tax rates.

For Australian residents, it’s crucial to maintain records of your tax deductions for a minimum of five years. This is vital if you’re audited by the ATO and are required to validate your claim.

Low-Income Tax Offset

Assessable Income: Understanding Your Taxable Earnings

Certain categories of assessable income, like employment wages, are directly communicated to the ATO by respective employers and financial establishments.

Employment income

- Regular compensations such as salary, commissions, bonuses, parental leave pay, and amounts received from job-associated insurance programs like income protection, sickness/accident benefits, or worker’s compensation.

- Employer-provided allowances like those for cars, travel, attire, laundry, meals, specific working conditions, or specialised duties/credentials.

- Additional revenues like gratuities, awards, or shares provided at an employee discount.

- Lump sum compensations, often disbursed for untapped leave upon exiting a position.

Super pensions and annuities

- Taxed Element: This portion has undergone taxation.

- Untaxed Element: Tax is still pending on this segment.

- Tax-Free Element: No tax obligation exists for this section.

On the other hand, if you secure a steady income from an annuity, it might contain both taxable and tax-free parts. You must declare the taxable segments in your income tax return.

Reporting Government Payments on Tax Returns

Types of Investment Income

- Interest: This might be earned from accounts held with banks or other financial entities.

- Dividends: Income derived from shares or returns associated with managed funds.

- Rental Income: Profits obtained from an investment property you own.

- Capital Gains: Any financial gains realised from selling an asset.

Business, Partnership, and Trust Income

Income derived from operating as a sole trader, earnings from partnerships, or distributions from trusts all contribute to your overall personal income.

Foreign Income

Crowdfunding Income

Non-Assessable Income

- Lump sum amounts from insurance policies.

- The tax-free portion of qualified termination payments.

- Genuine redundancy packages.

- Payments for child support or maintenance.

Residency and Taxation in Australia

Conversely, non-residents can’t claim the tax-free threshold and must pay tax on all their Australian income. Understanding your residency for tax purposes can be challenging. Given any doubts about your tax status, seeking personal financial advice is wise. Our expertise extends to assisting expatriates and those who split their year between overseas and domestic work. This is crucial when preparing to submit an annual tax return and evaluating your taxable income, ensuring you don’t pay too much tax or face unexpected tax bills.

Who are TMS Financials?

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

Unlock the secrets to a tax-efficient year

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.