Your Guide to Taxable Payments Annual Report (TPAR)

What is the Taxable Payments Annual Report or TPAR?

Staying up-to-date with tax compliance is necessary when running a business. Failure to comply with reporting obligations can lead to penalties, becoming a financial burden. You have to understand the general rules in tax compliance and the specific requirements imposed on the industry your business belongs to. An example of an industry-specific report is the Taxable Payments Annual Report (TPAR).

Under the taxable payments reporting system, certain businesses are required to report payments to contractors through the TPAR. Contractors include subcontractors, consultants, and independent contractors but not employees.

The Australian Taxation Office (ATO) uses the TPAR information to data match the contractor’s annual reported income with the payments you reported. The information gathered helps the ATO to ensure that the contractors have correctly reported their income on their tax returns. It also allows the tax office to identify which contractors are not reporting their income, not lodging their tax returns, or incorrectly quoting ABN on their invoices. ATO can also assess whether contractors should register for Goods and Services Tax (GST).

What details need to be included in a Taxable Payments Annual report?

It is important to have a record of the following information about the Contractors or Subcontractors you are paying:

- Australian Business Number (ABN),

- name of the business or individual

- address, and

- total payments for the financial year, including total GST.

The ATO may also ask for other information, such as:

- phone number,

- email address, and

- bank account details (if paid through electronic bank transfer).

You can verify if their provided details are correct by using ABN lookup or by checking if the ABN from their invoice matches your record.

Please note that you must not report the following payments in the Taxable Payments Annual Report:

- Payments for materials only. You must report the total fees if you receive an invoice containing the total costs for both labour and materials.

- Payments within a consolidated groups

- Payments for PAYG Withholding

- Contractors who did not provide an ABN

- Payments for private and domestic projects

- Incidental Labor

- Unpaid invoices as of 30 June

- Payments to foreign residents for the work they performed overseas or in Australia

- Workers under a labour-hire firm

Who needs to lodge a TPAR?

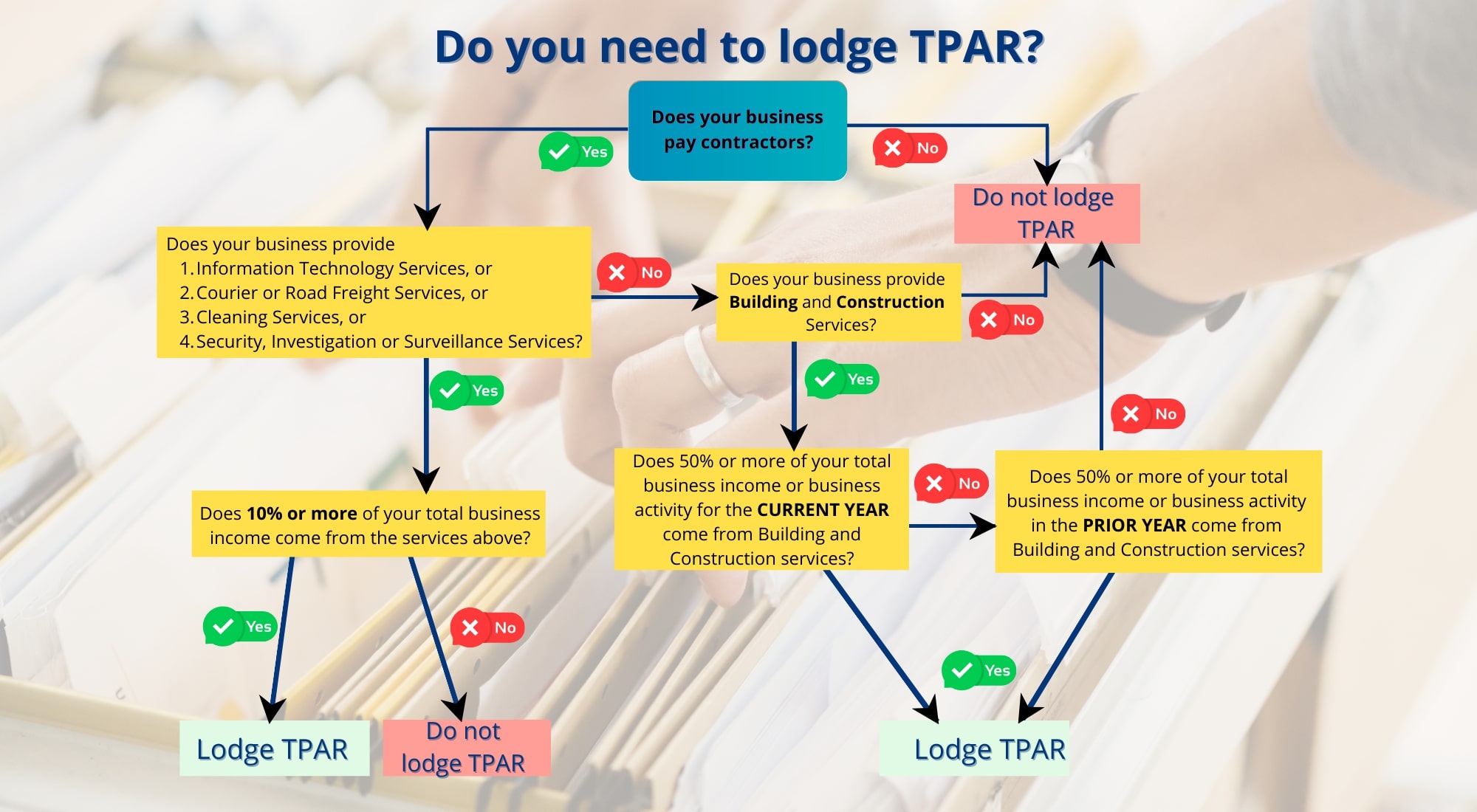

Since the TPAR report is a specific industry report, it applies only to certain businesses and government entities. If you are a business in a particular industry that pays contractors to provide relevant services, then you must lodge TPAR.

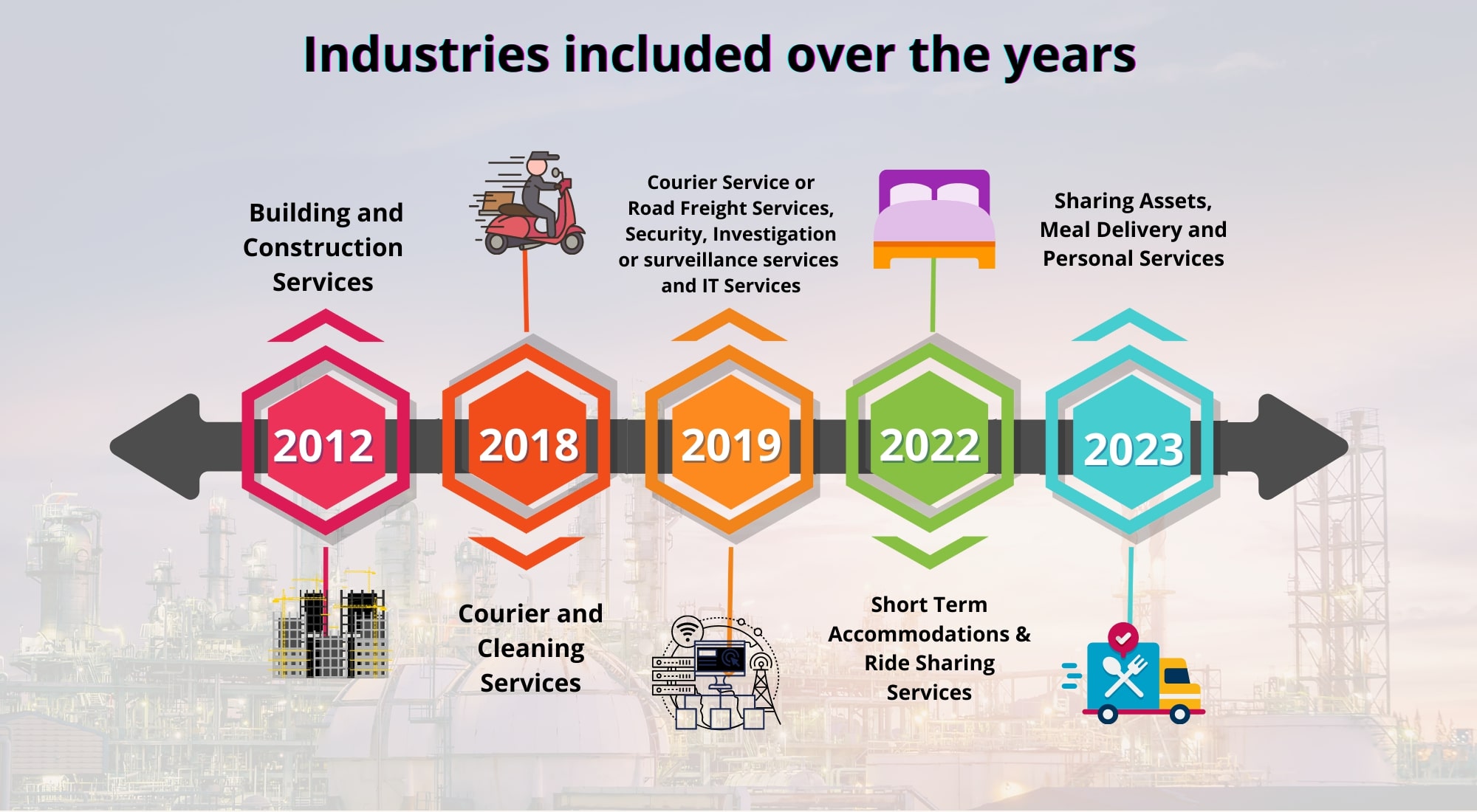

TPAR started with the building and construction industry but began to include more industries over the years.

The following industries are required to lodge Taxable Payments Annual Report:

Building and Construction services

These include services such as architectural, decorating, demolition, electrical, engineering, painting, landscaping, plumbing, surveying, and the like.

Information Technology (IT) services

These include on-site or offsite IT services such as consulting, computer programming, developing, installing, testing software, etc. The residence of the contractor does not matter as long as they have an Australian Business Number (ABN)

Courier Services or Road Freight services

Courier services include transporting small items, while road freight services include transporting large items.

Cleaning services

These include cleaning buildings, events, machinery, residences, parks, etc.

Security, Investigation, or Surveillance services

These include patrolling, screening, guarding people, premises, or property, gathering information, monitoring security systems, and any investigation related to security and surveillance.

Sharing Economy services

These include those activities dealt with through a digital platform (website or app) where businesses rent out or hire their assets or provide services for a fee. Some of Australia’s most common sharing economy services are travel/ride-sharing services, renting a room or a house on a short-term basis, sharing assets, meal delivery and personal services. As a recent update by the Tax Office, all sharing economy transactions must be reported through the TPAR. With this, if you fall under those providing short-term accommodation and ride-sharing services, reporting will cover transactions from 1 July 2022, while for all other services under the sharing economy, reporting will start from 1 July 2023.

If you are providing mixed services, you need to determine what percentage of your income comes from the relevant services mentioned above. You must lodge TPAR when:

- 10% or more of your gross income comes from the listed services above, except for income from Building and Construction Services. If you are below the 10% threshold or uncertain if you fall below the threshold, you can still choose to report TPAR.

- 50% or more of your gross income or business activity comes from providing Building and Construction Services in the current financial year

- 50% or more of your total business income comes from the financial year immediately before the current financial year

When is the TPAR’s due date?

The due date for lodging the TPAR report is 28 August every year. It is crucial to lodge on time, as the Australian Tax Office (ATO) uses the TPAR to pre-fill income tax returns for sole traders, update information on ATO online platforms, and identify contractors who may not be complying with their tax obligations. The ATO has increased its focus on TPAR obligations for businesses that pay contractors and will impose penalties on businesses that:

- Have overdue TPARs

- Have been notified about their overdue TPAR through three non-lodgement letters

- Do not respond to the ATO’s call regarding their overdue TPAR

How can I lodge TPAR?

You can lodge using different ways, such as through business software, ATO online services, paper form, or a tax agent.

Business Software

You can use software to lodge TPAR directly to ATO as long as it is SBR-enabled software.

ATO Online Services

You can lodge TPAR through ATO Online Services for business if you have an ABN, a myGov ID and a Relationship Authorisation Manager (RAM).

Paper form

You can lodge using the NAT 74109 form, which you can order online through the ATO publications ordering service.

Tax Professionals

A Tax agent can make your TPAR lodgement work easier. They can help you maintain contractor payments records and lodge TPAR on your behalf. Also, they can give you professional advice when tax compliance and third-party reporting requirements get complicated.

Who are TMS Financials?

TMS Financials provides you with a team of experienced professionals that help you achieve your financial goals through smart tax structures and financial planning. We’re a one-stop shop for all financial needs and pride ourselves on building strong partnerships with our clients.

Book a free financial health review to see the difference we can make in your financial future.

Disclaimer

Can’t keep up-to-date with tax compliance and reporting?

Find out how we can assist you with your TPAR and other tax requirements.

Related Articles

Minimising Capital Gains Tax on investment property guide

Minimising Capital Gains Tax on investment...

Division 7A compliance: Essential updates for business owners in 2025

Division 7A compliance: Essential updates for...

How to save FBT costs with your next Electric Vehicle

How to save FBT costs with your next Electric...

Contact Us

Tax Insights & Business Advice

Receive only the guidance that matters. Subscribe now for personalised tips and expert advice, directly suited for you and your business.