Non-concessional super contributions

.

The non-concessional contributions cap is the limit for the amount of after-tax contributions you can put into your super fund yearly without having to pay extra tax.

Starting 1 July 2021, the non-concessional contributions cap is $110,000. Each financial year, this cap is looked at and might change based on the average earnings (AWOTE). If you add more money than the cap to your super fund, you might be hit with extra tax.

If you go over the annual cap for non-concessional contributions, there’s a special rule called the bring forward rule. This rule lets you add more money in the coming years without extra penalties if you meet certain conditions.

However, if at the end of the previous financial year your total in the super account reaches or goes beyond the transfer balance cap (for example, $1.7 million for 2021–22 and $1.9 million for 2023–24), you won’t be allowed to make further non-concessional contributions for that year.

What are concessional contributions?

Concessional contributions are the amounts you voluntarily add to your super fund using your before-tax income. These before-tax contributions are then taxed at a rate of 15%.

What are non-concessional super contributions?

Non-concessional super contributions, or after-tax contributions, are amounts you voluntarily add to your super fund using the money you’ve earned and already paid tax on. Since this money has been taxed once, it doesn’t get taxed again within the super fund.

The idea behind these contributions is to prevent you from being taxed twice on the same money. However, there’s a catch: if you deposit more than a set limit into your super account in a financial year, you might end up having to pay extra tax. So, it’s crucial to be aware of the non-concessional contributions cap for each year to manage your retirement savings effectively.

Non-concessional contribution limits

From 1 July 2021, the limit for non-concessional contributions was raised to $110,000. This change is due to adjustments made according to the Average Weekly Ordinary Time Earnings (AWOTE). This limit is more generous than the concessional contributions cap, allowing you to boost your retirement savings through your super fund. If you add more than this, you might face extra tax charges. Between 1 July 2017 and 30 June 2021, this limit was set at $100,000.

Keep in mind, your personal limit might be different. It can depend on things like if you qualify for bring-forward rules or if the money in your super account is more than the general transfer balance cap. This cap was $1.6 million from 2017-2021 and will be $1.9 million starting from 1 July 2023.

If you take out money from your super fund and then put it back, it’s seen as a new non-concessional contribution. Also, if you’ve got money in different super funds, all the non-concessional contributions you make in a year, in all funds, will be added together to see if you’ve stayed under your limit.

The ATO can’t give you personal money advice but they can let you know if you’ve put in too much and help you understand your choices. You might have to take out the extra money or pay a special tax called the excess contributions tax.

Types of non-concessional contributions

There are several types of non-concessional contributions you can make to your super fund:

After-tax income contributions

After-tax income contributions are the amounts either you or your employer puts into your super fund after your income has been taxed.

Spouse contributions

Spouse contributions are funds your spouse adds to your super account. If you earn a lower income and your spouse contributes to your super fund, they might get a tax break. They can get this for up to the first $3,000 they put in, and it can be worth as much as $540.

Personal contributions without tax deductions

Personal contributions without tax deductions is money you put into your super fund that you didn’t get a tax break on.

Excess concessional contributions

If you put more before-tax contributions into your super fund than allowed, and this money isn’t taken out, it becomes a non-concessional contribution.

Over-the-limit Capital Gains Tax (CGT) contributions

Over-the-limit CGT contributions occur if the money you put in from selling assets, like property or stocks, is more than the capital gains tax limit.

Reinvested retirement benefits

If you take money out of your super fund and then put it back without getting a tax break on it, it’s counted as a non-concessional contribution.

Contributions for young people

If someone, other than your employer, puts money into your super fund and you’re under 18, it’s a non-concessional contribution.

Life insurance and fees

Sometimes, the costs of life insurance or certain super fund fees can be counted as non-concessional contributions. It’s a good idea to consider these when deciding how much to contribute.

Remember, depending on how old you are or if you’re working, your super fund might not accept some types of contributions. Always check the rules before adding money.

What doesn’t count towards your non-concessional cap?

Certain types of contributions are not counted towards your non-concessional contributions cap:

Personal injury payments

Often known as structured settlement contributions, these are payouts you might receive due to an injury.

Capital gains tax (CGT) allocations

Contributions you decide to count towards your Capital Gains Tax cap are exempt, but only if you haven’t gone over your lifetime limit.

Downsizer contributions

Money that comes from selling your house.

COVID-19 early release amounts

Money you took out of your super fund due to the COVID-19 early release scheme and then put back in.

It’s essential to understand these contributions are only left out if you meet all the necessary conditions. To make sure they’re not counted, you’ll need to give your super fund the right paperwork either before you put in the money or at the same time.

Additionally, contributions the government makes to match yours, known as government co-contributions, aren’t counted in non-concessional contributions either. You don’t need to do anything special to have these left out.

Understanding non-concessional caps for defined benefit fund members

If you’re part of a defined benefit fund, your contributions, which impact your defined benefit interest, generally count towards your non-concessional contributions cap. This is true even if your employer is the one making these contributions for you.

If you’re unsure which of your contributions count as non-concessional, it’s a good idea to reach out to your fund for clarity.

There are scenarios where your non-concessional contributions cap is zero. This happens if the money in your super account is the same as or more than the general transfer balance cap by the end of the last financial year. But, under some workplace agreements, you might still have to make certain non-concessional contributions. In such cases, these contributions are seen as going over the limit, and based on your fund’s rules, you might not be able to take them out.

If your super balance is under the general transfer balance cap, these mandatory contributions might not put you over your non-concessional cap. However, they could limit how much more you can contribute without getting hit with extra taxes.

If you put in too much and you can’t take out the extra money from any of your super funds, you’ll need to pay a special tax, called the excess non-concessional contributions tax, from your own money. Because the defined benefit funds can have special rules, it’s important to get in touch with your fund to know your choices.

Tips on how to avoid non-concessional contributions cap

To avoid going over your non-concessional contributions cap, you might consider:

- Stopping your contributions

- Lowering how much you contribute

- Turning your contributions into salary sacrifice contributions (this changes them to concessional contributions). But remember, you can only do this if your employer agrees.

Cutting your contributions entirely or going below certain amounts recommended by your fund might affect your defined benefits or other perks from your fund, like insurance. Also, if you decide to make contributions as salary sacrifices, you might go over your concessional contributions cap. So, it’s crucial to think through all the effects before making a decision.

Example: going over the non-concessional cap with defined benefit funds

Consider the situation of James. By 30 June 2019, James has a total super balance of $1.65 million. This means his non-concessional contributions cap for the 2019-20 financial year is set to zero. But James is in a defined benefit fund, so he still has to make non-concessional contributions to his super fund during that year. Because his cap is zero, any contributions he makes will be counted as excess non-concessional contributions.

The Australian Taxation Office (ATO) gets James’s individual tax return on 25 September 2020 and the annual contribution report from his fund on 30 October 2020. After reviewing, the ATO sends James a notice saying he’s gone over his contribution limit.

James decides to take out the extra money from his only fund. But his fund says no because he’s part of a defined benefit fund, and they don’t have to let him take it out. The ATO then tells James he can’t take out the extra contributions and sends him a bill for the excess non-concessional contributions tax. Now, James has 21 days to pay this tax, and he has to use his own money.

Always be aware of your contribution caps and the rules of your super fund to avoid such situations. If unsure, seeking personal financial advice is recommended.

Example: going over both concessional and non-concessional caps with defined benefit funds

Let’s take a look at the situation involving Michael. Michael is a member of a defined benefit fund where his employer contributes for him. Typically, these contributions are counted as non-concessional contributions. However, Michael chose a salary sacrifice option, making these concessional contributions. In the 2017-18 financial year, Michael’s concessional contributions went over the limit by $5,000. The ATO informed him about this excess, but Michael didn’t make any changes and left the overage in his super account.

Being in the highest tax bracket for 2017–18, Michael’s excess concessional contributions are taxed at 47% (this includes the Medicare levy). To account for the tax already paid on these contributions, Michael gets a 15% offset.

Considering Michael’s total super balance was more than $1.6 million at the end of 30 June 2017, his non-concessional contributions cap for 2017-18 is nil. This means the excess concessional contributions also become excess non-concessional contributions. Because Michael is in a defined benefit fund, he can’t take out the excess non-concessional contributions. This leads to another 47% tax on the same contributions, which, added to the previous 47% when they were excess concessional contributions, totals a whopping 94% tax on that amount.

This example highlights the critical importance of understanding how you contribute to your super fund. Michael’s choice of a salary sacrifice led to a staggering 94% tax rate on those contributions. Without that choice, he would’ve faced a tax of just 47%.

Compensation and how it affects your non-concessional contribution cap

If your super fund gets compensation because of bad financial advice or cases where you paid fees but didn’t get any advice, the compensation might cover things like a refund of those adviser fees, money for lost earnings, and some interest. Whether or not this compensation is considered a contribution to your super fund depends on the situation, like who hired the financial service provider and who has the right to compensation.

If the compensation goes directly to your super fund and is added to your account, it will be counted as a non-concessional contribution for that financial year. However, if you’ve given a proper notice saying you want to claim a tax deduction, and this deduction is approved, the compensation will be counted as a concessional contribution up to the amount mentioned in your notice.

Always be aware of how compensation payments might affect your contributions cap. If unsure, consulting with your super fund or seeking personal financial advice can provide clarity.

When are your contributions counted?

Remember, for a financial year, your super contributions are tallied up based on when your super fund actually gets them, not when you or your employer sends them out.

If you want your contributions to be counted for the current financial year, ensure they reach your super fund by June 30th.

To avoid going over your non-concessional contributions cap and facing extra taxes, it’s vital to track both the amount and the exact date when your contributions are received by your super fund. Always stay organised and monitor your contributions to ensure they align with your financial goals.

Your non-concessional cap might vary

The size of your non-concessional contributions cap could be different based on certain factors:

If, by the end of the previous financial year, your total super balance matches or goes over the general transfer balance cap of $1.6 million (relevant from 2017-2021) or $1.9 million (relevant from 2023-2024), then your non-concessional contributions cap for the present financial year will be set to zero.

However, there’s an exception. If you meet specific criteria, you could benefit from the bring-forward arrangement. This setup lets you use up to one or two future years’ non-concessional contributions cap earlier. Essentially, during the bring-forward period, you can contribute an amount that’s up to two or three times the yearly cap. Yet, starting from the 2022-23 financial year, if your total super balance reaches or surpasses $1.7 million, you won’t be eligible for the bring-forward arrangement.

Checking your non-concessional contributions cap details

To monitor your non-concessional contributions and understand your bring-forward arrangement status, you can use the ATO online services, accessible via myGov.

Here’s how you can view your information:

- Log in to the ATO online services.

- Choose the “Super” option.

- Navigate to “Non-concessional contributions.”

However, it’s essential to be aware that the latest data might not immediately appear on ATO online services due to the time it takes for funds, especially SMSFs, to report. For the most recent details, it’s best to directly reach out to your super fund.

Understanding bring-forward arrangements

If you contribute more than the yearly non-concessional contributions cap, you might be eligible for the bring-forward arrangement. This setup allows you to use caps from upcoming years without facing extra taxes.

To be eligible for the bring-forward arrangement, certain criteria must be met. Specifically, your age and your total super balance as of the end of the previous financial year are considered. Always check these factors to ensure you’re making informed decisions about your super contributions.

Age criteria for non-concessional contributions to your super

From 1 July 2022 and onwards:

If you’re under 75 years old at any point during a financial year, you could be eligible to make non-concessional contributions to your super. This means you can contribute up to three times the yearly non-concessional cap during that year.

However, if you’ve turned 75 or are older, your super fund can typically only receive employer contributions and downsizer contributions.

Example: Qualifying for the bring-forward arrangement

Let’s consider the case of Carlos. As of the end of the 2021-22 financial year, Carlos has a total super balance of $800,000. Come 1 July 2022, he’s 74 years old. For the 2022-23 financial year, his non-concessional contributions cap is set at $110,000. Given his age, he’s eligible for the bring-forward arrangement.

During that year, Carlos decides to make two separate non-concessional contributions to his super fund. He contributes $75,000 in October 2022 and another $75,000 in April 2023. By doing so, he activates the bring-forward arrangement.

This example underscores the importance of understanding your eligibility and the rules surrounding contributions, especially as they relate to age and the bring-forward arrangement. Always ensure you’re making informed decisions about your super contributions.

Understanding your total super balance impact

Starting 1 July 2017, your total super balance influences how much of your non-concessional contributions cap you can bring forward. It also determines whether you have a 2-year or 3-year bring-forward period. This balance is calculated at the end of 30 June for the financial year just before the one in which you made contributions that triggered the bring-forward.

For the 2022–23 Financial Year and Subsequent Years:

To access the non-concessional bring-forward arrangement, ensure you meet the following criteria:

- You are under 75 years old at least one day during the year the bring-forward gets triggered.

- You contribute more than the annual cap (from 2021–22, it’s $110,000).

- You shouldn’t be in an ongoing bring-forward period.

- Your total super balance on 30 June of the preceding financial year should be below the general transfer balance cap ($1.7 million from 2021–22, $1.9 million from 2023–24). For instance, for 2020–21, the balance on 30 June 2020 should be less than $1.5 million.

For the 2020–21 and 2021–22 Financial Years:

To leverage the non-concessional bring-forward arrangement:

- You are under 67 for at least a day during the year you trigger the bring-forward.

- You contribute beyond the yearly cap ($100,000 from 2017–18 and $110,000 from 2021–22).

- You avoid being in a current bring-forward period.

- By 30 June of the prior financial year, your total super balance should be below the general transfer balance cap ($1.6 million from 2017–18 and $1.7 million from 2021–22). As an example, for 2020–21, by 30 June 2020, your balance must be under $1.5 million.

For the 2019–20 financial year and before, the age criterion was set at 65 years.

Understanding the bring-forward arrangement from 1 July 2021

Starting from 1 July 2021, your capacity to use the bring-forward rule for non-concessional contributions is dependent to your total super balance as of 30 June of the preceding financial year.

Here’s how the amounts break down:

- If your Total Savings Balance (TSB) was below $1.68 million by June 30 of the last year, you’re allowed to contribute a maximum of $330,000 over a span of 3 years. This means, for the 2023-24 period, if your TSB was less than $1.68 million by June 30, 2023, you can still contribute up to $330,000 in the next 3 years.

- If your TSB on June 30 of the preceding year was between $1.68 million and $1.79 million, you can contribute up to $220,000 over the next 2 years.

- If your total super balance exceeds the super transfer balance cap of $1.79 million on 30 June of the previous financial year, you are not permitted to make any further non-concessional contributions.

The maximum amounts you can contribute are determined by the yearly non-concessional contribution limit of $110,000 and a general transfer balance ceiling of $1.9 million.

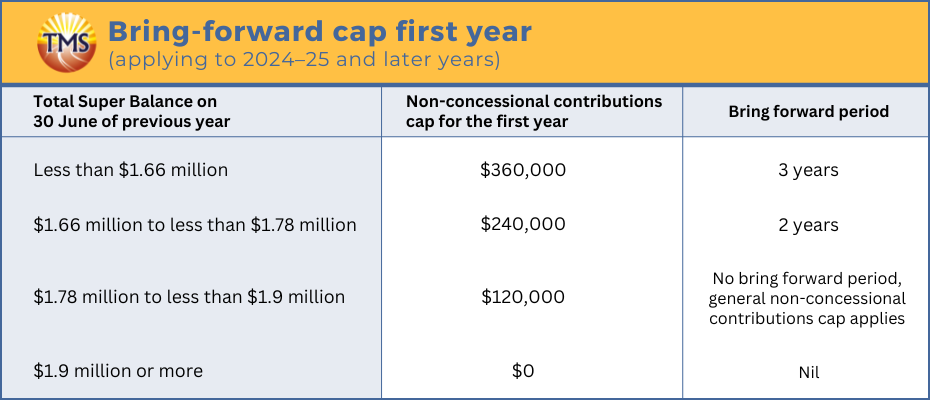

The table that follows displays the permitted contribution amounts for the initial year of the extended contribution plan.

Checking your bring-forward arrangement status

To get insights about your bring-forward arrangement:

- Login to your ATO online services account.

- Under this, you can:

- Determine if you’ve triggered a bring-forward arrangement.

- Evaluate the feasibility of making a significant contribution.

- After logging in, select the “Super” option.

- Then, head to the “Bring-forward arrangement” tab to view relevant details.

Next Step is to Contact TMS Financials

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

Have questions about your super contributions?

Related Articles

What car buyers and businesses need to know about Luxury Car Tax

What car buyers and businesses need to know...

Why you should provide your TFN to avoid unnecessary tax

Why you should provide your TFN to avoid...

How does negative gearing work for young professionals entering the Australian property market

How does negative gearing work for young...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.